IIFL Finance Elliott Wave analysis: Wave (2) correction nears completion, bullish rally ahead

IIFL Finance (NSE: IIFL) shows a corrective Elliott Wave pattern (2) with key support at ₹370.10. A potential bullish wave (3) rally may follow soon.

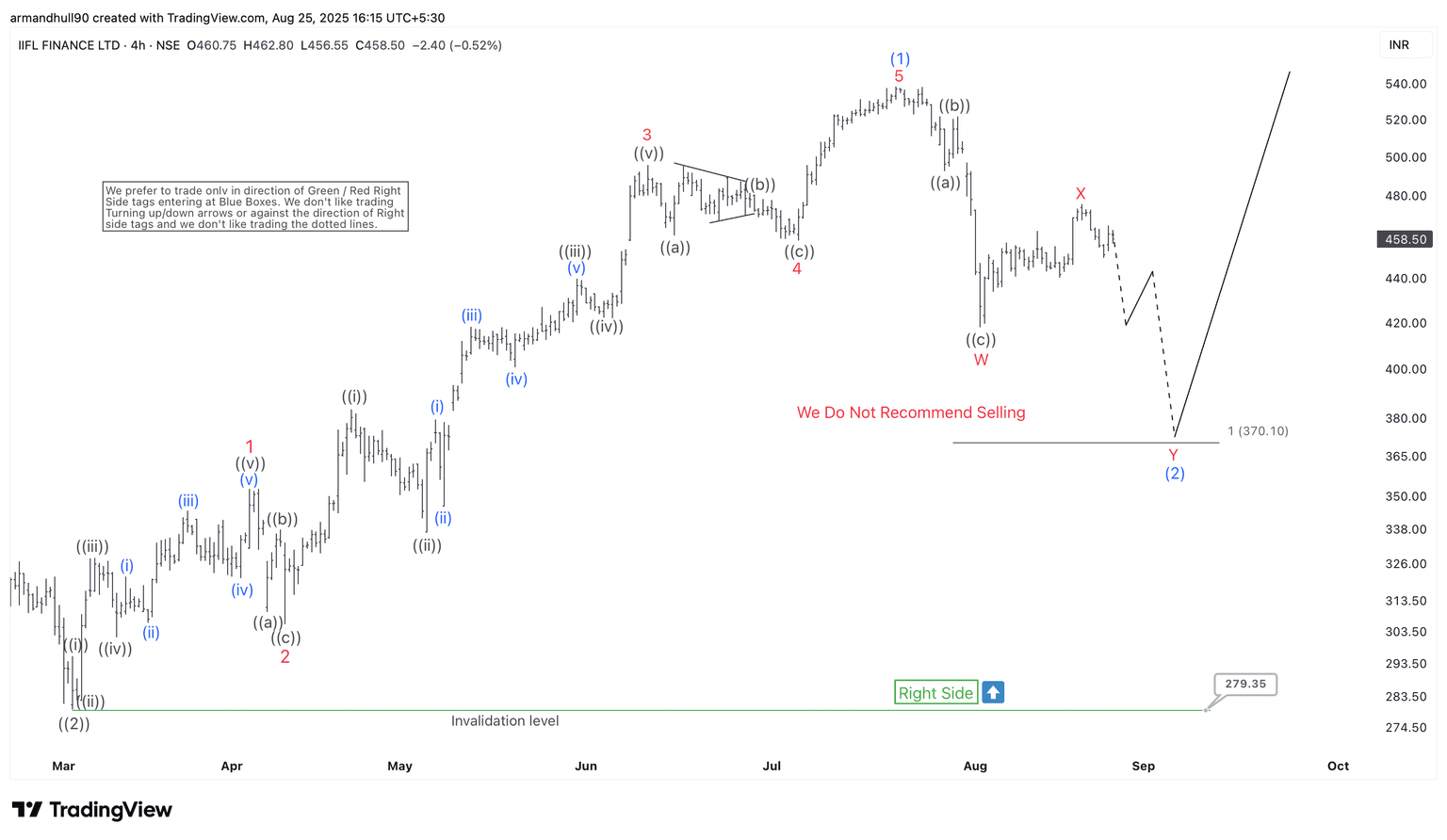

IIFL Finance Ltd (NSE: IIFL) continues to follow a well-defined Elliott Wave structure, suggesting the stock is undergoing a corrective phase before resuming its larger bullish trend. After completing wave (1) at the recent high, the stock is currently in wave (2), which is unfolding as a double three corrective pattern (W)-(X)-(Y).

The initial leg lower, wave W, has already completed, followed by a smaller recovery in wave X. The ongoing decline appears to be part of wave Y, which could ideally extend toward the 1.0 Fibonacci extension level around ₹370.10, marking equal legs before a potential reversal.

Despite this correction, the bigger picture stays bullish. The right-side tag shows a higher probability for upward movement. We do not recommend selling during this pullback. Instead, traders should wait for wave (2) to complete and prepare for a potential wave (3) rally. This next bullish wave can lead to new highs if the structure holds.

The invalidation level for this outlook is ₹279.35. If the price stays above this point, the current decline remains corrective. Pullbacks can then create buying opportunities once signs of a reversal appear.

Summary:

In summary, IIFL Finance is likely in the final stages of its wave (2) correction within a broader bullish cycle. Traders and investors should stay patient, avoid shorting, and prepare for a possible continuation higher once the corrective structure completes.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com