HDFC Bank Indian stocks Elliott Wave technical analysis [Video]

![HDFC Bank Indian stocks Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/display-panel-of-daily-stock-market-59908972_XtraLarge.jpg)

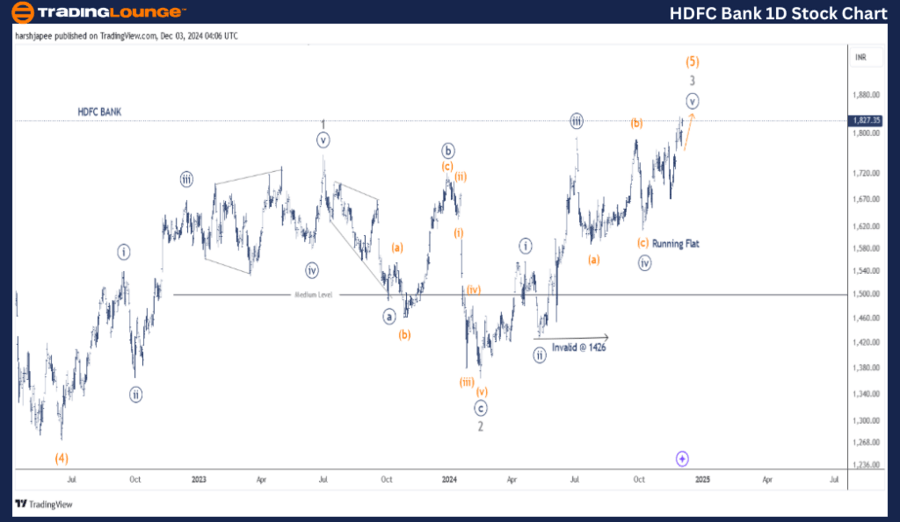

HDFC Bank (one day chart) Elliott Wave technical analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange).

Mode: Motive.

Structure: Impulse.

Position: Minute Wave ((iv)) Navy Flat.

Details: Minute Wave ((v)) Navy, is now progressing higher within Minor Wave 3 Grey of Intermediate Wave (5) Orange against 1426. No change.

Invalidation point: 1426.

HDFC BANK daily chart technical analysis and potential Elliott Wave counts:

HDFC BANK daily chart is indicating a progressive rally, which is within Minor Wave 3 Grey of Intermediate Wave (5) Orange against 1426 mark. The stock has closed above 1800 mark and could accelerate as immediate resistance around 1795 has been taken out.

The stock had dropped to 1275 lows in June 2022, terminating Intermediate Wave (4). The wave structure has been quite overlapping and the best possible counts could be Minor Wave 1 and 2 complete around 1750 and 1365 levels respectively.

Since then, Minor Wave 3 has been unfolding and is potentially extending. An alternative count could be Minute Wave ((i)) of Minor 3 is unfolding against 1426 mark.

HDFC Bank (four-hour chart) Elliott Wave technical analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange).

Mode: Motive.

Structure: Impulse.

Position: Minute Wave ((iv)) Navy Flat.

Details: Minute Wave ((v)) Navy, is now progressing higher within Minor Wave 3 Grey of Intermediate Wave (5) Orange against 1426. Aggressive traders could tighten risk further to 1600-10 range.

Invalidation point: 1426.

HDFC BANK four-hour chart technical analysis and potential Elliott Wave counts:

HDFC BANK 4H chart is primarily highlighting its sub waves from Minute Wave ((iii)), which completed around 1495 in July 2024. Minute Wave ((iv)) unfolded as a running flat terminating around 1610 mark. If the above holds well, Minute Wave ((v)) could be unfolding at the moment and possibly carve an impulse or a diagonal.

Conclusion:

HDFC BANK is progressing within Minute Wave ((v)) Navy of Minor Wave 3 Grey within Intermediate Wave (4) Orange against 1426.

Elliott Wave Analyst: Harsh Japee

HDFC Bank Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.