Gores Guggenheim Stock News and Forecast: GGPI explodes after Hertz announces Polestar partnership

- Gores Guggenheim stock soars after Hertz (HTZ) makes an order.

- Gores Guggenheim will take Polestar public via SPAC deal.

- GGPI stock catching interest on social media sites.

Update: The share price of Gores Guggenheim (NASDAQ: GGPI) broke out of its consolidative phase and exploded on Monday, surging to fresh four-month highs of $13.30. GGPI shares booked a whopping 11.87% gain on the day, closing the day at $12.82. The price of the Electric Vehicle (EV) maker rocketed after Polestar announced that the premium electric performance car maker has entered into a new global partnership with Hertz rental. The partnership includes purchasing up to 65,000 electric vehicles over five years. The upbeat tone on Wall Street also collaborated with the massive surge in GGPI stock price, despite mounting Russia-Ukraine tensions.

Gores Guggenheim (GGPI) is often the EV name that gets overlooked by retail traders who focus on the big daddy, Tesla (TSLA), and then look to homegrown names such as Mullen Automotive (MULN), Lucid (LCID) and Rivian (RIVN). This may be because Polestar is a sort of Scandinavian Volvo offshoot and as of yet is not that visible in the US. The company did attempt to turn this around with an eye-catching Superbowl ad that included a dig at Tesla, but so far the stock has failed to grab consistent investor or meme trader enthusiasm. Might that be about to change?

Gores Guggenheim Stock News

Hertz (HTZ) last year launched a frenzy in Tesla stock when it announced it was going to buy 100,000 Teslas. Tesla's stock price roared ahead by 13% on the news of the Hertz (HTZ) order, which added about $70 billion to the valuation. This time Hertz has announced it is prepared to order 65,000 cars from Polestar over the next five years as part of a global partnership. Then 65% of the gain means we should see the market cap of GGPI rise by $40 billion today? Easy, right?

Wishful thinking on my part as I am long the stock, but the order is certainly noteworthy and underlined the Polestar concept. Polestar is backed by Volvo and Geely. It will piggyback on Volvo's manufacturing plants using its US plant and potentially others globally. Polestar will also piggyback on Volvo's service network. This removes costly investment and means production should be quickly scalable.

Gores Guggenheim Stock Forecast

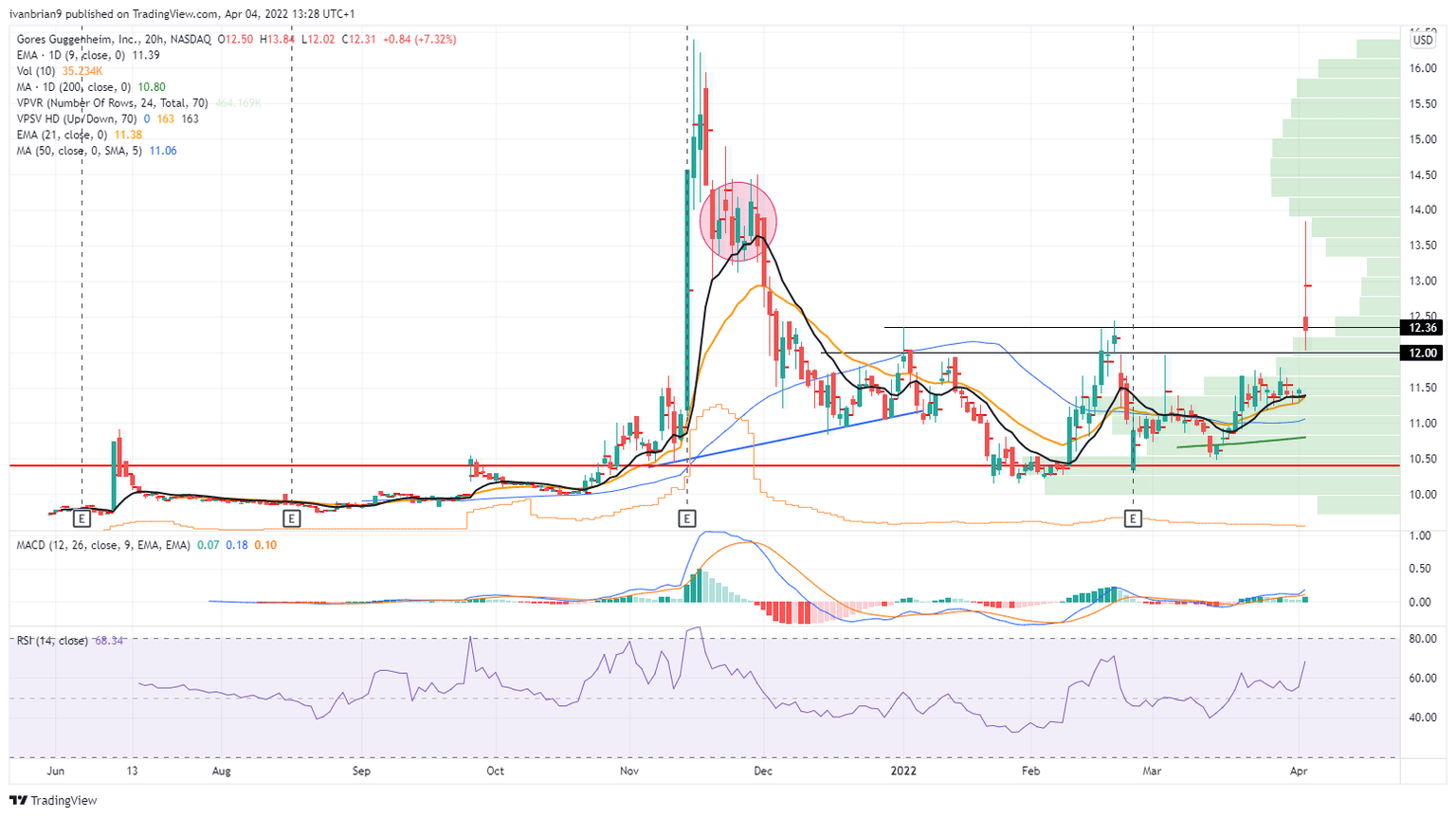

GGPI has broken resistance at $12 and $12.36. These levels are now key support if the move is to be sustained. We can see already that GGPI has reached up to $14 in the premarket. This is strong resistance and is the circled area from the last spike in November/December last year. Volume is higher up there, and it is a consolidation area meaning GGPI will now find it as a resistance level.

GGPI stock chart, 20-hour

The author is long GGPI.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.