Gold recovers as stagflation fears take hold, Trump trade fades

- Gold is trading higher as stagflation fears take hold, suggesting inflation may remain elevated amid slower growth.

- The nomination of Kamala Harris as the Democrat presidential candidate further aids Gold as her policies are seen as less inflationary.

- Gold is potentially unfolding a down-leg within a widening sideways trading range.

Gold (XAU/USD) recovers for a second day in a row, trading back up in the $2,410s as “stagflation” fears mount. The term, which describes above-trend inflation coupled with weak growth and jobs data, is a portmanteau of “stagnant” and “inflation”. Economists are applying it to the current environment following the release of the Philadelphia non-manufacturing Business Outlook Survey, which combined a weak headline and a high prices paid component. At the same time, US Existing Home Sales fell 5.4% month-over-month in June – further evidence of a slowdown – according to analysts at Rabobank.

Gold trades higher amid US economic slowdown

Gold's recovery is also fueled by expectations of potential interest rate cuts from the Federal Reserve (Fed), which make non-interest-bearing assets like Gold more attractive to investors. The interplay of economic indicators and central bank policies will continue to be crucial in shaping Gold's price trajectory in the near term.

Traders now await the release of more US economic data later this week for clarity on the trajectory of US interest rates. Of major interest will be the US Q2 Gross Domestic Product (GDP) growth data on Thursday and the Personal Consumption Expenditures (PCE) Price Index report for June on Friday.

The Q2 GDP growth advance estimate is expected to show a 1.9% expansion, up from 1.4% in Q1, while the PCE price index is forecasted to see a 0.1% uptick after remaining flat in May. Although recently, cooling US headline consumer inflation bolstered expectations that the Fed will begin cutting interest rates in September, whether more cuts are likely before the end of the year remains open for debate. If the data surprises to the upside, the Fed may delay lowering interest rates beyond September. This would weigh on the Gold price.

Another factor impacting Gold price is that US Vice President Kamala Harris secured the support of enough delegates to clinch the Democratic nomination. This has prompted some unwinding of the “Trump trade” and dragged US bond yields lower – both positive factors for Gold. In some polls, Harris now leads Trump, suggesting a less inflationary outlook for the economy if she wins.

Wednesday's release of the preliminary US S&P Global Purchasing Managers Index (PMI) for July will be looked upon for fresh cues about the health of the global economy and potentially allow traders to grab short-term opportunities around the precious metal.

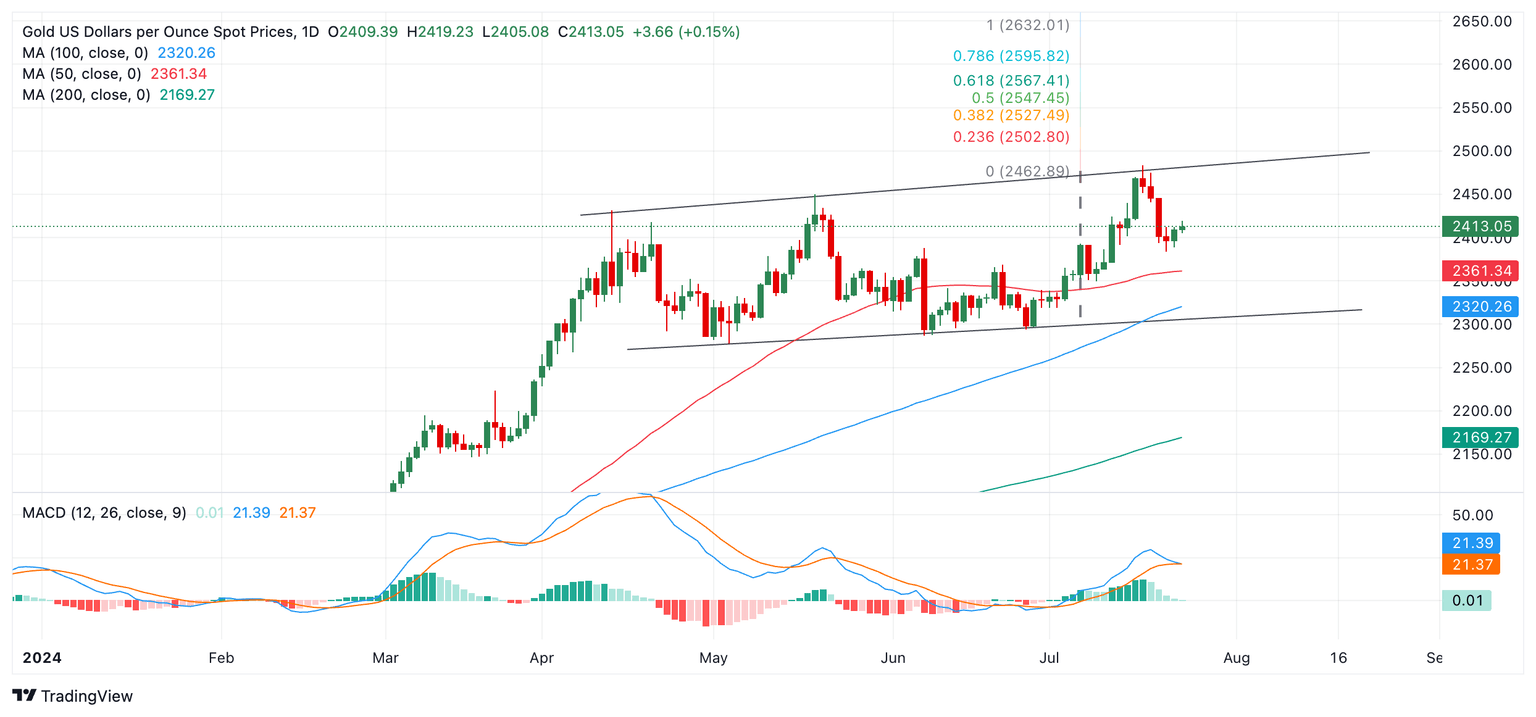

Technical Analysis: Gold potentially unfolding down leg in sideways consolidation

Gold looked like it broke out of the upside of a sideways range last week but failed to sustain any bullish follow-through. It has since capitulated back inside the range. It is possible to redraw the range with a slanting top, which would indicate the new high achieved on July 17 was still within the confines of the range rather than a breakout, as previously thought.

XAU/USD Daily Chart

Such a revision would also now suggest the Gold price was unfolding a new down leg within the widening range towards the floor and the 100-day Simple Moving Average (SMA) at circa $2,320. The 50-day SMA at $2,360 is likely to present temporary support on the way down. A break below Monday’s low of $2,383 would provide bearish confirmation of more downside towards the range low.

Alternatively, above the $2,483 new all-time-high would indicate the establishment of a higher high and suggest the possibility of a breakout to the upside and an extension of the uptrend. Such a move might unlock Gold’s next upside target at roughly $2,555-$2,560, calculated by extrapolating the 0.618 Fibonacci ratio of the height of the range higher.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.