Gold surges past $3,450 as traders eye Fed independence, NFPs

- XAU/USD climbs 0.87% to $3,476 as quiet US session fuels momentum toward record levels.

- Traders price in 85% chance of September Fed cut despite inflation stubbornly above target at 2.9% YoY.

- Fed independence doubts and tariff uncertainty boost safe-haven appeal, with Nonfarm Payrolls now in focus.

Gold rises above $3,450 and may challenge the $3,500 record on Monday, as US markets are quiet for Labor Day. Concerns regarding the Federal Reserve’s (Fed) independence and ongoing uncertainty about the trade war have kept the US Dollar subdued and increased flows toward the precious metals sector. At the time of writing, the XAU/USD trades at $3,476, up by over 0.87%.

Bullion rallies toward $3,500 record high amid subdued US Dollar

Last week, inflation data showed prices were nearly 3% higher on an annual basis, above the Fed's 2% target. Fed Chair Jerome Powell highlighted labor market weaknesses at Jackson Hole, making jobs data the focus, while traders overlooked the core PCE Price Index release.

The core PCE rose 2.9% YoY in July as expected, showing that the disinflation process is far from resuming. Despite inflation remaining above target, the expectations for a rate cut persist due to labor market weakness. The chances of a Fed September rate cut remain high with odds standing at 85%, according to Prime Market Terminal interest rate probabilities tool.

In the meantime, Gold traders are laser focused on the release of Nonfarm Payrolls (NFP) figures and further developments in the firing of Fed Governor Lisa Cook by US President Donald Trump.

XAU/USD has extended its gains as market participants believe that the White House’s response could undermine the Fed’s independence, leading to concerns about monetary policy stability. Also, the decision of the US Court of Appeals of ruling most tariffs illegally would keep uncertainty in the markets and boost Bullion’s appeal.

Daily digest market movers: Gold resumes uptrend ahead of busy US economic docket

- US Treasury yields are flat, with the 10-year Treasury note sitting at 4.232%. US real yields — which are calculated from the nominal yield minus inflation expectations — are unchanged at 1.822% at the time of writing.

- The US Dollar Index (DXY), which tracks the performance of the US Dollar against a basket of six currencies, is down 0.14% to 97.71.

- The court hearing for Trump’s attempt to remove Fed Governor Lisa Cook ended on Friday with no decision. Judge Jia Cobb has asked Cook's legal team to submit further briefs, pushing the earliest possible decision to Tuesday.

- Over the weekend, San Francisco Fed President Mary Daly wrote that it will “soon be time to recalibrate policy to better match our economy,” adding her name to the dove chorus led by Fed Governors Waller and Bowman. She added that tariffs would trigger a “one-off” inflation uptick, and that signs of labor market weakness warrant easing policy

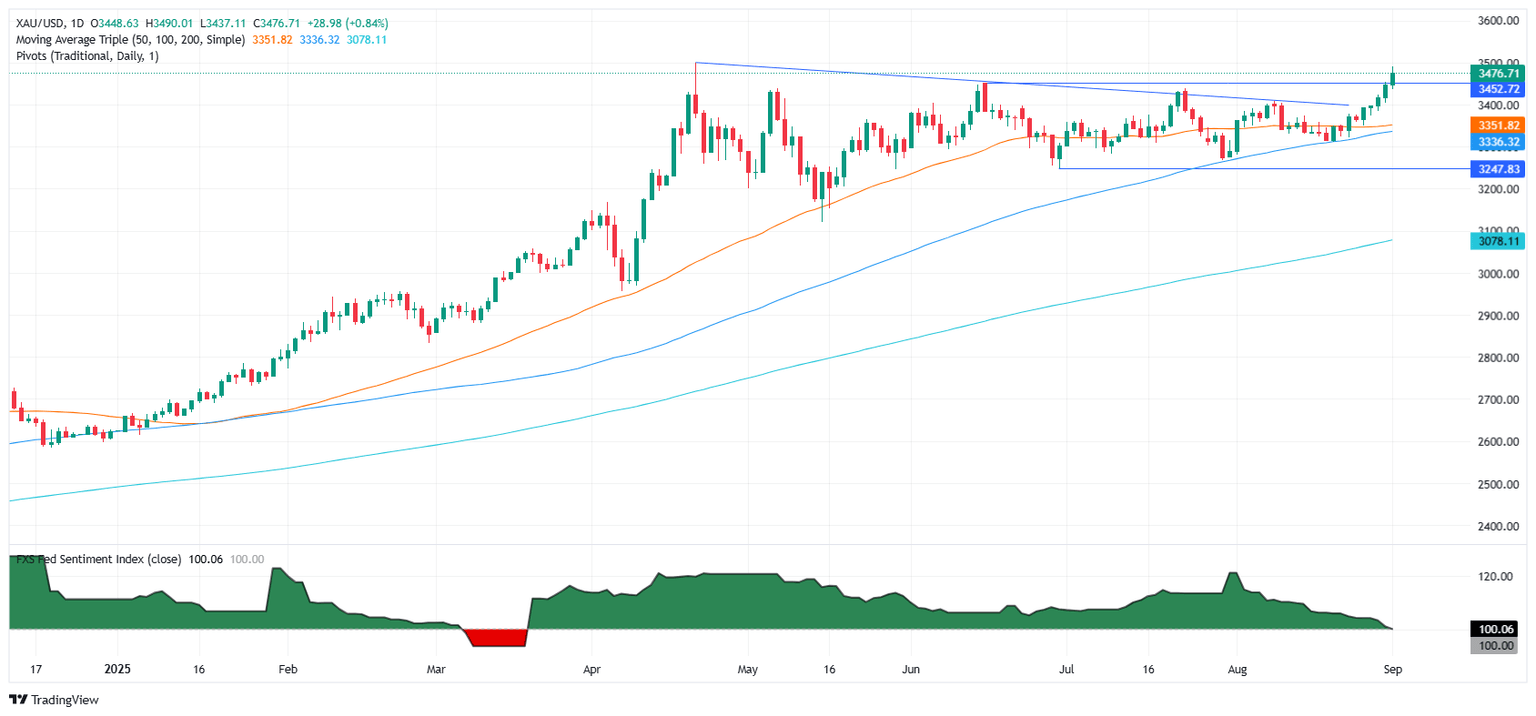

Technical outlook: Gold price poised to challenge $3,500 in the near term

Gold’s uptrend resumed on Monday as the yellow metal hit a two-month high of $3,489, before retreating toward $3,476. Although the Relative Strength Index (RSI) is nearing the 70 threshold, current trend strength suggests that the most significant overbought conditions are expected closer to the 80 level.

Given current conditions, Gold may rise above $3,500 if buying momentum continues. Once surpassed, the next resistance levels are at $3,550 and $3,600. Conversely, if XAU/USD falls below the June 16 high of $3,452, now acting as support, it could move toward the July 23 high of $3,438. Additional declines may bring the price to $3,400.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.