Gold prices head toward $3,400 as Bullion bulls step in

- Bets on a Fed rate cut for September rise on promising signs that inflation is slowing.

- The appeal of Bullion as a safe haven gains on tensions in the Middle East ahead of US-Iran nuclear talks. and Gold prices surge.

- XAU/USD rallies toward $3,400, which could open the door for a retest of the $3,500 record high.

Gold (XAU/USD) prices are attempting to retest the key psychological level of $3,400, as the US Dollar remains pressured on Thursday.

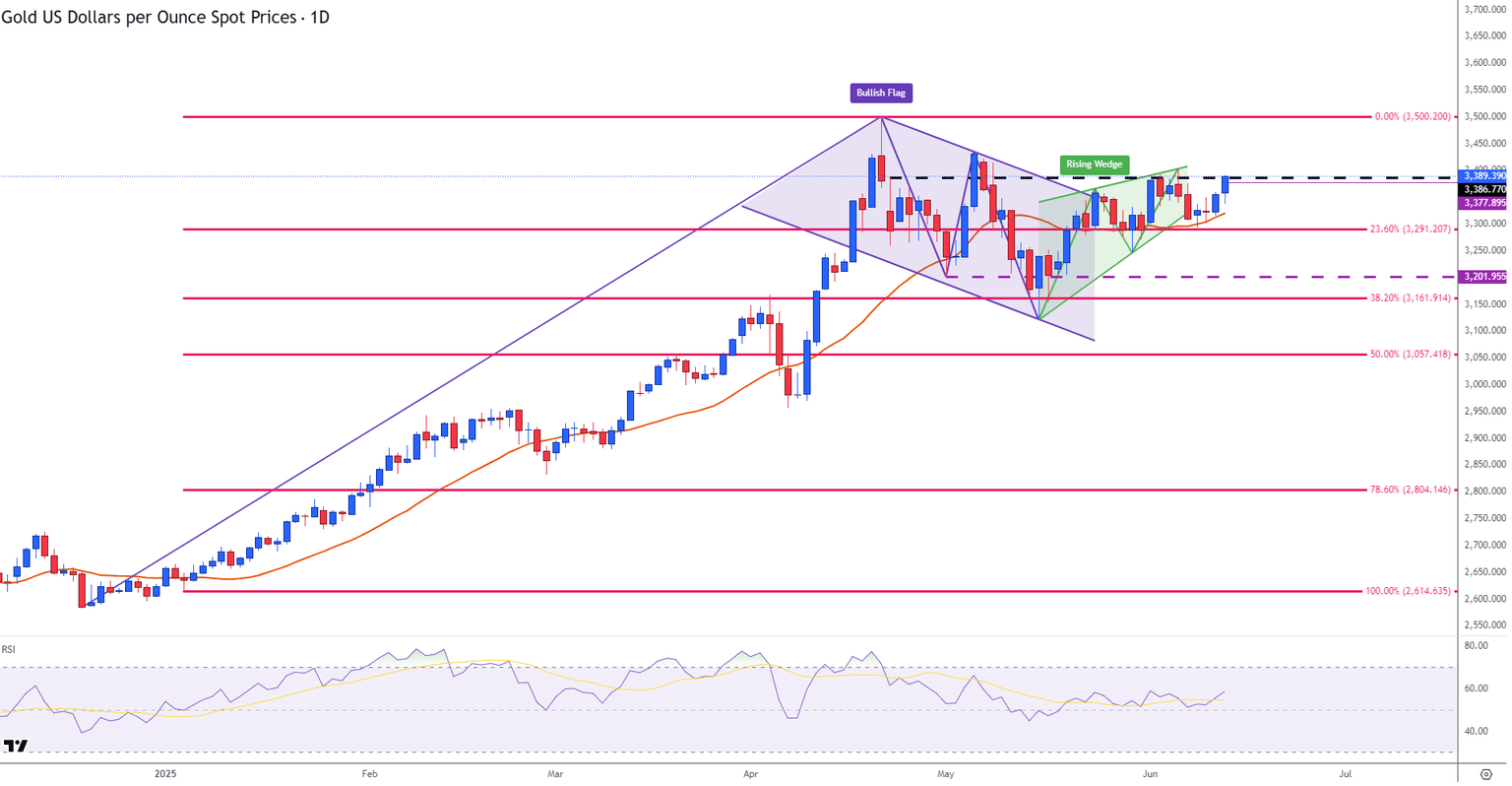

At the time of writing, the yellow metal is battling another major resistance zone above $3,380, a level that coincides with the upper boundary of the rising wedge pattern.

The resurgence of bullish momentum can be attributed to several factors. Over the past 24 hours, these have included the release of US inflation data, rising tensions in the Middle East, and the ongoing tariff threats from the US Trump administration.

The release of US Producer Price Index (PPI) data on Thursday has shown that inflation is slowing on the wholesale level. Following Wednesday’s downside surprise in CPI numbers, further confirmation that price pressures are easing could provide additional impetus to Gold as expectations for a September rate cut rise.

Additionally, the threat of an escalating conflict in the Middle East, following reports that Israel is considering a military strike on Iran, and Trump’s latest tariff threats support the precious metal, which benefits from safe-haven flows.

Gold daily digest market movers: Inflation is softening, Fed rate cut bets are rising and XAU/USD is benefiting

- On Wednesday, NBC News reported, citing five people familiar with the matter, that Israel is considering taking military action against Iran in the coming days.

- At the same time, Trump confirmed on Wednesday that US personnel are being moved out of parts of the Middle East due to the escalating tensions between Israel and Iran. This occurs ahead of the sixth round of nuclear talks between the US and Iran, scheduled for this weekend.

- Recent headlines surrounding trade also added to the sour market mood. Trump has stated that the US will set its own terms for unilateral tariffs, overshadowing the optimistic narrative surrounding the US-China “trade truce” announced on Wednesday.

- Trump stated that “We will be sending out letters over the next weeks telling them what the deal is”. These comments were reported by Bloomberg on Thursday.

- The monthly US PPI report, released by the US Bureau of Labor Statistics, provides insight into inflation trends (price pressures) from a wholesale and business perspective.

- Headline PPI showed an annual increase of 2.6% in May, in line with analyst forecasts, following a 2.5% increase in April.

- Core PPI, which excludes volatile goods, fell to 3% in May, down from 3.2% in April.

- This report follows the release of the US Consumer Price Index (CPI) on Wednesday, which showed that inflation at the consumer level continued to ease in May.

- For the Federal Reserve (Fed), softer inflation provides room for interest rate cuts, which in turn, has reduced demand for US Treasury Yields, adding additional pressure on the Greenback and supporting Gold.

- Prior to the US CPI release on Wednesday, the CME FedWatch Tool indicated that analysts were pricing in a 52% probability of a rate cut in September. However, after the release of these inflation reports, the probability has increased to approximately 60%, with rates still expected to remain within the 4.25%-4.50% range at the June and July meetings.

Gold (XAU/USD) technical analysis: Bulls head toward $3,400

From a technical standpoint, Gold prices are trading above the resistance zone of $3,380, near $3,390 at the time of writing, a level that aligns with the upper bound of the rising wedge formation. This technical chart pattern, which formed on the daily chart, emerged after prices rebounded from the mid-May low near $3,320.

With a move above this zone opening the door for last week’s high around the psychological level of $3,400, the April ATH of $3,500 could come back in sight.

Meanwhile, the Relative Strength Index (RSI) stands at 59 and points upwards, indicating a bullish bias. On the downside, the $3,350 psychological level, which has provided support throughout the week, remains intact. Below that is the 23.6% Fibonacci retracement of the January-April high at around $3,291.

For bearish momentum to gain traction, a breach of this zone may pave the way for the next big psychological level of $3,200.

Gold (XAU/USD) daily chart

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.