Gold stuck as US yield spike, tariff worries drag prices beneath $3,000

- Gold ends a three-day losing streak, constrained by rising Treasury yields and low yield appeal.

- VIX rises amid 104% tariffs on China and renewed recession worries; equities lose early gains.

- Fed’s Daly, Goolsbee caution tariffs could increase inflation; attention turns to FOMC minutes and upcoming CPI/PPI data.

Gold price snaps three days of losses, consolidates below the $3,000 figure as US Treasury yields rise, making the non-yielding metal less appealing for investors. Even though there are hopes of trade deals between partners, the “trade war” between the US and China makes investors uneasy. At the time of writing, XAU/USD trades at $2,980 a troy ounce, virtually unchanged.

Sentiment shifted to negative as Wall Street registered substantial losses. Monday’s rally was short-lived as the bear market resumed, with the Volatility Index (VIX) pushing once again toward higher levels, indicating that market participants remain uncertain about the economic outlook.

The White House's announcement that the US would keep 104% tariffs on China triggered a spike in the VIX. Consequently, the S&P 500, the Dow Jones, and the Nasdaq erased their earlier gains and plunged on Tuesday.

Nevertheless, Gold prices tumbled as US Treasury yields spiked across the whole yield curve. The swaps market had priced in a 40% chance of a Fed rate cut in May. Despite this, elevated US yields continue to pressure XAU/USD.

In the meantime, Federal Reserve officials crossed the newswires. San Francisco Fed Mary Daly said that CEOs feel uncertain but optimistic about growth. She is concerned about a pickup in inflation due to tariffs. Earlier, Chicago Fed Austan Goolsbee said that tariffs are much higher than expected, adding there’s anxiety that high inflation will return.

Traders are eyeing the release of the Fed’s last meeting minutes, which would be overshadowed by the latest inflation figures on the consumer and producer sides.

Daily digest market movers: Gold price remains firm, capped by jump in US real yields

- US real yields surge six bps to 2.071%, as shown by the US 10-year Treasury Inflation-Protected Securities (TIPS) yields, a headwind for Gold prices.

- The US Consumer Price Index (CPI) is expected to fall from 2.8% to 2.6% YoY in March. The Core CPI is projected to decline over the next twelve months, from 3.1% to 3%.

- Recession fears had increased according to Goldman Sachs, which said the chances of a recession rose from 35% to 45% in 12 months, while downward revising growth forecasts, with the bank expecting the Gross Domestic Product (GDP) at 0.5%, due to “sharp tightening in financial conditions, foreign consumer boycotts and a continued spike on policy uncertainty.”

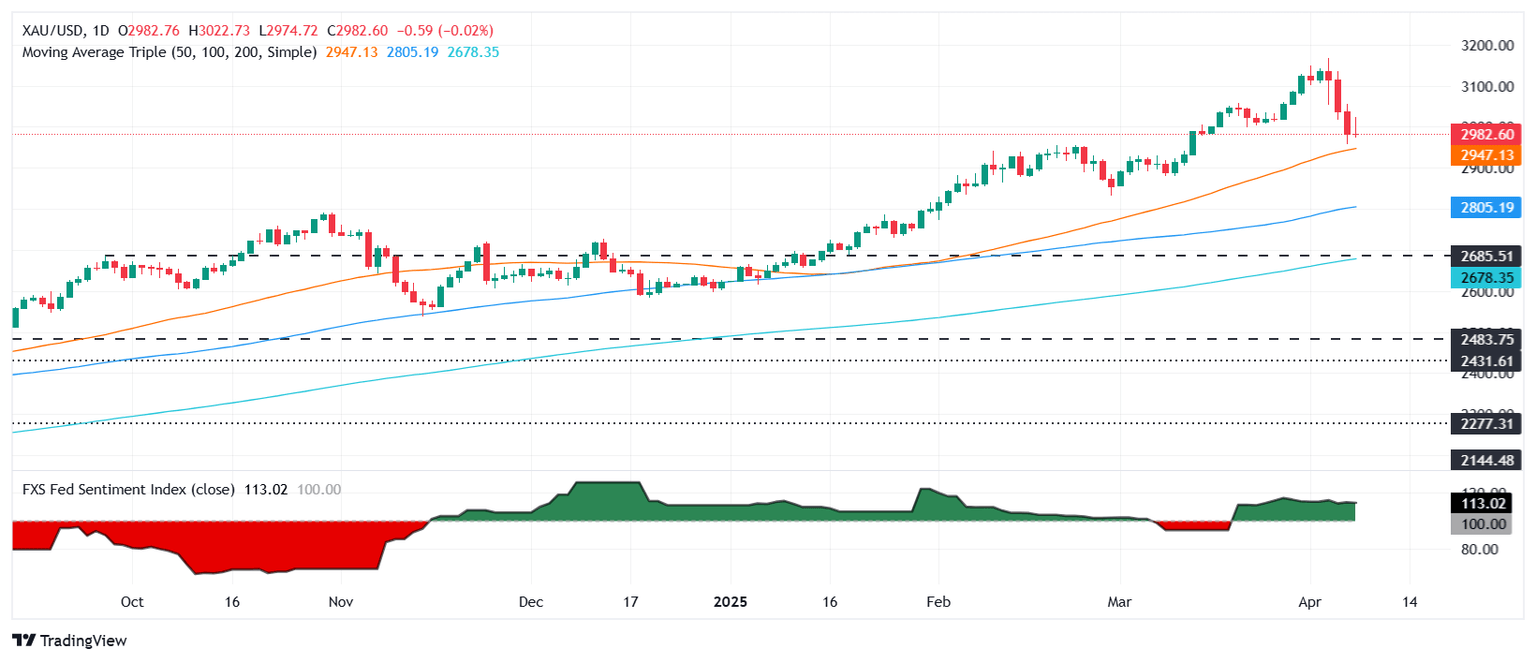

XAU/USD technical outlook: Gold price hovers below $3,000 a troy ounce

Gold price stabilized near the $2,980, though price action suggests that traders are not finding acceptance past the $3,000 figure. Failure to achieve a daily close above the latter, could trigger a test of the 50-day Simple Moving Average (SMA) at $2,947. A breach below that level could drive XAU/USD towards the $2,900 mark ahead of the 100-day SMA at $2,805.

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.