Gold shrugs off solid US jobs print, surges above $4,200 on Fed easing hopes

- Gold rises above $4,200 as strong JOLTS and ADP job reports fail to shift expectations for a December Fed cut.

- Markets maintain 88% odds of easing ahead of Fed decision, SEP update and Powell’s remarks.

- Improved risk appetite from the US–China trade progress and peace signals in Ukraine offer additional support.

Gold (XAU/USD) resumed its uptrend on Tuesday and is up 0.57% following a solid jobs report from the United States (US), which wouldn’t deter the Federal Reserve (Fed) from easing rates on Wednesday. XAU/USD trades at $4,213 after bouncing off daily lows of $4,170.

Bullion climbs despite strong US labor data, markets remaining confident the Fed will ease policy on Wednesday

The latest US Job Openings and Labor Turnover Survey (JOLTS) report showed that the labor market is more resilient than expected, as the number of vacancies rose, according to the US Bureau of Labor Statistics (BLS). Earlier, ADP revealed that private companies added an average of 4,750 people per week to the workforce in the week ending November 22, exceeding the previous 13,500 reduction.

After the data, expectations that the Fed will reduce rates on Wednesday remained unchanged at 88%, according to Capital Edge rate expectations data.

Regarding geopolitics, the Ukrainian President Volodymyr Zelensky said that Ukraine and Europe are ready to present a peace plan to the US in the “near future.”

Risk appetite has improved as trade headlines between the US and China have been more conciliatory. US President Donald Trump approved the sale of Nvidia H200 chips to China, while Beijing is poised to buy more soybeans as promised.

On Wednesday, the economic docket will feature the Federal Reserve monetary policy decision, the Fed Chair Jerome Powell press conference and the update of the Summary of Economic Projections (SEP), which could lay the path for monetary policy in 2026.

Daily digest market movers: Gold surges as US Treasury yields remain firm

- US Treasury yields remain firm with the 10-year benchmark note rate standing flat at 4.178%, following Monday’s rise of three basis points (bps). US real yields, which correlate inversely with Gold prices, are also unchanged at 1.912%, a headwind for bullion.

- The US Dollar Index (DXY), which tracks the Greenbacks’ performance against a basket of six peers, gains over 0.16% up at 99.26.

- US JOLTS data showed a surprise increase in labor demand for October, with job openings rising to 7.67 million from 7.658 million, according to the Bureau of Labor Statistics (BLS).

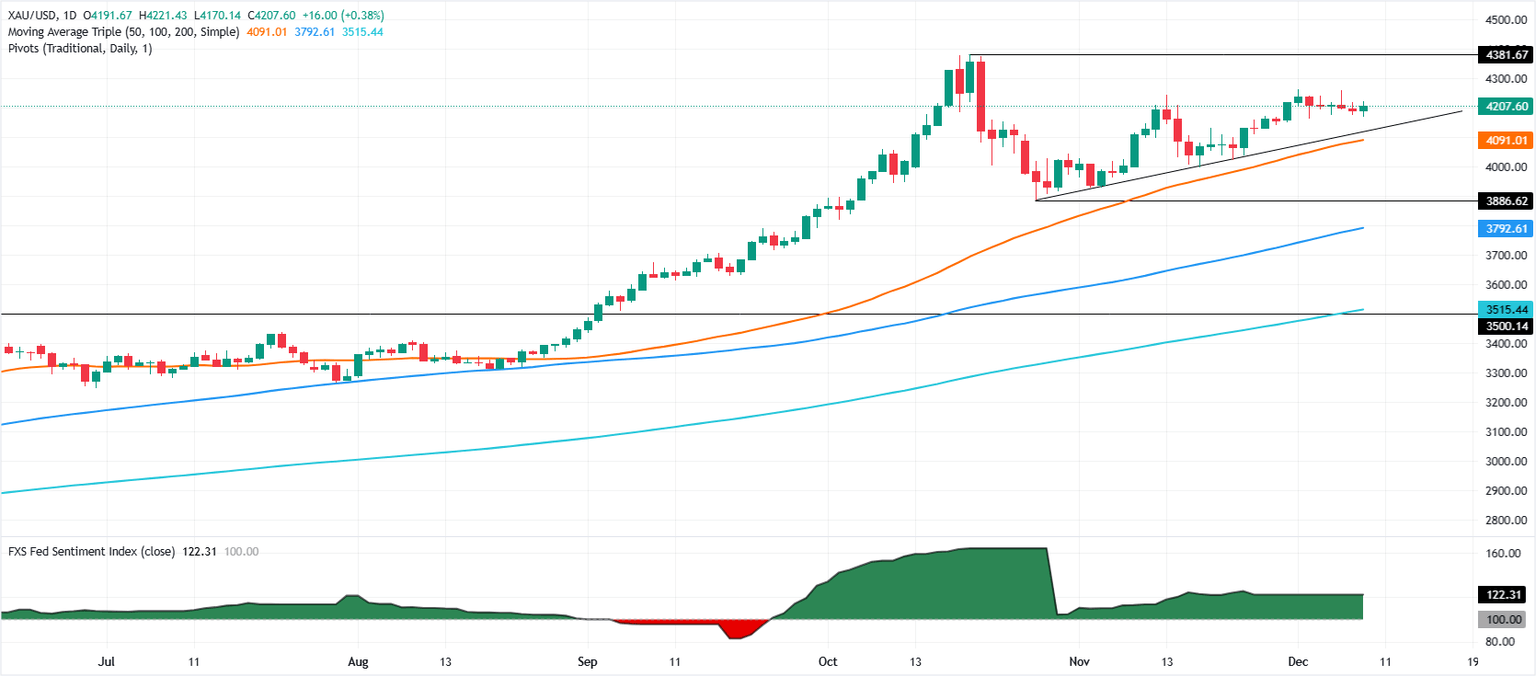

Technical Analysis: Gold climbs past $4,200 eyes on $4,250

Gold’s uptrend resumed on Tuesday as the yellow metal reached a new weekly high of $4,221, opening the door to testing higher prices like last Friday’s peak at $4,259. Bulls are gathering momentum as depicted by the Relative Strength Index (RSI).

That said, XAU/USD first resistance would be the December 5 high of $4,259, followed by the $4,300 milestone and the record high at $4,381. Conversely, a drop below $4,200 would expose the 20-day Simple Moving Average (SMA) near $4,149, and also the $4,100 mark. On further weakness, the next support would be the 50-day SMA at $4,083.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.