Gold edges higher in line with broader bull trend

- Gold is rising as bulls push the price higher again following a temporary consolidation.

- The yellow metal weakened initially on Tuesday after the news that Israel will show restraint when it strikes Iran.

- Gold faces a headwind from a continued reduction in market bets that the Federal Reserve will need to aggressively cut interest rates.

Gold (XAU/USD) recovers into the $2,650s on Tuesday after weakening following an easing of tensions in the Middle East. This came after a The Wall Street Journal (WSJ) exclusive in which Israeli Prime Minister Benjamin Netanyahu reportedly told US President Joe Biden that he would only strike military targets in Iran during the anticipated retaliation.

This, and a continued reduction in market bets that the Federal Reserve (Fed) will slash interest rates, is driving the US Dollar (USD) higher and weighing on Gold price. US survey data is also showing that inflation expectations remain elevated, with the latest Michigan Consumer Sentiment Survey indicating expectations in the long-term (5-10 years) have “skyrocketed” to 7.1% in October, “the highest in 40 years” according to analysts at The Kobeissi Letter.

Concerns regarding China, the world’s largest consumer of Gold, and the slowdown in its economy further weigh, particularly following market disappointment at the lack of clarity provided by Beijing about its much-anticipated fiscal stimulus programme.

Gold to continue to benefit from central bank demand

Gold is finding support, however, from expected continued robust demand from global central banks. The precious metal has enjoyed an increase in demand from this sector over recent years as central banks hoard Gold for its safety, liquidity and as a hedge against currency devaluation. Whilst central bank buying has declined in 2024, it is still expected to remain a major force, according to comments by the heads of three central banks at a recent panel discussion held at the London Bullion Market Association (LBMA).

Representatives of the Central Bank of Mongolia, Czech Republic, and Mexico “all agreed that Gold’s role as a reserve asset in global foreign reserves will continue to grow, even though each central bank views the precious metal differently within its portfolio,” reported Kitco News.

Gold market movers on the calendar

Gold price is more likely to be moved by the verbal rather than data-driven on Tuesday. Speeches from three Fed officials, including San Francisco Fed’s President Mary Daly, Fed Governor Adriana Kugler, and Atlanta Fed’s President Raphael Bostic, could all impact the price of the precious metal if they influence market expectations of the trajectory of interest rates.

On the data side, The NY Empire State Manufacturing Index is the metric of the day for the Greenback, with possible implications for Gold.

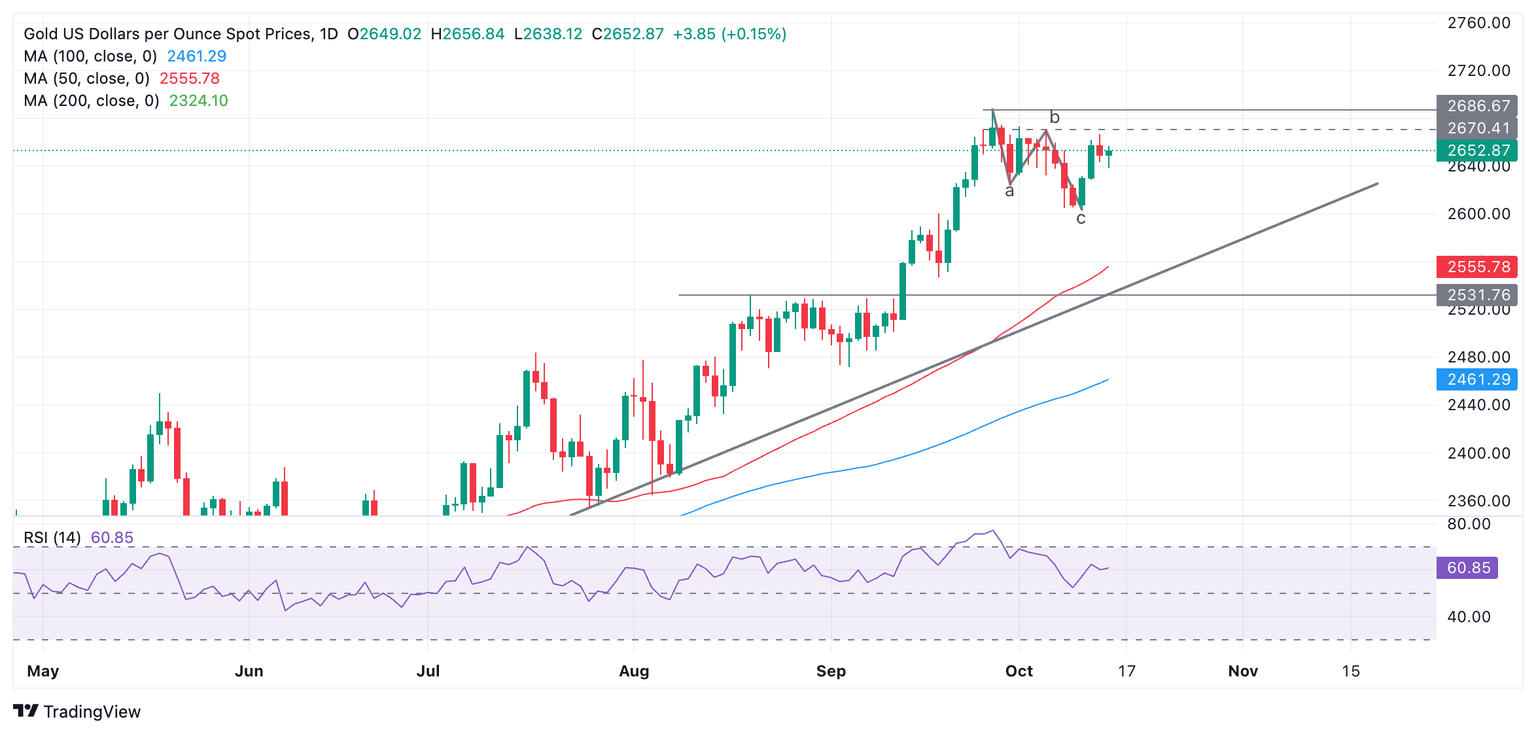

Technical Analysis: Gold tests resistance at $2,670

Gold pauses after bouncing following the end of a pullback. The precious metal appears to resume its dominant uptrend after a three-wave (abc) correction concluded at the October 10 lows.

XAU/USD Daily Chart

Gold tested a resistance level at around $2,670 on Monday but recoiled. A break of $2,673, however, would bring bullish confirmation and probably lead to a continuation up to the $2,685 all-time high. A break above that would indicate a continuation to the next target at $2,700 – a round number and psychological level.

Gold is in an uptrend on a short, medium, and long-term basis, and given the theory that “the trend is your friend,” the odds continue to favor more upside.

It would require a break below $2,600 (low of wave c on the chart) to flip the uptrend and turn the short and medium-term outlooks bearish.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.