Gold sticks to strong gains; remains below $3,500 amid slightly overbought RSI

- Gold prolongs its uptrend and climbs back closer to the all-time peak on Monday.

- Fed rate cut bets keep the USD depressed and benefit the non-yielding commodity.

- Escalating geopolitical tensions also lend support to the safe-haven XAU/USD pair.

Gold (XAU/USD) maintains its strong bid tone through the first half of the European session on Monday and remains well close to the all-time peak amid a combination of supporting factors. Despite signs of stubborn inflation, traders seem convinced that the US Federal Reserve (Fed) will cut interest rates this month. Moreover, growing concerns over the Fed’s independence further contribute to the bearish sentiment surrounding the US Dollar (USD) and benefit the non-yielding yellow metal.

Apart from this, fresh geopolitical risks stemming from Russia's attack on Ukraine and escalating Israel-Hamas conflict offer support to the safe-haven Gold. However, slightly overbought conditions on short-term charts might hold back the XAU/USD bulls from placing fresh bets and cap any further upside ahead of this week's important US macro releases. Nevertheless, the fundamental backdrop suggests that any corrective pullback might be seen as a buying opportunity and remain limited.

Daily Digest Market Movers: Gold benefits from Fed rate cut bets, weaker USD and geopolitical risks

- The US Bureau of Economic Analysis reported on Friday that the annual Personal Consumption Expenditures (PCE) Price Index held steady at 2.6% in July. Moreover, the core PCE Price Index, which excludes volatile food and energy prices, edged higher to 2.9% during the reported month from June's rise of 2.8%, matching analysts' estimates.

- The data reaffirmed bets that the US Federal Reserve will cut interest rates this month. According to the CME FedWatch Tool, traders are currently pricing in an 87% chance that the Fed will lower borrowing costs by 25 basis points at the end of a two-day meeting on September 174 and deliver at least two interest rate cuts by the year-end.

- US President Trump dismissed Fed Governor Lisa Cook over alleged mortgage fraud. Cook filed a lawsuit and refused to step down, raising concerns about the central bank's autonomy. Cook's departure would give Trump another appointment to the Fed's seven-member board and command a majority for the first time in decades.

- On the geopolitical front, Russia carried out deadly strikes on Ukrainian cities last week and launched 598 drones and decoys, along with 31 missiles. Ukrainian President Volodymyr Zelenskyy vowed to retaliate by ordering strikes deep inside Russia. The latter said on Sunday that it had downed 112 Ukrainian drones over the past 24 hours.

- Meanwhile, Israeli forces pounded the suburbs of Gaza City from the air and ground. Israeli Defence Minister Israel Katz said that the spokesperson of Hamas’ armed wing, Abu Ubaida, was killed. This keeps geopolitical risks in play, which turns out to be another factor benefiting the safe-haven Gold and contributing to the momentum.

- The US markets will be closed on Monday in observance of Labor Day. Traders might also refrain from placing aggressive directional bets ahead of this week's important US macro releases scheduled at the start of a new month, including the closely-watched US Nonfarm Payrolls (NFP) report on Friday.

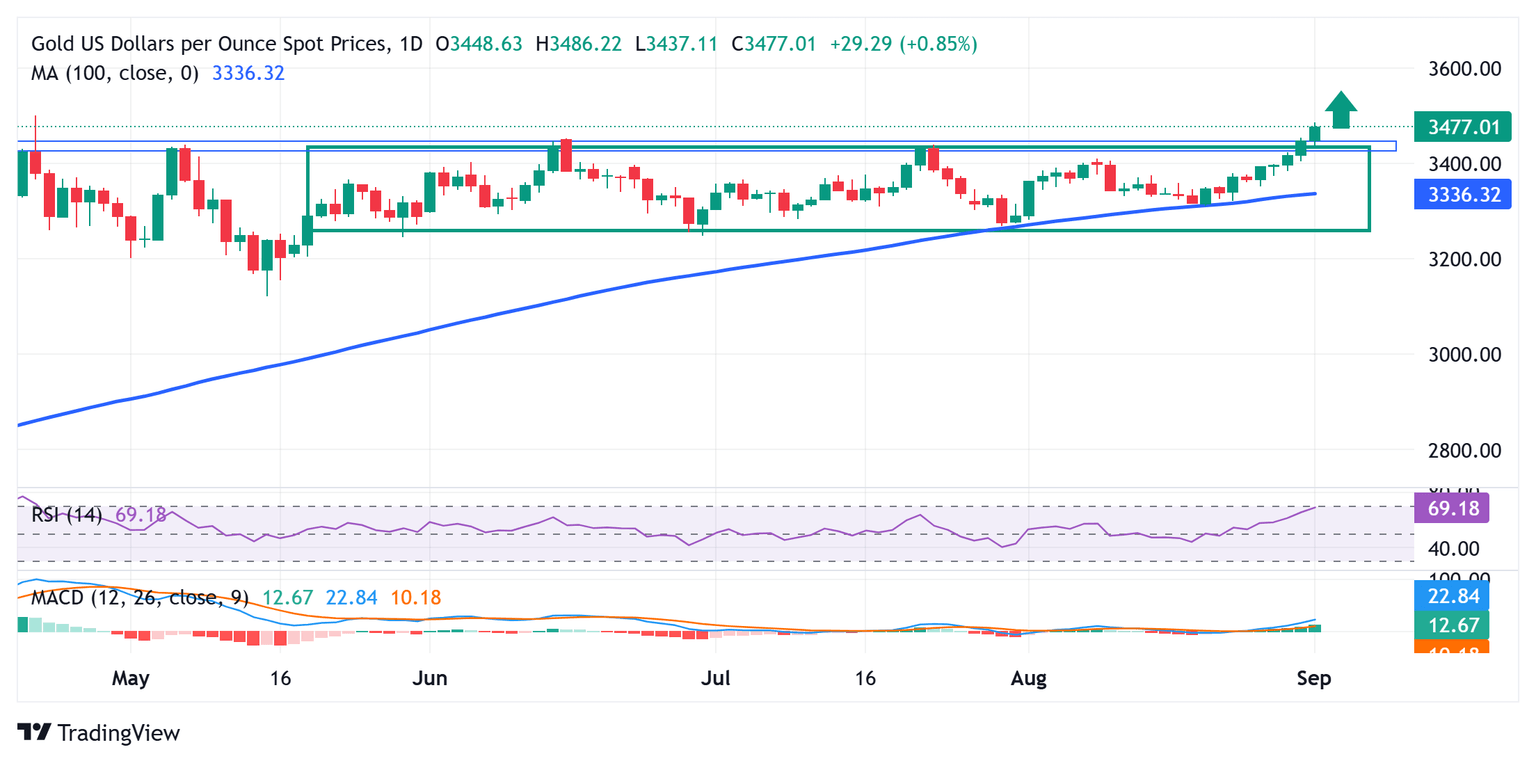

Gold bulls might refrain from placing fresh bets amid slightly overbought RSI; $3,500 holds the key

From a technical perspective, Friday's breakout through the $3,440 supply zone, or the top boundary of over a three-month-old trading range, was seen as a fresh trigger for the XAU/USD bulls. Moreover, oscillators on the daily chart have been gaining positive traction and back the case for a further appreciating move. However, the daily Relative Strength Index (RSI) has moved to the verge of breaking into the overbought territory, suggesting that Gold could pause for a breather near the $3,500 psychological mark, or the all-time peak touched in April.

On the flip side, any corrective pullback might now find decent support near the $3,440 resistance breakpoint. Any further slide could be seen as a buying opportunity and is more likely to remain limited near the $3,400 round figure. The latter should act as a strong near-term base for the Gold, which, if broken decisively, might prompt some technical selling and pave the way for deeper losses. The XAU/USD might then decline further towards the $3,372 intermediate support en route to the $3,350 region.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.