Gold rallies to 2-month high amid weaker US Dollar and Fed uncertainty

- Gold reverses losses on Friday, climbing to a 2-month high near $3,450.

- Despite a firmer US Dollar, bullion found renewed demand as traders maintained bets on Fed easing.

- US Core PCE rose 0.3% MoM and 2.9% YoY in July, while headline PCE gained 0.2% MoM and held steady at 2.6% YoY.

Gold (XAU/USD) reverses course on Friday, erasing intraday losses and climbing back to fresh highs. The precious metal is now trading near $3,447, its strongest level since June 16, after the US Personal Consumption Expenditures (PCE) inflation report came broadly in line with expectations. A softer tone in the US Dollar (USD) helped underpin bullion, with traders maintaining bets on monetary policy easing in September.

At the time of writing, XAU/USD is up around 0.85% on the day, recovering sharply from early weakness near $3,404 in the European session. The metal remains on track to secure solid monthly gains, supported by safe-haven flows, Fed policy expectations, and persistent geopolitical and economic uncertainty. Concerns over the Fed’s independence have further bolstered its appeal, and short-term corrections are likely to be viewed as dip-buying opportunities within the broader bullish trend.

Data from the Bureau of Economic Analysis showed that the Core PCE Price Index rose 0.3% month-on-month in July, matching forecasts and unchanged from June’s pace. On a yearly basis, core inflation edged up to 2.9% from 2.8%, marking its highest level since February. Headline PCE increased 0.2% MoM, in line with estimates but slightly softer than June’s 0.3%, while the yearly rate held steady at 2.6%.

Market movers: Greenback holds ground, yields stabilize, markets eye US inflation data

- The US Dollar Index (DXY), which tracks the Greenback against a basket of six major currencies, is holding firm after a three-day decline. At the time of writing, the index trades near the 98.00 mark, struggling around the lower end of this month’s narrow range.

- US Treasury yields are steady across the curve, with the benchmark 10-year halting a three-day slide and hovering near 4.22%, close to four-month lows. The 30-year yield is snapping a two-day losing streak, trading around 4.90%. Meanwhile, the 10-year TIPS yield is seen near 1.81%.

- Geopolitical tensions remain elevated as peace efforts falter. Following the meeting between Russian President Vladimir Putin and US President Donald Trump in Alaska, the White House said it believed Putin had agreed to meet with Ukrainian President Volodymyr Zelenskyy and that planning was “underway.” However, German Chancellor Friedrich Merz told reporters on Thursday that it now seems clear no such meeting will take place, casting doubt on the prospects for a negotiated settlement. The remarks came just hours after a deadly Russian missile strike on Kyiv that killed at least 23 people and damaged European Union (EU) and British diplomatic offices, underscoring the fragile and deteriorating state of the conflict.

- Fed independence concerns deepened on Thursday as President Trump’s attempt to dismiss Fed Governor Lisa Cook escalated into a legal showdown. Cook filed a lawsuit challenging the move as unlawful, citing the Federal Reserve Act, and sought a temporary restraining order to block her removal. A court hearing is scheduled for Friday, keeping the issue in sharp focus for markets.

- Fed Governor Christopher Waller reinforced expectations for policy easing on Thursday, stating that he supports a 25 basis point (bps) rate cut starting in September, with further reductions potentially totaling 125-150 bps over the next three to six months. Waller downplayed the case for a larger 50 bps move next month but added, “That view, of course, could change if the employment report for August points to a substantially weakening economy and inflation remains well contained.”

- US Personal spending grew 0.5% in July, ahead of the expected 0.3% and faster than June’s 0.3% gain. Personal income rose 0.4% MoM, in line with consensus and above the prior 0.3%, reinforcing evidence that household consumption remains resilient despite signs of a softer labor market.

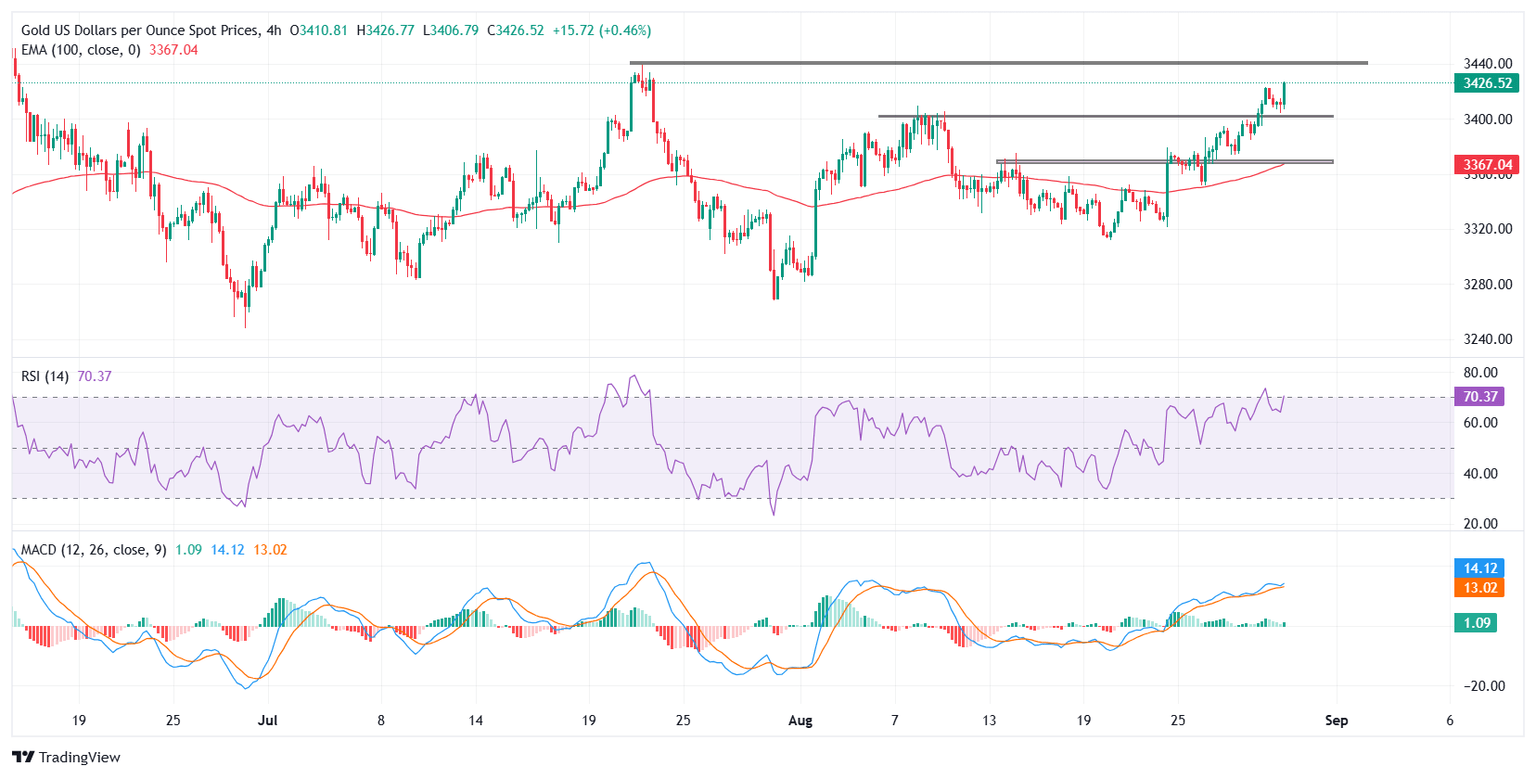

Technical analysis: Gold consolidates above $3,400, PCE report eyed as next catalyst

Gold (XAU/USD) trimms losses on Friday after finding support just above the $3,400 mark, rebounding toward Thursday’s peak at $3,423 — its strongest level in over five weeks. The $3,400 psychological handle now acts as immediate support, with additional downside cushions at the 21-period Exponential Moving Average (EMA) near $3,395 and the 100-period EMA around $3,365.

The Relative Strength Index (RSI) is approaching overbought territory, currently hovering near 70. The indicator remains firmly in bullish territory, suggesting buyers could continue to step in as long as the $3,400 support holds.

On the upside, Thursday’s high at $3,423 marks initial resistance. A sustained break above this barrier could extend the advance toward the $3,450 psychological region. Conversely, a move below $3,400 would risk exposing the $3,380-$3,370 area, where stronger technical support is layered.

With the US core PCE report as the next catalyst, short-term direction will likely hinge on whether Gold can defend the $3,400 base or push decisively beyond $3,423 resistance.

Economic Indicator

Core Personal Consumption Expenditures - Price Index (MoM)

The Core Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The PCE Price Index is also the Federal Reserve’s (Fed) preferred gauge of inflation. The MoM figure compares the prices of goods in the reference month to the previous month.The core reading excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Next release: Fri Aug 29, 2025 12:30

Frequency: Monthly

Consensus: 0.3%

Previous: 0.3%

Source: US Bureau of Economic Analysis

After publishing the GDP report, the US Bureau of Economic Analysis releases the Personal Consumption Expenditures (PCE) Price Index data alongside the monthly changes in Personal Spending and Personal Income. FOMC policymakers use the annual Core PCE Price Index, which excludes volatile food and energy prices, as their primary gauge of inflation. A stronger-than-expected reading could help the USD outperform its rivals as it would hint at a possible hawkish shift in the Fed’s forward guidance and vice versa.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.