Gold surges to record high, poised to extend gains amid tariff disputes

- Gold rises 0.87%, maintaining gains as market navigates US tariff implications on global trade.

- US Dollar Index peaks at two-week high, later retreating as the US-Mexico tariff delay tempers momentum.

- Investors focus on upcoming US Nonfarm Payrolls and Fed communications.

Gold price hit a record high on Monday after the US initially scheduled tariffs on Canada, Mexico and China, sparking flows toward the non-yielding metal's safe-haven appeal. At the time of writing, XAU/USD trades at $2,821 above its opening price by 0.87%.

Market mood has improved, yet the golden metal holds to previous gains. Tariffs have been the main driver of the markets since US President Donald Trump took office. The Greenback began the week on the front foot after the US enacted 25% tariffs on two of its largest trading partners and 10% on China.

The US Dollar Index (DXY) hit a two-week high of 109.88, but news that the US is delaying tariffs on Mexico due to an agreement between both countries weighed on the Greenback, providing a leg-up in XAU/USD.

In the meantime, tariffs on Canada and China remain in place, set to begin on Tuesday. However, US President Trump said he would hold talks with Canada’s Prime Minister Justin Trudeau.

Moving to economic drivers, the Institute for Supply Management (ISM) revealed that US business activity in the manufacturing sector improved. Furthermore, traders will be eyeing US data, with the release of US Nonfarm Payrolls (NFP) for January and Federal Reserve (Fed) officials crossing the newswires.

Daily digest market movers: Gold price boosted by falling US Treasury yields

- The US 10-year T-note yield drops one and a half basis points to 4.537%. US real yields, as measured by the 10-year Treasury Inflation-Protected Securities (TIPS), are unchanged at 2.095%.

- The ISM Manufacturing PMI for January rose to 50.9, surpassing expectations of 49.8 and improving from December's reading of 49.2, signaling an enhancement in business activity. A closer look at the data shows the prices paid sub-component increased from 52.5 to 54.9, indicating higher input costs. Additionally, the employment index showed significant improvement, moving from 45.4 in December to 50.3, reflecting better employment conditions within the sector.

- Bart Melek, Head of Commodity Strategies at TD Securities, commented that the market is not fully aware of the extent of the trade war. "We haven't seen a complete response from Gold, and if this trade war continues for a considerable period, it could lead to significantly higher Gold prices down the road," he added.

- Boston Fed President Susan Collins said the Fed could be patient on rate cuts due to tariff uncertainty.

- Atlanta’s Fed President Raphael Bostic said the Fed needs to get inflation to 2% for the credibility of the institution. He added that the labor market is solid, and he wants to see what the 100 bps of easing last year translates into the economy.

- Money market futures now price in 44 basis points of Fed rate cuts in 2025, with traders anticipating the first move in June.

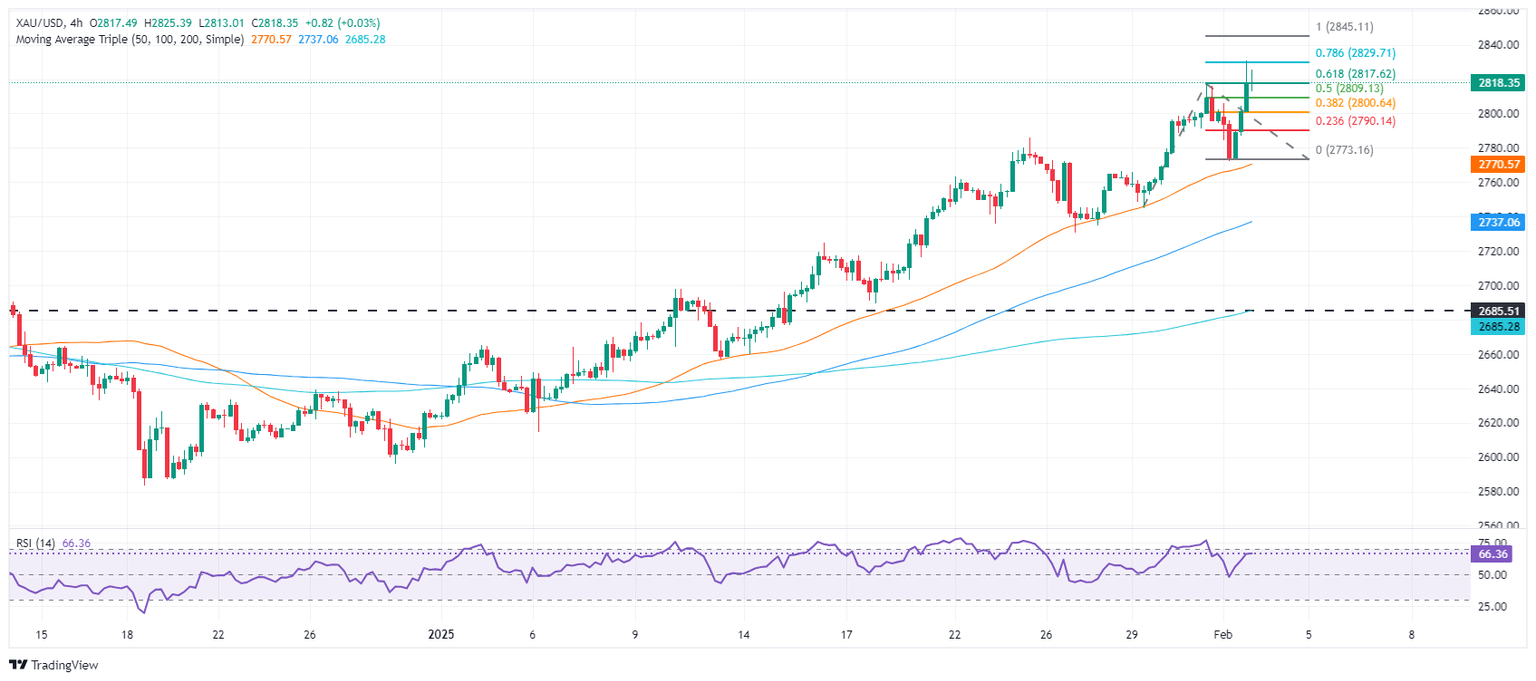

XAU/USD technical outlook: Gold price remains bullish as buyers eye $2,850

Gold price’s uptrend resumed on Monday as the yellow metal hit an all-time high (ATH) of $2,830. Further upside is seen amid geopolitical uncertainty due to the US imposing tariffs, the Middle East conflict, and the Russia-Ukraine war.

If XAU/USD rises past $2,830, the next resistance would be the 100% Fibonacci level near $2,844 as part of the January 25 to January 31 leg up, which can be seen in the 4-hour chart below. If surpassed, the next resistance will be the 161.8% Fib extension at $2,889, ahead of $2,900.

Conversely, if sellers clear the 50-period Simple Moving Average (SMA) at $2,770, this will be followed by the January 27 swing low of $2,730. The next stop below there would be $2,700.

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.