Gold price moves further away from all-time peak; bullish bias remains amid trade jitters

- Gold price buying remains unabated as trade uncertainties continue to boost safe-haven demand.

- Geopolitical risks and Trump's threat to the Fed’s independence further benefit the XAU/USD pair.

- Bulls, however, pause for a breather amid extremely overbought conditions on the short-term charts.

Gold price (XAU/USD) retreats from the $3,500 mark, or a fresh all-time peak touched earlier this Tuesday as bulls pause for a breather amid extremely overbought conditions on short-term charts. The commodity, however, retains its positive bias through the first half of the European session amid persistent worries about the potential economic fallout from US President Donald Trump's tariffs. This, along with geopolitical tensions, might continue to act as a tailwind for the safe-haven bullion.

Meanwhile, Trump's back-and-forth tariff announcements have weakened investors' confidence in the US economy. Adding to this, Trump's attack on Federal Reserve (Fed) Chair Jerome Powell raised doubts about the central bank’s independence and keeps the US Dollar (USD) bulls on the defensive. This, along with the prospects for more aggressive policy easing by the Fed, favors bullish traders and suggests that the path of least resistance for the non-yielding Gold price is to the upside.

Daily Digest Market Movers: Gold price bulls not ready to give up yet amid US tariffs-inspired recession fears

- The uncertainty over US President Donald Trump’s steep tariffs and their impact on the global economy continues to push the safe-haven Gold price to fresh record highs on Tuesday.

- Moreover, Trump's rapidly shifting stance on trade policies, along with a call to fire Federal Reserve Chair Jerome Powell, keeps investors on the edge and further benefits the commodity.

- Trump accused Powell of not moving fast enough to bring down interest rates. Furthermore, Trump and his team are studying whether they can oust Powell before the end of his term.

- This raises doubts over the Fed's monetary policy independence, which, along with bets that the US central bank will resume its rate-cutting cycle, continues to weigh on the US Dollar.

- According to the CME Group's FedWatch Tool, traders are pricing in the possibility of the Fed cutting interest rates by 25 basis points in June and deliver at least three rate reductions in 2025.

- On the geopolitical front, Russian forces had launched 96 drones and three missiles into eastern and southern Ukraine after the 30-hour short-lived and partially observed Easter ceasefire.

- Traders now look forward to the release of the Richmond Manufacturing Index from the US, which, along with speeches from influential FOMC members, will drive the USD demand.

- The focus, however, will remain on the flash PMIs on Wednesday, which would offer fresh insight into the global economic health and provide some meaningful impetus to the XAU/USD pair.

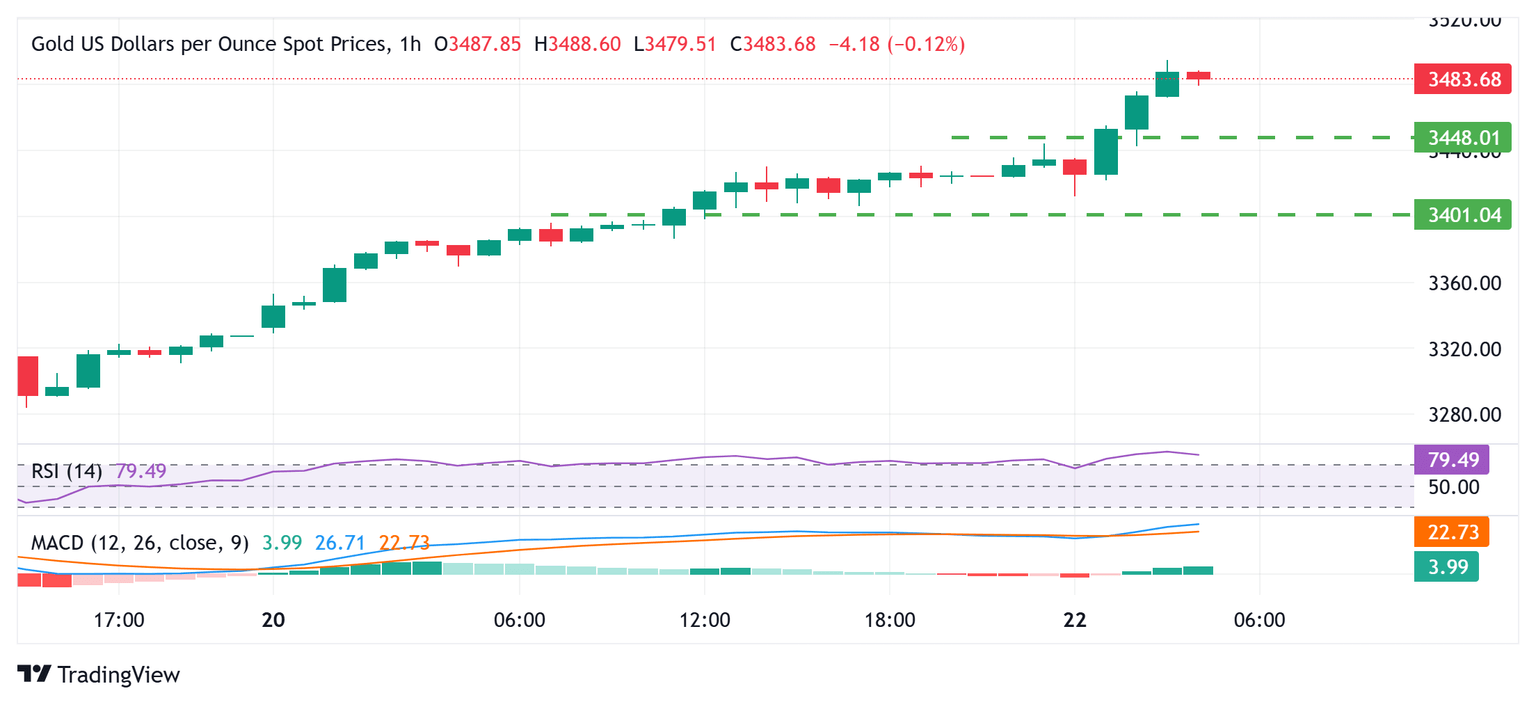

Gold price needs to consolidate or retreat further before the next leg up amid overbought daily RSI

From a technical perspective, the daily Relative Strength Index (RSI) remains well above the 70 mark and warrants caution for bulls. Hence, it will be prudent to wait for some near-term consolidation or a modest pullback before placing fresh bullish bets around the Gold price and positioning for an extension of the recent well-established uptrend witnessed over the past four months or so.

In the meantime, any meaningful corrective slide is likely to find decent support near the $3,425-3,423 horizontal zone ahead of the $3,400 mark. A convincing break below the latter might prompt some technical selling and drag the Gold price further toward the $3,358-3,357 region. This is followed by the $3,344 support, which if broken decisively should pave the way for deeper losses.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.