Gold price selling bias remains unabated; bears retain control amid a combination of negative factors

- Gold price kicks off the new week on a weaker note in reaction to the optimism over the US-China trade deal.

- The US and China agree to substantially move down tariff levels by 115% for an initial period of 90 days/

- Easing US recession fears and the Fed’s hawkish pause underpin the USD, and further weigh on the commodity.

Gold price (XAU/USD) drops to a one-and-a-half-week low, around the $3,216 area, during the first half of the European session on Monday and seems vulnerable to slide further. The latest optimism over the US-China trade deal remains supportive of the upbeat market mood and continues to weigh heavily on the traditional safe-haven commodity.

Meanwhile, easing concerns about a US recession, along with the Federal Reserve's (Fed) hawkish pause, lifts the US Dollar (USD) to its highest level since April 10. This turns out to be another factor driving flows away from the Gold price and validates the near-term negative outlook in the absence of any relevant market-moving economic releases from the US.

Daily Digest Market Movers: Gold price is pressured by US-China trade optimism, receding recession fears and stronger USD

- The US and China ended high-stakes trade talks in Switzerland on a positive note on Sunday. In fact, US Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer said that a trade deal had been struck with China.

- Adding to this, China's Vice Premier He Lifeng said that the meeting achieved substantial progress, and reached consensus on key issues, triggering a fresh wave of global risk-on trade and undermining the safe-haven Gold price.

- The US Dollar holds steady near a one-month high amid the Federal Reserve's hawkish signal that it is not leaning towards cutting interest rates anytime soon, as traders await more details on the US-China trade agreement.

- China's Vice Premier He Lifeng said that a joint statement would be released in Geneva on Monday, and that it is going to be big news and good news for the world, which further adds to the latest market optimism.

- Russian President Vladimir Putin has agreed to hold direct talks with his Ukrainian counterpart Volodymyr Zelenskyy and stated that these talks should begin "without preconditions and delay" on Thursday, May 15.

- Meanwhile, Hamas said that the last living American hostage in Gaza, Edan Alexander, will be released and confirmed plans to hold direct talks with the US as part of efforts to reach a ceasefire and resume the delivery of aid.

- Traders this week will confront the release of US inflation figures. Apart from this, Fed Chair Jerome Powell's appearance on Thursday will be looked upon for cues about the future rate-cut path and a fresh impetus.

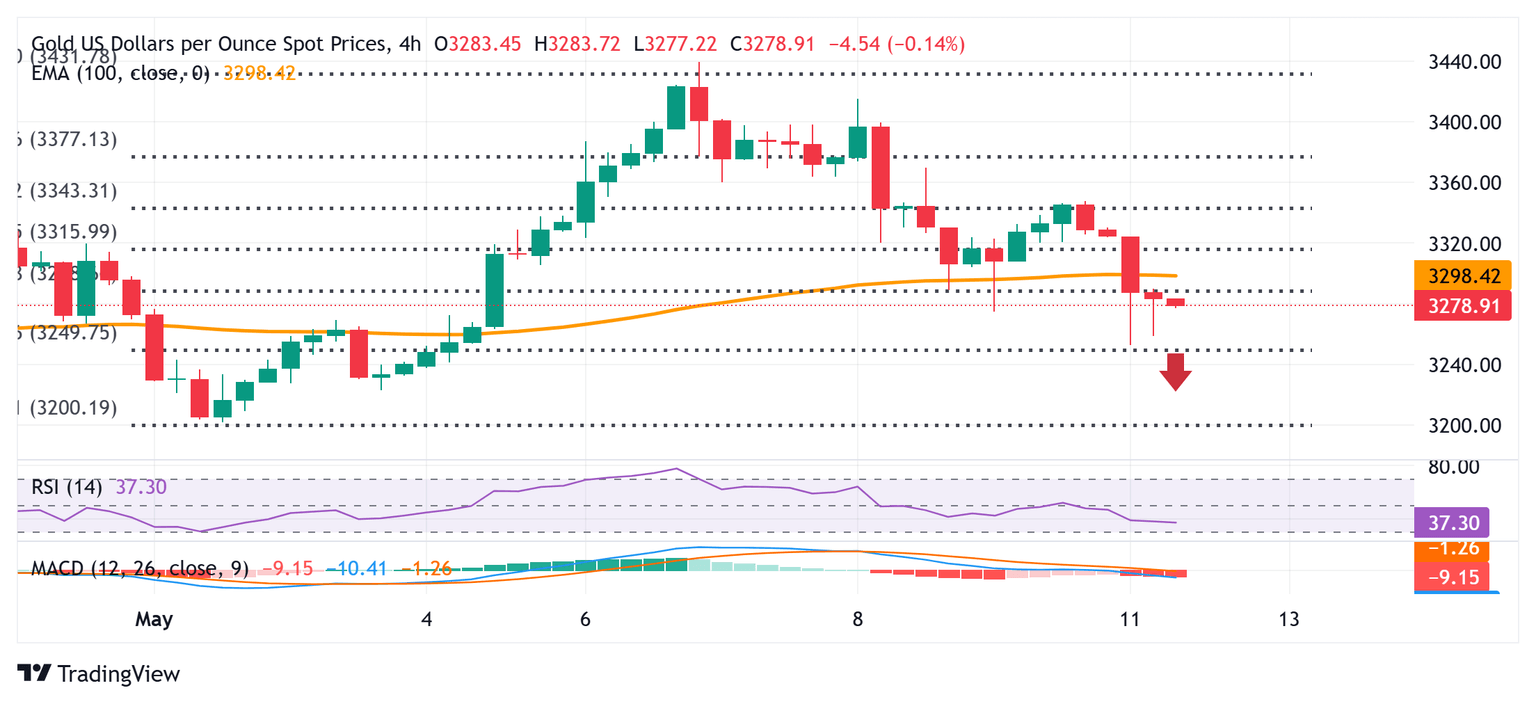

Gold price remains on track to challenge the monthly swing low, around the $3,200 mark

From a technical perspective, any intraday breakdown and acceptance below the $3,295-3,290 confluence – comprising the 100-period Exponential Moving Average (EMA) on the 4-hour chart and the 61.8% Fibonacci retracement level of the recent move up from the monthly low – could be seen as a key trigger for bearish traders. Moreover, oscillators on hourly charts have been gaining negative traction and support prospects for a further intraday depreciating move for the Gold price. Some follow-through selling below the Asian session low, around the $3,253-3,252 region, will reaffirm the bearish bias and expose the monthly low, around the $3,200 mark. The latter should act as a pivotal point, which, if broken decisively, should pave the way for the resumption of the prior retracement slide from the $3,500 psychological mark, or the all-time peak touched in April.

On the flip side, any recovery back above the $3,300 round figure now seems to attract fresh sellers near the $3,317-3,318 zone, or the Asian session peak. A sustained strength, however, might trigger a short-covering move and lift the Gold price to the $3,345-3,347 hurdle, representing the 38.2% Fibo. level. This is followed by the $3,360-3,365 static hurdle, which, if cleared decisively, would negate the near-term negative bias and set the stage for a move towards reclaiming the $3,400 mark.

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.