Gold hits new all-time high as US yields tumble, buyers eye $2,500

Most recent article: Gold rises after Kugler speech and Shanghai bets

- Gold price hits an all-time high of $2,469 on growing expectations of a Fed rate cut in September.

- Trump’s potential election win fuels market volatility, driving investors to non-yielding assets.

- Lower-than-expected inflation data and Powell’s dovish comments underpins Gold.

Gold price skyrockets to a new all-time high of $2,469 on Tuesday amid growing bets that the US Federal Reserve (Fed) will begin its easing cycle in September. This, along with increasing chances that former President Donald Trump would win November’s election, underpinned the yellow metal. The XAU/USD trades at $2,467, gains more than 1.70%.

Last week’s lower-than-expected consumer inflation figures pushed non-yielding metal prices higher amid the Fed’s dovish pivot. The CME FedWatch Tool shows that the odds for a 25-basis point rate cut in September are 100%, with a minuscule part of economists foreseeing a 50 bps of easing.

Besides this, over-the-weekend political developments involving former President Trump sponsored a leg-up on the Golden metal. Trump’s Presidency will aim to increase tariffs and cut taxes, which will most likely increase the US budget deficit and generate inflationary pressures.

Meanwhile, Fed Chair Jerome Powell appeared at the Economic Club of Washington, where he commented that the economy performed well and added that the Fed will lower borrowing costs once it is confident that inflation is moving toward the 2% goal.

Data-wise, the US Census Bureau reported that Retail Sales in June were unchanged, as expected. However, excluding autos, sales rose sharply, exceeding forecasts.

Daily digest market movers: Gold climbs as traders ignore mixed US data

- Weaker-than-expected US Consumer Price Index (CPI) data sponsored Gold’s leg-up above $2,400, as the odds for Fed rate cuts increased, as reflected by falling US Treasury bond yields.

- US Retail Sales in June were flat at 0% MoM, as expected. Core sales expanded by 0.4% MoM, above the projected 0.1%.

- June Export and Import Prices both decreased, with Export prices dropping -0.5% MoM, below the forecast of -0.1%. Import prices rose compared to May’s -0.2% decline, coming in at 0%, beneath the estimated 0.2% increase.

- Meanwhile, the US Dollar Index (DXY), which tracks the Greenback against a basket of six currencies, is up by a minimal 0.02% at 104.27.

- December 2024 fed funds rate futures contract implies that the Fed will ease policy by 53 basis points (bps) toward the end of the year, up from 50 last Friday.

- Bullion prices retreated slightly due to the People's Bank of China (PBoC) decision to halt gold purchases in June, as it did in May. By the end of June, China held 72.80 million troy ounces of the precious metal.

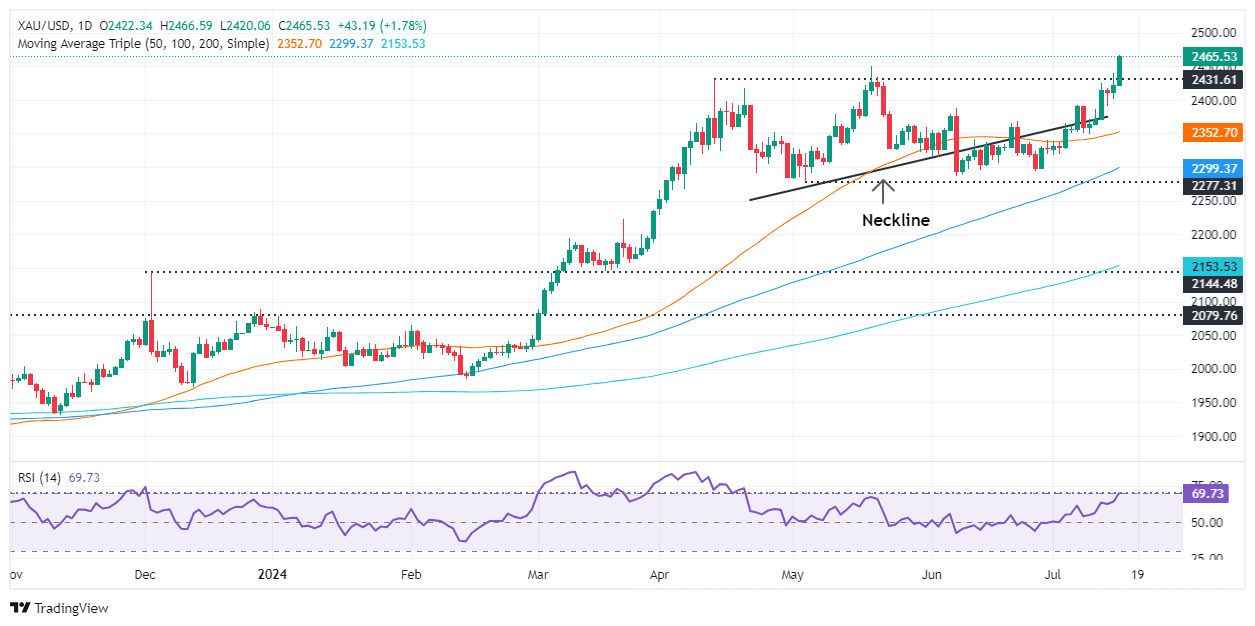

Gold technical analysis: XAU/USD surged and extended rally as traders eye $2,500

Gold prices remain bullish and trading at all-time highs, clearing the May 20 high of $2450, which opened the door for further gains. Momentum is still in the bulls' favor, as depicted by the Relative Strength Index (RSI), which aims higher and is shy of reaching “regular” overbought conditions.

XAU/USD's next resistance would be $2,475, followed by the $2,500 figure. Conversely, if gold prices slide below $2,450, the first resistance would be the $2,400 figure, followed by the July 5 high at $2,392. If cleared, XAU/USD would continue to $2,350.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.