Gold price consolidates below $3,300 as traders keenly await the release of the US PCE Price Index

- Gold price meets with a fresh supply on Friday amid the emergence of some USD dip-buying.

- Trade tensions, geopolitical risks, and Fed rate cut bets should limit losses for the commodity.

- Traders now look forward to the US PCE Price Index for Fed rate cut bets and a fresh impetus.

Gold price (XAU/USD) consolidates below the $3,300 mark, or the daily low during the first half of the European session on Friday as traders opt to move to the sidelines ahead of the crucial US inflation figures. Heading into the key data risk, some repositioning trade assists the US Dollar (USD) to regain some positive traction. This, in turn, is seen undermining demand for the commodity, though a combination of factors holds back traders from placing aggressive bearish bets and helps limit deeper losses.

A federal appeals court paused a separate trade court ruling and reinstated US President Donald Trump's tariffs on Thursday, adding a layer of uncertainty in the markets and weighing on investors' sentiment. Apart from this, persistent geopolitical risks stemming from the protracted Russia-Ukraine war and conflicts in the Middle East offer some support to the safe-haven Gold price. Moreover, expectations that the Federal Reserve (Fed) will cut rates further cap the USD and act as a tailwind for the XAU/USD pair.

Daily Digest Market Movers: Gold price struggles to lure buyers amid modest USD strength; downside seems limited

- The overnight sharp US Dollar retracement slide lacks follow-through as bears seem reluctant ahead of the release of the crucial US Personal Consumption Expenditure (PCE) Price Index later this Friday.

- A federal appeals court on Thursday temporarily reinstated US President Donald Trump's sweeping trade tariffs, a day after a separate trade court deemed them illegal and ordered an immediate block.

- Meanwhile, the Wall Street Journal (WSJ) reported late Thursday that the Trump administration is considering an existing law that includes language allowing for tariffs of up to 15% for 150 days.

- Kremlin spokesman Dmitry Peskov said on Thursday, that Russia, so far, has now received a response from Ukraine over its proposal to hold the next round of peace talks in Istanbul next week.

- White House spokeswoman Karoline Leavitt told reporters that Israel has agreed to a US ceasefire proposal. Hamas said that the terms did not meet its demands, keeping geopolitical risks in play.

- Traders have been pricing in the possibility that the Federal Reserve (Fed) will step in to support the economy and deliver at least two 25 basis points interest rate cuts by the end of this year.

- However, Minutes of the FOMC May meeting released on Wednesday revealed a consensus to maintain the wait-and-see stance amid the uncertainty over the economic outlook and trade policies.

- Meanwhile, Chicago Fed President Austan Goolsbee noted that the US central bank could return to a situation where interest rates could come down if tariffs are avoided by a deal or otherwise.

- Moreover, San Francisco Fed President Mary Daly said that two rate cuts this year would make sense if the labor market stays solid and inflation falls, but the range of possible risks is large.

- Separately, Dallas President Lorie Logan said that risks to employment and inflation goals are roughly balanced. If the balance shifts, the Fed is well prepared to respond, Logan added further.

- Fed Chair Jerome Powell, on the other hand, met with the President on Thursday and reiterated that decisions on monetary policy are based on the incoming economic data from the US.

- Hence, Friday's crucial inflation data will play a key role in influencing expectations about the Fed's rate-cut path, which will drive the USD and provide a fresh impetus to the XAU/USD pair.

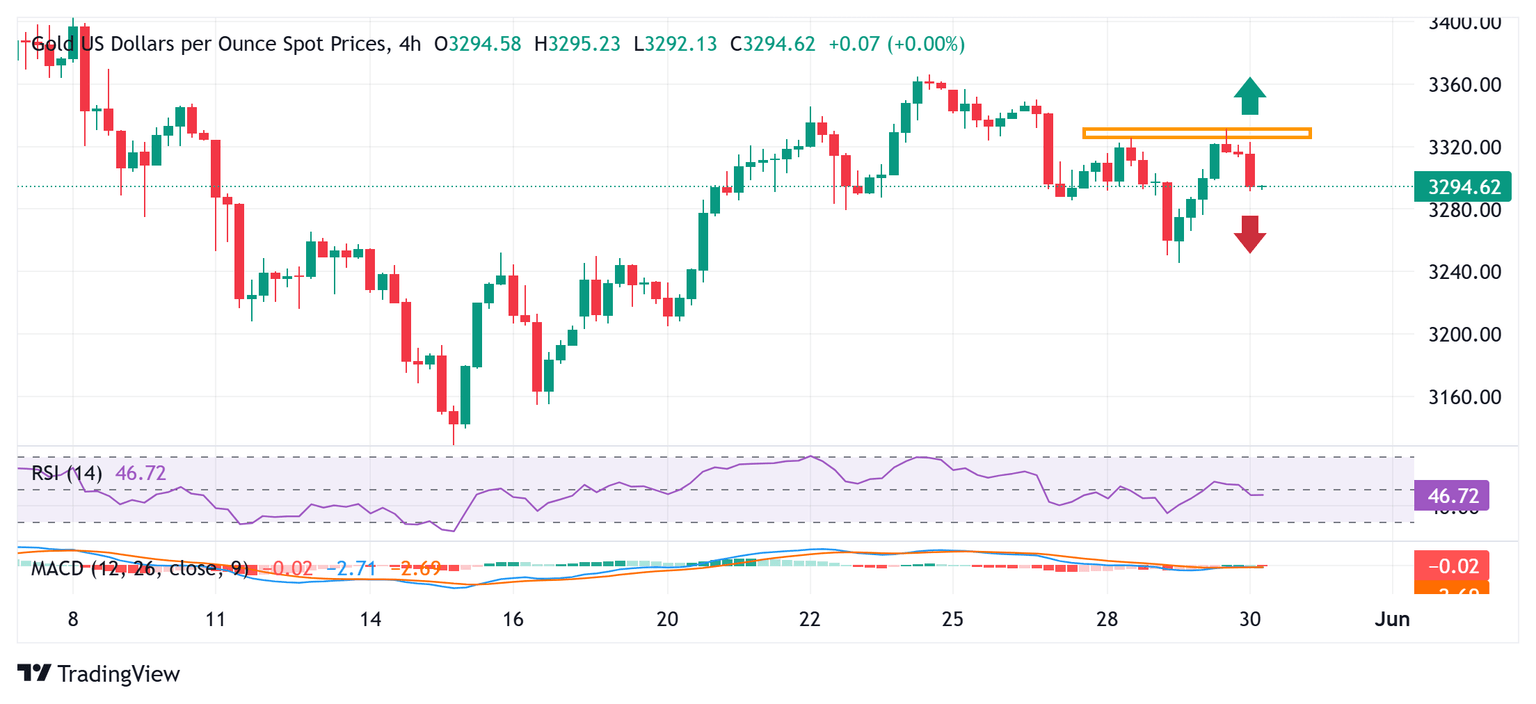

Gold price could accelerate the intraday downfall once the $3,280 immediate support is broken decisively

From a technical perspective, the overnight failure near the $3,325-3,326 horizontal resistance and a subsequent slide below the $3,300 mark favor the XAU/USD bears. Moreover, oscillators on the 4-hour chart have again started gaining negative traction and back the case for a further intraday depreciating move for the Gold price. Hence, some follow-through weakness towards the $3,280 static support, en route to the overnight swing low around the $3,246-3,245 region, looks like a distinct possibility. A convincing break below the latter should pave the way for deeper losses and expose the $3,200 round figure.

On the flip side, the $3,325-3,326 area might continue to act as an immediate hurdle ahead of the $3,345-3,350 supply zone. A sustained strength beyond could negate the negative outlook and trigger a fresh bout of a short-covering move, which should allow the Gold price to reclaim the $3,400 mark. The momentum could extend further towards the next relevant barrier near the $3,432-3,434 region.

Economic Indicator

Core Personal Consumption Expenditures - Price Index (YoY)

The Core Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The PCE Price Index is also the Federal Reserve’s (Fed) preferred gauge of inflation. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The core reading excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures." Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Next release: Fri May 30, 2025 12:30

Frequency: Monthly

Consensus: 2.5%

Previous: 2.6%

Source: US Bureau of Economic Analysis

After publishing the GDP report, the US Bureau of Economic Analysis releases the Personal Consumption Expenditures (PCE) Price Index data alongside the monthly changes in Personal Spending and Personal Income. FOMC policymakers use the annual Core PCE Price Index, which excludes volatile food and energy prices, as their primary gauge of inflation. A stronger-than-expected reading could help the USD outperform its rivals as it would hint at a possible hawkish shift in the Fed’s forward guidance and vice versa.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.