Gold price shines as USD slips, trade war fuels safe-haven demand

- Gold is on track for a weekly gain above 1.5% as tariff threats shift the mood sour.

- Trump confirms tariffs of up to 70% may take effect on August 1 amid trade flare-up.

- Treasury’s Bessent expects 100 countries to face reciprocal tariffs, while trade deals are incoming.

Gold price resumes its uptrend on Friday, poised to print gains of over 1.50% for the week as the US Dollar is on the back foot amid thin liquidity conditions following the closure of US markets in celebration of Independence Day. A slight escalation of the trade war boosted bullion prices. The XAU/USD trades at $3,333, up 0.26%.

US President Donald Trump said that they would start sending letters to countries on Friday, ahead of the July 9 deadline. He announced that some of the tariffs imposed will be within the range of 10% to 70% and will take effect on August 1. On this, US Treasury Secretary Scott Bessent said that he expects a flurry of trade deals before July 9 and estimates that about 100 countries will receive a minimum 10% reciprocal tariff. He added that they will be announcing some deals.

Expectations that the Federal Reserve (Fed) might keep rates on hold for quite some time capped Gold’s advance. Data released on Thursday revealed that the US labor market posted solid numbers, although the majority of new additions to the workforce came from the government. Contrarily, private hiring was the smallest in eight months as businesses brace for an economic slowdown.

Regarding geopolitics, Trump said that he had a conversation with Russian President Vladimir Putin, revealing that there was no progress on Ukraine and Russia. Recently, Trump told Ukrainian President Zelensky he wants to help with air defense due to Russian attacks, via Axios.

Next week, the US economic docket will remain light. Traders will await the release of the Federal Open Market Committee (FOMC) meeting minutes, followed by Initial Jobless Claims for the week ending July 5, and Fed speeches.

Daily digest market movers: Gold price edges up amid steady US yields

- Gold price uptrend appears to be capped by elevated US Treasury yields. The US 10-year Treasury bond yield ended up six and a half five basis points at 4.338% on Thursday. US real yields are also up three bps at 2.018%.

- The US Dollar Index (DXY), which tracks the Greenback’s performance against a basket of currencies, is down 0.13% but clings to the 97.00 figure.

- The 'One Big Beautiful Bill' primarily “extends most of the individual and estate provisions of Trump’s 2017 Tax Cuts and Jobs Act, which were largely set to expire at the end of 2025,” via Bloomberg. The Congressional Budget Office (CBO) and the Joint Committee on Taxation revealed that the bill will add $3.4 trillion over a decade to the national deficit.

- The addition of trillions of Dollars to the national debt might put pressure on the Greenback and push Gold prices higher as a hedge against an already high US debt ceiling.

- On Thursday, the US Bureau of Labor Statistics (BLS) revealed June’s Nonfarm Payrolls, which came at 147K, above expectations of 110K, and up from May’s revised figure of 144K. The Unemployment Rate declined to 4.1% from 4.2%, and supports the Fed Chair Jerome Powell’s cautious wait-and-see approach as the central bank monitors the potential inflationary impact of trade tariffs.

- Initial Jobless Claims for the week ending June 28 fell to 233,000, below the expected 240,000 and lower than the previous week’s reading, signaling a resilient labor market.

- Money markets suggest that traders are pricing in 50 basis points of easing toward the end of the year, according to Prime Market Terminal data.

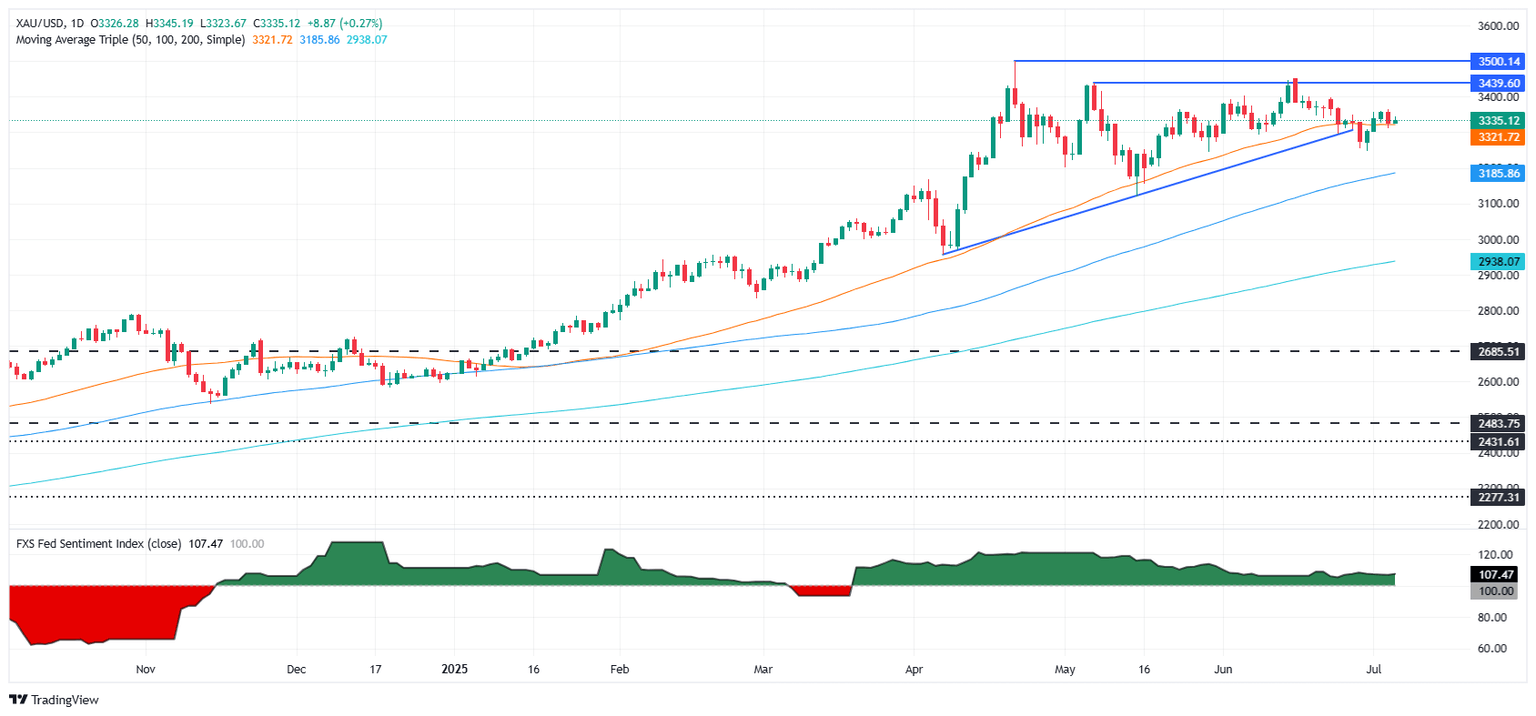

XAU/USD technical outlook: Gold price trades sideways above/below $3,350

Gold price uptrend is not compromised, despite the yellow metal has failed to print a new cycle high past the June 16 peak of $3,452. The Relative Strength Index (RSI) suggests that XAU/USD may consolidate in the near term, as RSI is flat around its neutral line.

For a bullish continuation, Bullion must clear $3,400 and $3,452. Once breached, the next target is the record high of $3,500. On the flip side, if Gold collapses beneath $3,300, a move toward the June 30 swing low of $3,246 is on the cards. This level is critical for buyers because once cleared, the next demand zone would be the May 15 swing low of $3,120.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.