Gold price makes a fresh attempt to build on momentum beyond $3,400 mark

- Gold price attracts some dip-buyers following an intraday downtick amid trade jitters.

- Bets for a September rate cut by the Fed further support the non-yielding yellow metal.

- The risk-on mood and a modest USD rebound cap the upside for the safe-haven commodity.

Gold price (XAU/USD) continues with its struggle to find acceptance or build on the momentum beyond the $3,400 mark and remains below a two-week high through the early European session on Friday. Against the backdrop of the upbeat market mood, a modest US Dollar (USD) uptick turns out to be a key factor acting as a headwind for the commodity. However, the fundamental backdrop seems tilted in favor of bulls.

Investors remain on edge amid US President Donald Trump's fresh tariff threats, which add a layer of uncertainty in the markets and might continue to underpin the Gold price. Furthermore, the growing acceptance that the Federal Reserve (Fed) will resume its rate-cutting cycle in September might keep a lid on any meaningful USD recovery. This should limit losses for the non-yielding yellow metal and warrants caution for bears.

Daily Digest Market Movers: Gold price bulls look to retain control amid tariff jitters, Fed rate cut bets

- The US Dollar recovers slightly from a nearly two-week low touched the previous day. Moreover, Asian stocks rose for the fifth consecutive day and seem poised to register the best week since June, which, in turn, prompts some profit-taking around the Gold price on Friday.

- US President Donald Trump imposed additional levies on Indian imports as "punishment" for buying oil from Russia, taking the total tariffs to 50%. Trump had also announced this week that tariffs on semiconductors and pharmaceuticals will be imposed within the next week or so.

- The developments revive concerns about the potential economic fallout from a global trade war. Adding to this, official data on Thursday showed that China's central bank extended Gold purchases for the ninth straight month in July. This could act as a tailwind for the precious metal.

- Traders ramped up their bets that the US Federal Reserve will resume its rate-cutting cycle in September after the US Nonfarm Payrolls report last Friday. Adding to this, the US Jobless Claims rose for the second straight week and pointed to a deterioration in labor market conditions.

- In fact, the US Labor Department reported on Thursday that the number of Americans filing new applications for unemployment benefits ticked up to a seasonally adjusted 226K during the week ended August 2. This marked the highest level since the week ending July 5.

- According to the CME Group's FedWatch Tool, traders see over a 90% chance that the Fed will lower borrowing costs at the next monetary policy meeting in September. Moreover, the Fed is expected to deliver at least two 25-basis-point rate cuts by the end of this year.

- Meanwhile, Trump nominated Council of Economic Advisers Chairman Stephen Miran to serve out the rest of Fed Governor Adriana Kugler's term until January 31, 2026. Furthermore, Trump has shortlisted four candidates as replacements for Fed Chair Jerome Powell.

- This might hold back the USD bulls from placing aggressive bets and cap the upside, which could lend support to the commodity. In the absence of any relevant macro data, speeches from influential FOMC members might provide some impetus to the XAU/USD pair.

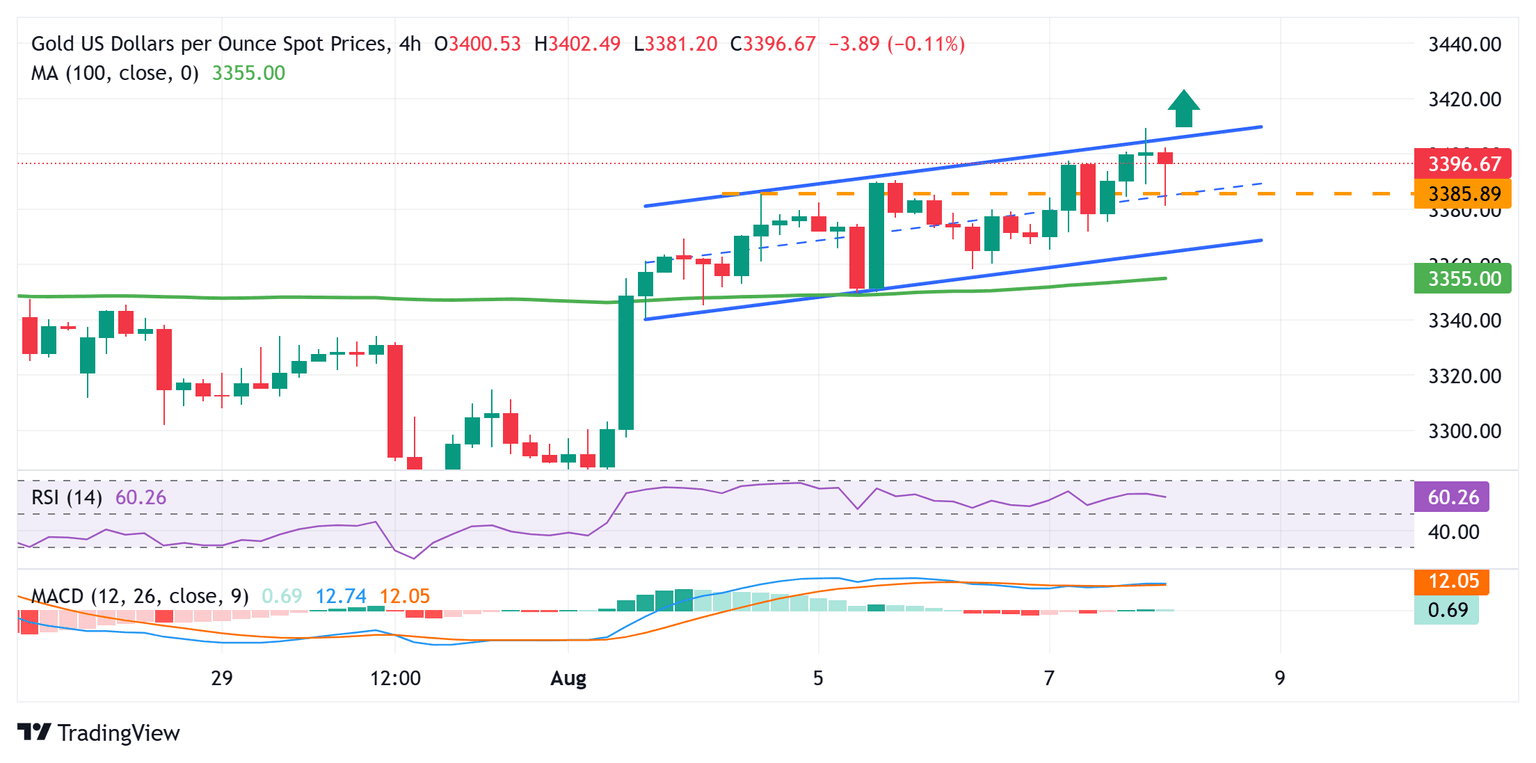

Gold price acceptance above the $3,400 mark should pave the way for a further appreciating move

From a technical perspective, the overnight sustained strength beyond the $3,383-3,385 supply zone and positive oscillators on the daily chart suggest that the path of least resistance for the commodity is to the upside. However, the Asian session uptick falters near a resistance marked by the top boundary of the weekly uptrend. Hence, it will be prudent to wait for some follow-through buying beyond the $3,309-3,310 region before positioning for further gains. The momentum might then lift the Gold price to the next relevant hurdle near the $3,422-3,423 area en route to the $3,434-3,435 region. A sustained strength beyond the latter should pave the way for a move towards challenging the all-time peak, around the $3,500 psychological mark touched in April.

On the flip side, weakness below the trading range resistance breakpoint, around the $3,385-3,383 region, could be seen as a buying opportunity and remain cushioned near the $3,353-3,350 area. The latter represents the 200-period Simple Moving Average (SMA) on the 4-hour chart, which should act as a key pivotal point. A convincing break below might shift the bias in favor of bearish traders and drag the Gold price to the $3,315 intermediate support en route to the $3,300 round figure and the $3,268 region, or a one-month low touched last week.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.