Gold price flat lines below one-week high; bullish potential seems intact as traders await US data

- Gold price attracts some dip-buyers following an intraday sharp pullback from a one-week high.

- A softer US CPI lifts Fed rate cut bets and weighs on the USD, underpinning the precious metal.

- Trade uncertainties and rising geopolitical tensions contribute to limiting losses for the XAU/USD.

Gold price (XAU/USD) reverses an early European session slide to the $3,338 area and is currently placed in neutral territory, just below a one-week high touched this Wednesday. The initial market reaction to a positive development surrounding the US-China trade war turned out to be short-lived in the wake of US President Donald Trump's fresh tariff threats on Wednesday. Furthermore, rising geopolitical tensions in the Middle East temper investors' appetite for riskier assets and act as a tailwind for the safe-haven bullion.

Meanwhile, the US Dollar (USD) struggles to capitalize on a modest intraday bounce and languishes near its lowest level since April 22 amid dovish Federal Reserve (Fed) expectations. In fact, traders ramped up their bets that the US central bank would resume its rate-cutting cycle in September after data released on Wednesday showed that US consumer prices rose at a slower-than-anticipated pace in May. This is seen as another factor that lends support to the non-yielding Gold price and contributes to stalling the intraday retracement slide.

Daily Digest Market Movers: Gold price bulls not ready to give up amid a combination of supporting factors

- US President Donald Trump flared up trade tensions on Wednesday, saying that he would set unilateral tariff rates and inform trading partners within two weeks. This adds a layer of uncertainty and overshadows the optimism led by a positive tone following US-China trade talks in London.

- The US ordered some staff to depart its Baghdad embassy and allowed military families to voluntarily leave the Middle East amid rising security risks. This comes after Iran's Defence Minister Aziz Nasirzadeh threatened to strike US bases in the region if conflict erupts over its nuclear program.

- Russia intensified bombardments that it said were retaliatory measures for Ukraine's recent attacks. A new concentrated wave of drone attacks on Ukraine's second-largest city of Kharkiv was reported early on Thursday. This keeps geopolitical risks in play and underpins the safe haven Gold price.

- On the economic data front, the US Bureau of Labor Statistics (BLS) reported on Wednesday that the headline Consumer Price Index (CPI) rose less than expected, to the 2.4% annualized pace in May from 2.3% in the previous month. The consensus estimate was for a reading of 2.5%.

- Meanwhile, the core gauge, which excludes volatile food and energy prices, matched April's increase and climbed 2.8% during the reported month. Traders are now pricing in a 70% chance that the Federal Reserve will cut interest rates in September, dragging the US Dollar to a fresh monthly low.

- The market focus now shifts to Thursday's US economic docket – featuring the release of the Producer Price Index (PPI) and Weekly Initial Jobless Claims later during the North American session. Nevertheless, the fundamental backdrop suggests that the path of least hurdle for the XAU/USD pair is to the upside.

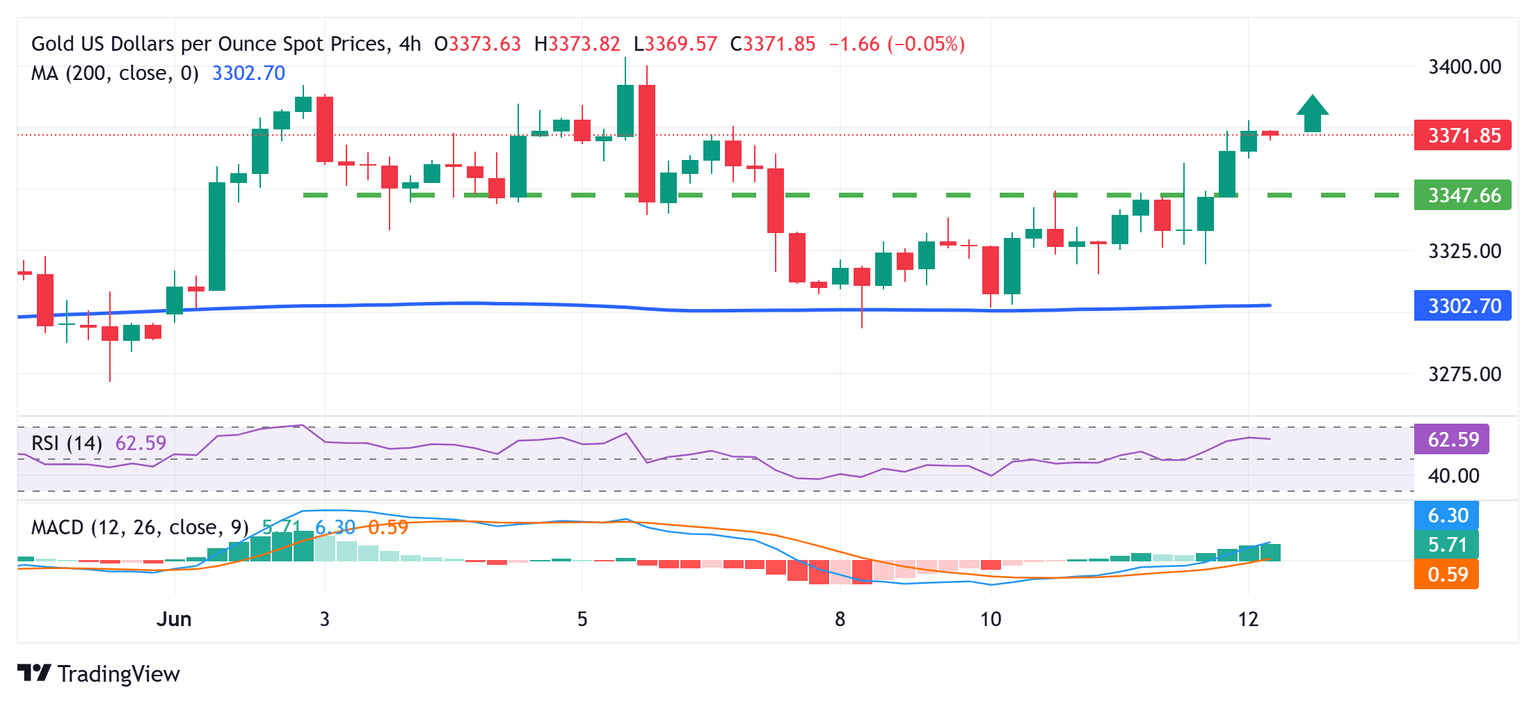

Gold price remains on track to reclaim the $3,400 mark despite intraday volatility

From a technical perspective, this week's rebound from the 200-period Simple Moving Average (SMA) and the subsequent strength beyond $3,348-3,350 horizontal resistance favors the XAU/USD bulls. This, along with positive oscillators on daily/hourly charts, validates the near-term constructive outlook and should allow the Gold price to climb further towards reclaiming the $3,400 round figure. Some follow-through buying should pave the way for an extension of the momentum to the $3,430-3,435 region, above which the commodity could aim to retest the all-time peak, around the $3,500 psychological mark touched in April.

On the flip side, the aforementioned resistance breakpoint, around the $3,350-3.348 area, now seems to protect the immediate downside. Any further pullback could be seen as a buying opportunity near the $3.323-3,322 region. This should help limit the downside for the Gold price near the $3,300 round figure, or the 200-period SMA on the 4-hour chart. The latter should act as a pivotal point, which if broken would shift the near-term bias in favor of bearish traders.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.