Gold Price News and Forecast: XAU/USD triangle pattern completing final wave E pattern

Gold bull markets: History and prospects ahead

Would you like to know one simple way of achieving investment successes and getting rich? That’s great, I will reveal this secret to you – and you even don’t have to click anything! The trick is to find a bull market and go long! And, what a coincidence, gold is right now in the bull market… If you don’t believe, then look at the chart below.

If the chart does not present the bull market then I have no idea either what it presents or what is the bull market. As you can see, gold gained about $800, or two thirds, since the autumn of 2018, which seems to be quite bullish! Read More...

Gold triangle pattern completing final wave E pattern

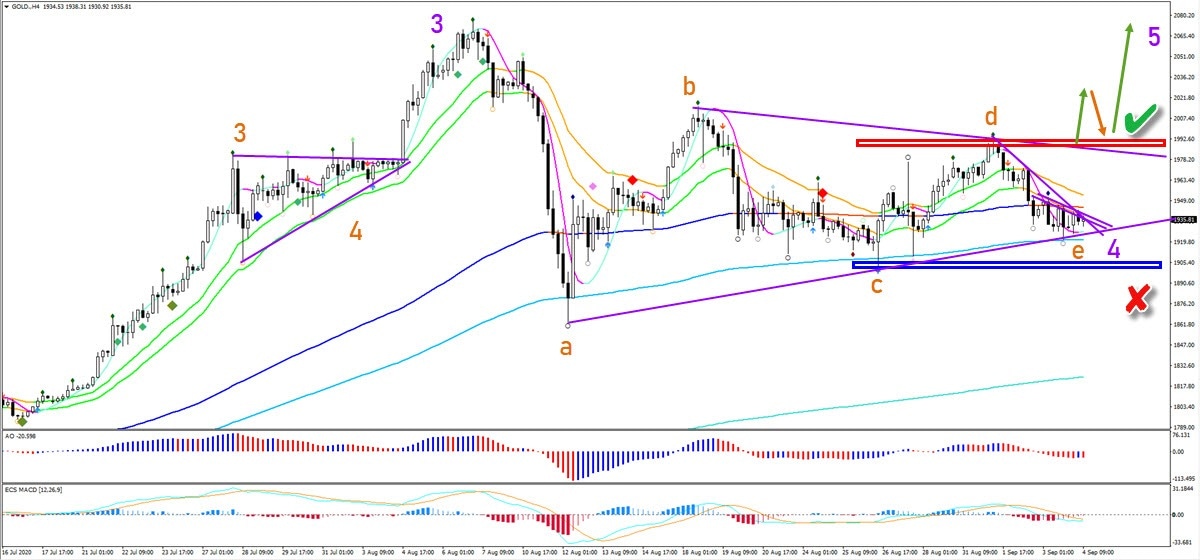

Gold (XAU/USD) is confirming a contracting triangle chart pattern. This price pattern was expected in our analysis after price action strongly dropped within a large and established uptrend. Is the triangle now close to being completed?

The XAU/USD is now testing the bottom of wave C (blue box). This is a critical and interesting point of any potential triangle pattern. The reason is simple: price is close to either confirming (green check) or invalidating (red x) this wave pattern. The retest of the previous bottoms could be a final wave E (orange) and indicate the end of the triangle pattern. This would also complete wave 4 (purple). Read More...

Gold: A break above 1961 is a short term buy signal

Gold Spot broke below 1942 for a short term sell signal targeting 1937, 1931 & our buying opportunity at 1924/22. This trade worked perfectly as we bottomed exactly here & shot higher to 1941.

Silver Spot longs at 2725/15 worked perfectly as we shot higher to the target of 2760/70 & topped exactly here. However we reversed & broke 2725/15 for our sell signal targeting 2650/40 & bottomed exactly here.

Gold meets first resistance at 1947 for some profit taking on any remaining longs. Sell at 1950/55 with stops above 1961. A break higher is a short term buy signal targeting 1970/72 & perhaps as far as strong resistance at 1983/86. Shorts need stops above 1991. Read More...

Author

FXStreet Team

FXStreet