Gold Price News and Forecast: XAU/USD looks to capitalize on safe-haven flows amid Wall Street chaos

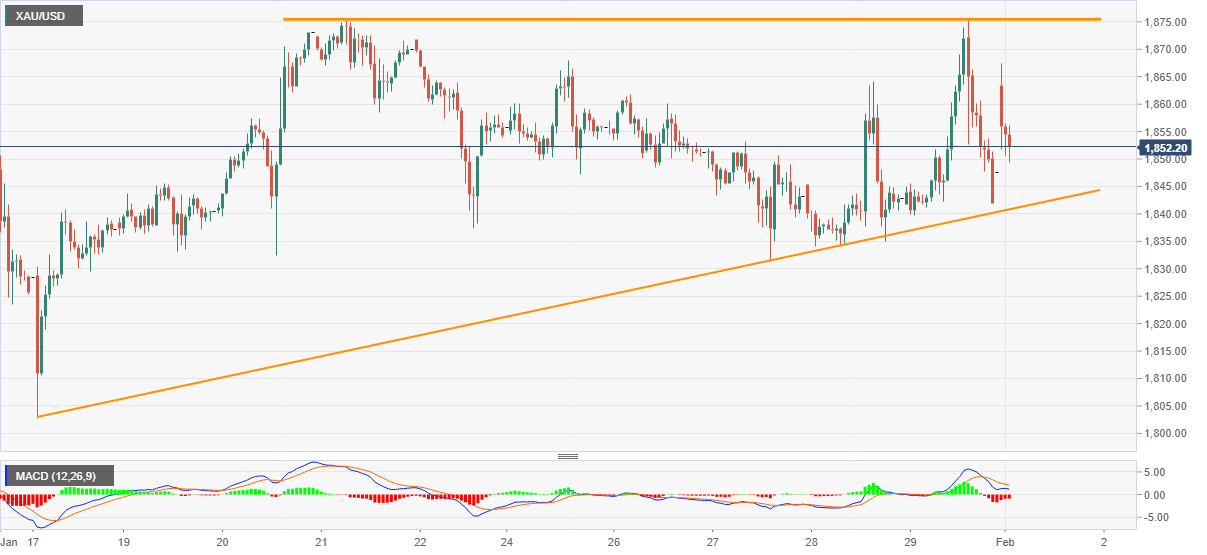

Gold Price Analysis: XAU/USD fills the gap above $1,850 inside immediate ascending triangle

Gold drops to $1,851.39 while trimming the gains to 0.50% during Monday’s Asian session. In doing so, the yellow metal stays inside a short-term ascending triangle.

Given the bearish MACD favoring the quote’s further downside, gold sellers will wait for a clear break of the triangle’s support, currently around $1,840, for fresh entries. Following that, the previous week’s low near $1,830 and January’s low near $1,802, also the $1,800 threshold, can entertain the commodity sellers.

Gold Weekly Forecast: XAU/USD looks to capitalize on safe-haven flows amid Wall Street chaos

After gaining more than 1% in the previous week, the XAU/USD pair struggled to preserve its bullish momentum and edged lower during the first half of the week. Although the pair staged a rebound and rose above $1,860 on Thursday from the weekly low it set at $1,831 on Wednesday, it couldn't close the day in the positive territory. With buyers remaining in control on Friday, the pair closed the week virtually flat slightly above $1,850.

Author

FXStreet Team

FXStreet