Gold Price News and Forecast: XAU/USD getting heavier [Video]

![Gold Price News and Forecast: XAU/USD getting heavier [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Crosses/XAUUSD/gold-close-up-9646056_XtraLarge.jpg)

Gold: The bulls just cannot get a handle on the sell-off right now [Video]

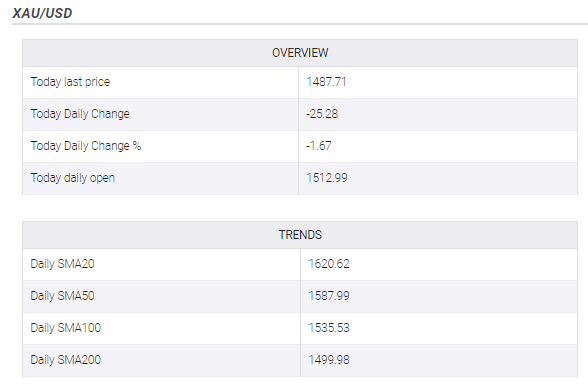

The decline of gold and its intraday volatility are astounding right now (although this can be said of a lot of markets). Yesterday’s daily range of $122 was the fourth largest high/low range ever on gold and was more than double the Average True Range of $54. The trouble is that the bulls just cannot get a handle on the sell-off right now. A run of enormous bear candles has continued even into today’s session. Momentum has now taken a decisive turn for the worse, with RSI hitting 30. This is the lowest since August 2018, when recovery first started to build into the bull market that has been a feature of the past 18 months. Whilst the daily chart shows bear candles, we remain cautious. Read more...

Gold getting heavier

Some folks have attributed gold’s recent decline, in the face of collapsing equity prices and interest rates, to a stronger US dollar. This is not the case, as gold in euro terms have also fallen equally sharply. Investors are therefore abandoning the so-called safe-haven metal for other reasons, including because of concerns over physical demand as Covid-19 wreaks havoc on the global economy. It is not hard to imagine there might be some forced liquidation as leveraged portfolios with large long equity portions have or nearly gone bust. With the safe haven metal not responding in the way you would expect it to in times like now, I can’t help but feel more pain is on the way for gold bugs. Read more...

Gold slides to $1485 region, closer to over 1-month lows set on Monday

Gold edged lower through the early European session on Tuesday and is currently placed near the lower end of its daily trading range, around the $1484 region.

A combination of factors failed to assist the precious metal to capitalize on the previous day's goodish intraday recovery move from over one-month lows to levels beyond the key $1500 psychological mark.

Gold weighed down by a combination of factors

Having recorded their worst drop in more than three decades on Monday, a strong rebound in the US equity futures dented the commodity's safe-haven status and exerted some fresh downward pressure.

This coupled with a goodish pickup in the US dollar demand further undermined demand for the dollar-denominated commodity and contributed to the weaker tone for the seventh consecutive session on Tuesday. Read more...

Author

FXStreet Team

FXStreet