Gold Price News and Forecast: XAU/USD gaining 0.7% this morning, as coronavirus fears continue to dominate financial markets [Video]

![Gold Price News and Forecast: XAU/USD gaining 0.7% this morning, as coronavirus fears continue to dominate financial markets [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/gold-coins-on-a-weight-scale-gm173237086-20246712_XtraLarge.jpg)

Gold: Expect weakness to be seen as an opportunity [Video]

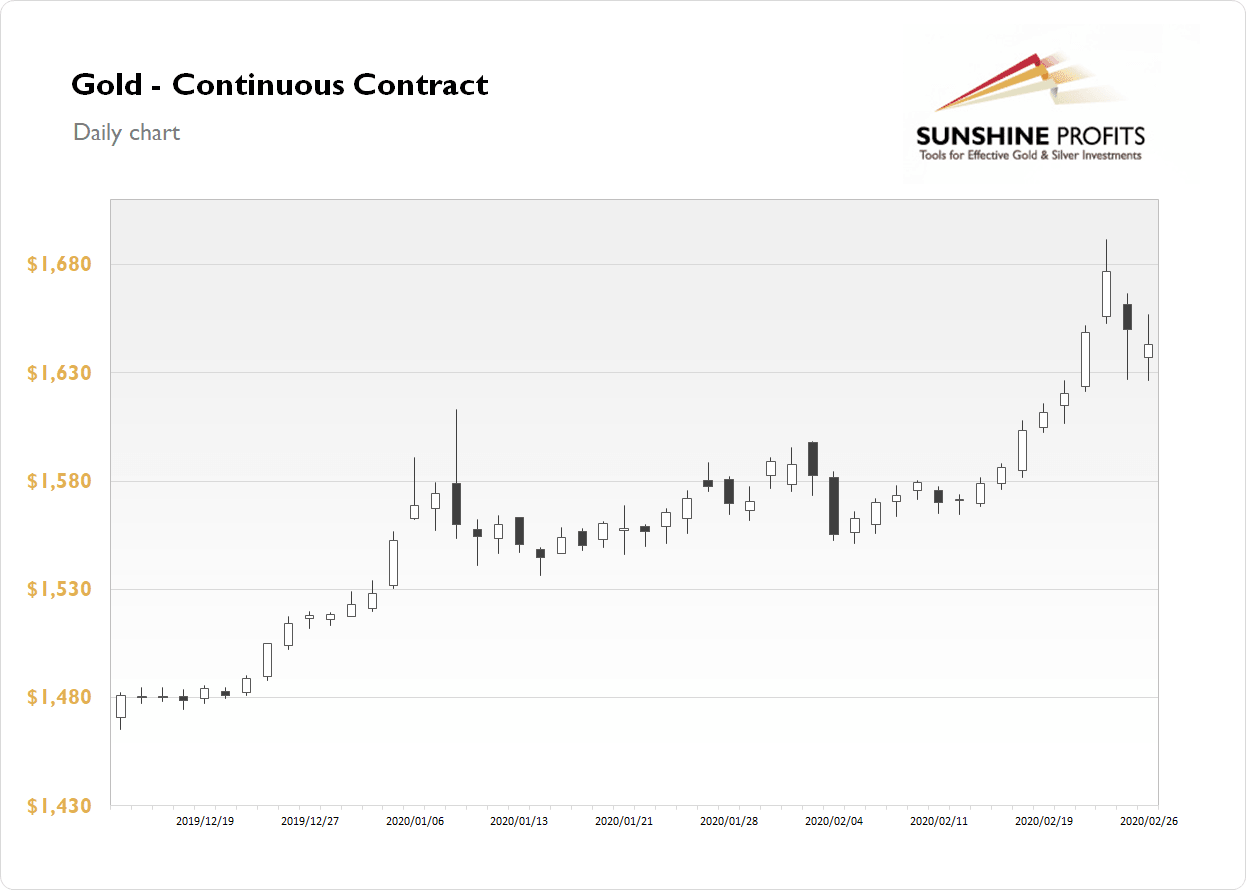

The gold buyers may have lost the momentum of their bull run, but we continue to expect weakness to be seen as an opportunity. The retracement has become rather choppy in the past 48 hours, but there is a basis of support around the 23.6% Fibonacci level (of $1445/$1688) around $1631. To yesterday’s low, the unwind has been $63 from the high (becoming comparable to the $75 unwind in January). It seems as though there is still an appetite to buy gold, judging by the overnight rebound once more, which has supported the market at $1625. Read more...

Gold is gaining 0.7% this morning, as coronavirus fears continue to dominate financial markets

The gold futures contract lost 0.42% on Wednesday, as it fluctuated after retracing most of Friday’s-Monday’s rally. The daily trading range reached over 30 dollars and it shows how high short-term volatility is. Investors were buying the safe-haven asset amid coronavirus outbreak, economic slowdown fears recently. But gold has retraced a big chunk of that rally after bouncing off $1,700 mark. Read more...

Gold ignores US data, trades at fresh daily highs above $1,650

The XAU/USD pair continues to trade in the positive territory in the early trading hours of the American session as USD struggles to capitalize on the macroeconomic data releases from the US. As of writing, the pair was up 0.82% on the day at $1,653.

Risk aversion and USD weakness drive gold's action

The US Bureau of Economic Analysis' second estimate for the annualized GDP growth in the fourth quarter stayed unchanged at 2.1% as expected on Thursday. Additionally, the US Census Bureau reported that Durable Goods Orders in January declined by 0.2% to better analysts' estimate for a decrease of 1.5%. Read more...

Author

FXStreet Team

FXStreet