Gold is gaining 0.7% this morning, as coronavirus fears continue to dominate financial markets

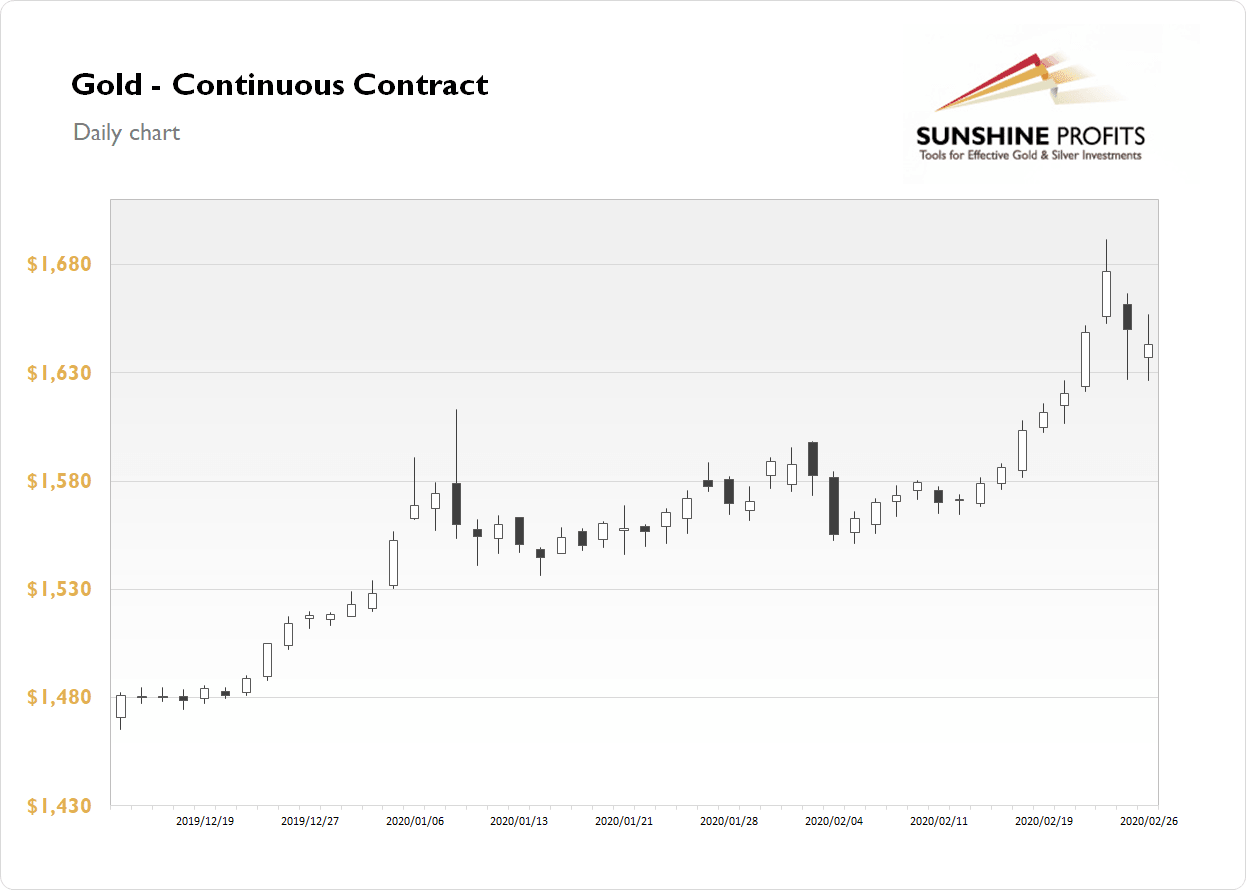

The gold futures contract lost 0.42% on Wednesday, as it fluctuated after retracing most of Friday’s-Monday’s rally. The daily trading range reached over 30 dollars and it shows how high short-term volatility is. Investors were buying the safe-haven asset amid coronavirus outbreak, economic slowdown fears recently. But gold has retraced a big chunk of that rally after bouncing off $1,700 mark.

Gold is gaining 0.7% this morning, as coronavirus fears continue to dominate financial markets. What about the other precious metals? Silver lost 1.52% on Wednesday, as it got back to its Tuesday’s daily low. And the price fell below $18 mark. Silver is currently 0.9% higher. Platinum lost 1.88% on Tuesday, and right now it is trading 0.2% higher. The metal bounced off $1,000 mark and it is getting closer to $900. Palladium was the only gainer again on Wednesday, as it advanced by 0.72%. However, it is retracing some of the short-term uptrend today, as it trades 1.2% lower.

The financial markets went risk-off since last Friday, as coronavirus fears came back again. The economic data releases seem less important than the mentioned virus scare recently. Yesterday’s New Home Sales number was better than expected but it didn’t improve investors’ sentiment that much. Today we will have the Durable Goods Orders along with Preliminary GDP number release at 8:30 a.m. Then at 10:00 the Pending Home Sales data will be released.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Paul Rejczak

Sunshine Profits

Paul Rejczak is a stock market strategist who has been known for the quality of his technical and fundamental analysis since the late nineties.