Gold Price News and Forecast: XAU/USD fades upside momentum towards $1,850 amid mixed catalysts

Gold Price Analysis: XAU/USD risks ending 3-day winning trend

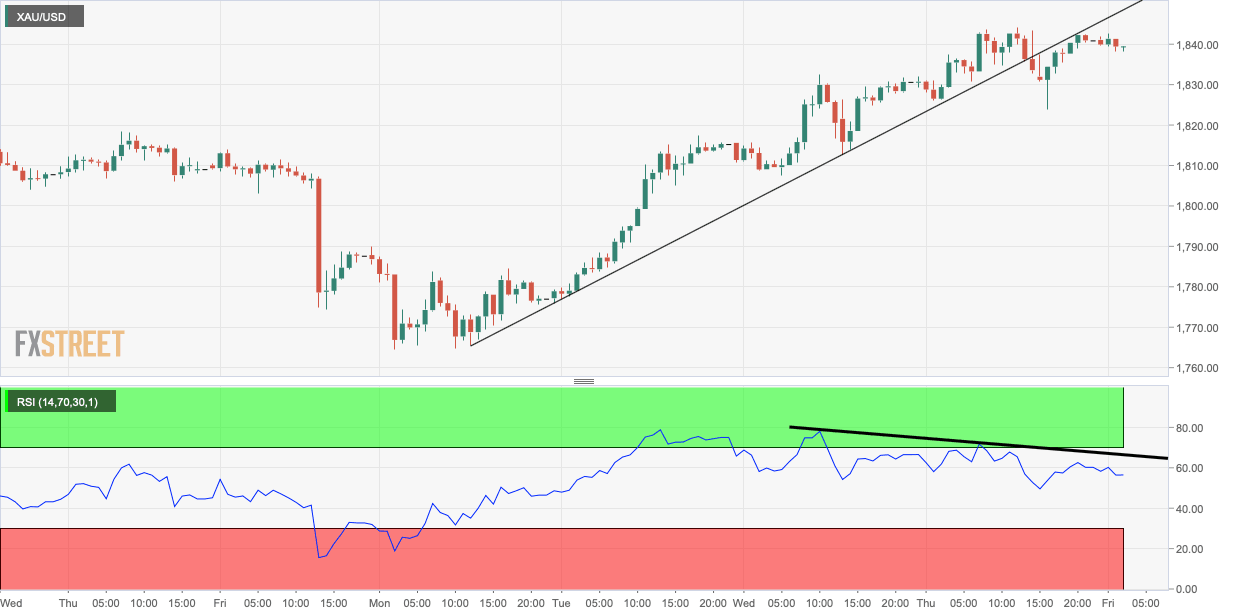

Gold gained over 0.5% to $1,840 per ounce on Thursday, confirming a three-day winning streak and erasing more than 505 of the previous week's decline from $14,869 to $1,774. However, the recovery rally could run out of steam, as the hourly chart has violated the trendline rising from recent lows. Further, the hourly chart Relative Strength Index has created lower highs, contradicting higher highs on the price chart. The bearish divergence indicates the bounce from the previous week's low has run out of steam.

The hourly chart shows immediate support is located at $1,823. A violation there would expose the 5-day Simple Moving Average at $1,819. On the higher side, resistance is seen at $1,850. The metal is currently trading at $1,838 per ounce.

Gold Price Analysis: XAU/USD fades upside momentum towards $1,850 amid mixed catalysts

Gold recedes to $1,840, down 0.10% intraday, as markets in Tokyo open for Friday’s trading. The yellow metal rose to the nine-day high the previous day as the US dollar weakness, coupled with the market optimism, favored the bulls. However, the recently mixed catalysts confuse the commodity traders.

While Moderna sees the availability of around 100 to 150 million doses of its coronavirus (COVID-19) vaccine globally in 2021, Pfizer-BioNTech cites the material supply chain for the inability to deliver the promised 100 million doses of its much-awaited vaccine. On the other than, Joe Biden praises, indirectly, US Health official Dr. Anthony Fauci while saying, “I will get the covid-19 vaccine when Dr. Fauci says it is safe and will take it publicly.”

Author

FXStreet Team

FXStreet