Gold Price News and Forecast: XAU/USD eyes a daily close below 100-DMA

Gold Price Forecast: Bears eye a daily close below 100-DMA amid dollar’s upsurge

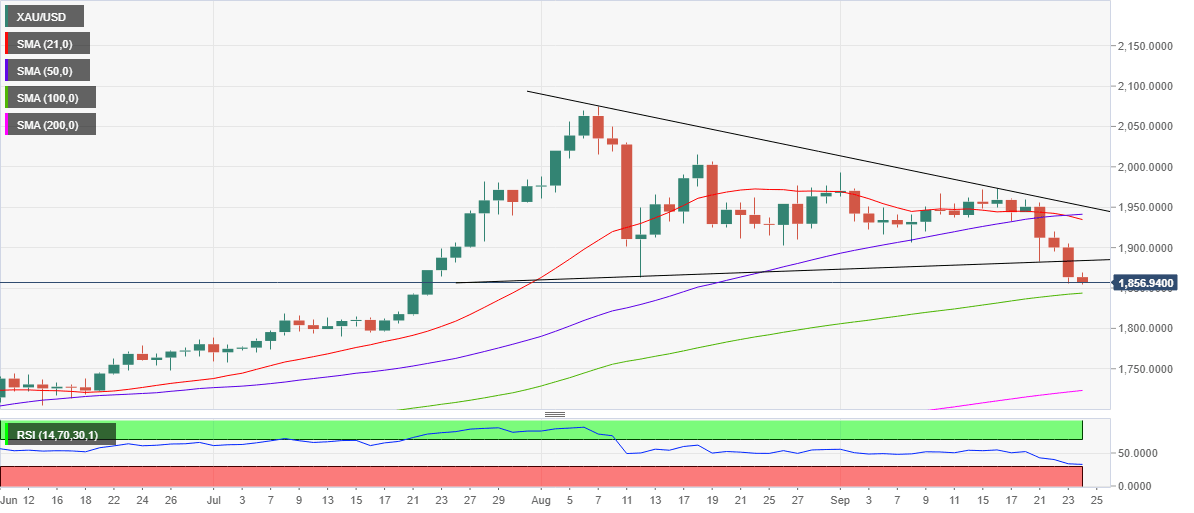

Gold (XAU/USD) finally breached the August low of $1863 on Wednesday, as the sell-off continued amid persistent US dollar strength against its higher-yielding rivals. The yellow shed another 2% to reach the lowest levels in six weeks at $1856 before settling the day at $1863. Concerns over the economic recovery in the US and Europe resurfaced, amid intensifying second-wave of the coronavirus, which further fuelled the dollar’s demand as a safe-haven.

Fed's gospel choir off-key with markets

Gold's close below its August low at $1863.00 an ounce is significant, and it is now testing its overnight lows at $1855.00 an ounce. The 100-DMA nearby at $1843.00 an ounce should provide the same initial support as it did with silver. Both metals are now entering oversold territory on their technical indicators as well, also modestly supportive.

Author

FXStreet Team

FXStreet