Gold Price News and Forecast: XAU/USD eyes $1980 amid weaker dollar

Gold Price Forecast: XAU/USD eyes $1980 amid weaker dollar, focus shifts to Wednesday’s FOMC

Gold (XAU/USD) built on Monday’s 1% rally after a steady start on Tuesday, reaching fresh nine-day highs at $1967. The US dollar was dumped across the board amid an improvement in the risk-sentiment, courtesy of the vaccine hopes, upbeat Chinese data and renewed US-Sino trade optimism. The Chinese activity numbers came in stronger than the estimates, suggesting the economic recovery is gathering steam. Also, news that China extended tariffs exemptions on some of the US good imports further fuelled the market optimism.

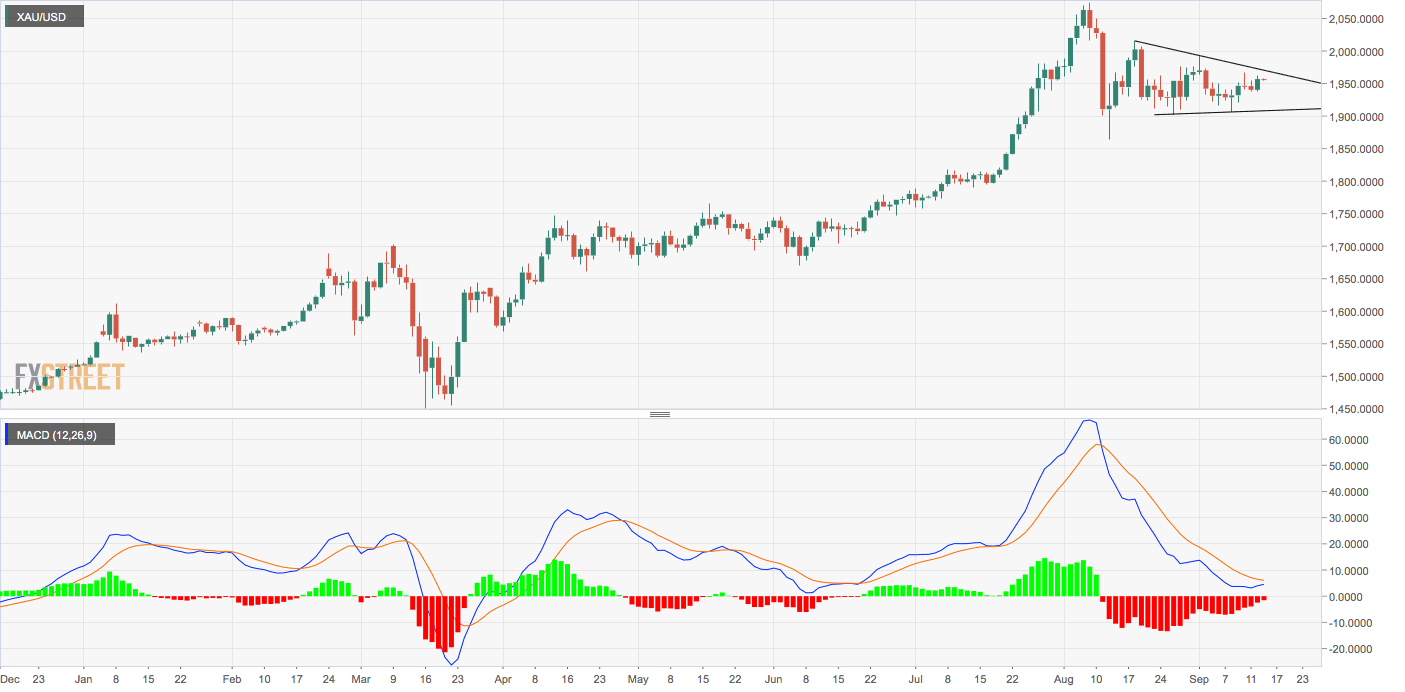

Gold Price Analysis: Nears descending triangle resistance

Having jumped 0.89% on Monday, gold is now closing on the upper end of the four-week-long descending triangle pattern seen on the daily chart. A close above the triangle resistance, currently at $1,970, would imply revival of the broader uptrend and expose the record high of $2,075 reached on Aug. 7. On the way higher, the yellow metal may encounter resistance at $$1,992 (Sept. 1 high) and $2,016 (Aug. 18 high).

A breakout looks likely as the MACD histogram has charted higher lows, a sign of weakening of downward momentum. On the downside, the triangle support at $1,909 is the level to beat for the bears. At press time, gold is trading near $1,955 per ounce.

Author

FXStreet Team

FXStreet