Gold Price News and Forecast: XAU/USD Could Extend its Gains

Gold: the bulls are no longer in control of the market [Video]

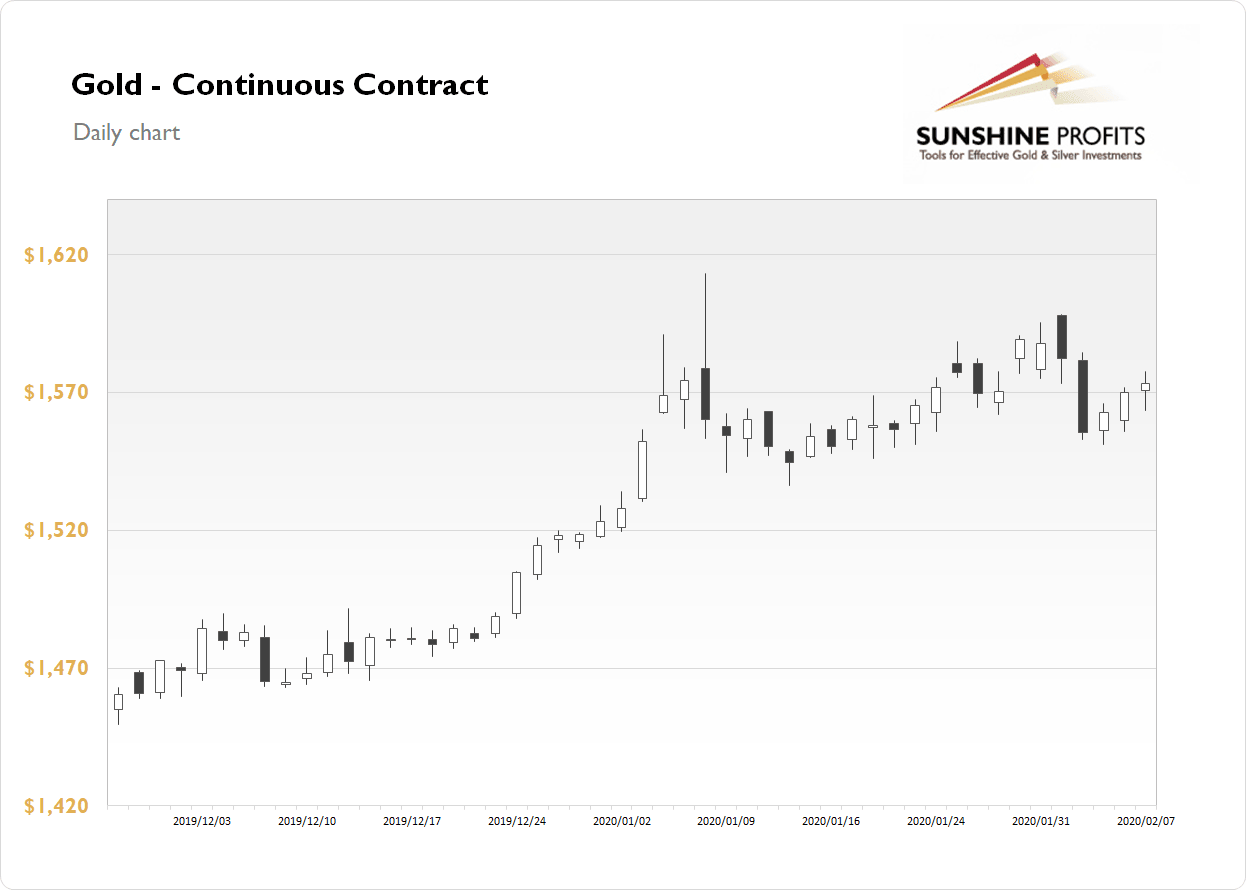

The outlook on gold remains mixed after Friday’s small-bodied candlestick. Although the pressure is beginning to build once more for a positive bias, given the corrective signals still present on MACD and RSI, we are still mindful that the bulls are no longer in control of the market. This makes for what is likely to be an ongoing period of uncertainty on gold (impacted by risk-on/risk-off newsflow of the Coronavirus). The Fibonacci retracements of the November to January bull run (from $1445/$1611) maintain an important role in the near term outlook. 38.2% Fib is supportive at $1548 whilst 34. 6% at $1572 is a basis of resistance. Read more...

Gold Could Extend its Gains

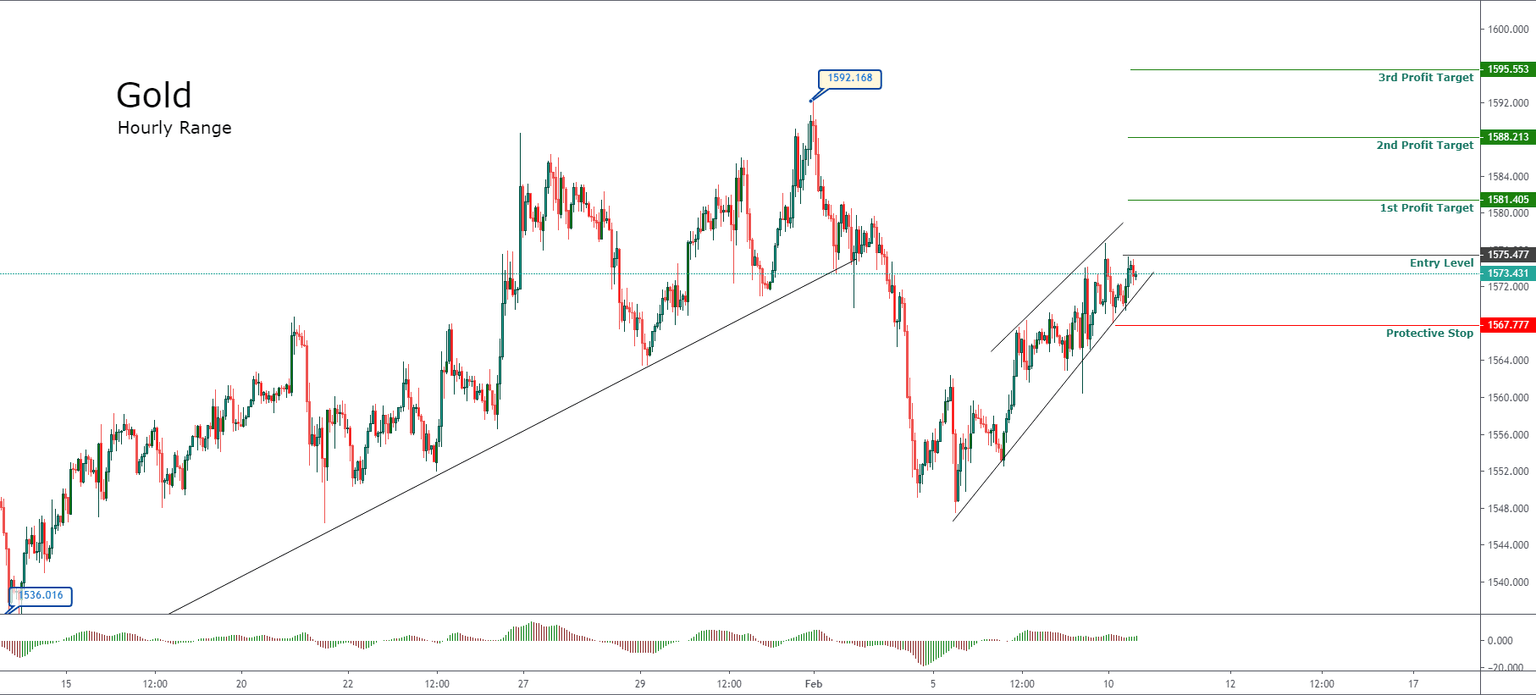

Gold, in its hourly chart, presents a short-term bullish sequence that began on February 05th, at $1,547.55 per ounce, boosted mainly by coronavirus spread concerns and its potential impact on the global economy.

Taking into consideration that the short-term upward trend remains intact and the price action doesn't reveal any signs of a bearish reversal, a potential bullish continuation in the golden metal is likely, which could be confirmed if the price consolidates above $1,575.47 per ounce.

A bullish position will activate if the price breaks and closes above $1,575.47 per ounce. Our conservative perspective considers a potential profit target at $1,581.40 per ounce. If Gold continues extending its gains, the price could climb to $1,588.21, and even up to $1,595.55 per ounce. Read more...

Gold Daily News - Gold continues to trade within a month-long consolidation

The gold futures contract gained 0.22% on Friday, as it slightly extended its short-term uptrend. The market has retraced some more of Tuesday’s decline following bouncing off $1,550 support level on Wednesday. Overall, gold continues to trade within a month-long consolidation following the early January rally over $1,600 mark.

This morning, gold is 0.1% higher, as it basically continues going sideways. What about the other precious metals? Silver lost0.71% on Friday, as it remained within a short-term consolidation after bouncing of $17.50 support level. It is currently 0.5% higher. Platinum gained 0.2% on Friday, and right now it is up 0.5%. Palladium lost 1.21% on Friday, as it extended its short-term sell-off after reaching close to the record high again. But it is 2.80% higher this morning. Read more...

Author

FXStreet Team

FXStreet