Gold Daily News - Gold continues to trade within a month-long consolidation

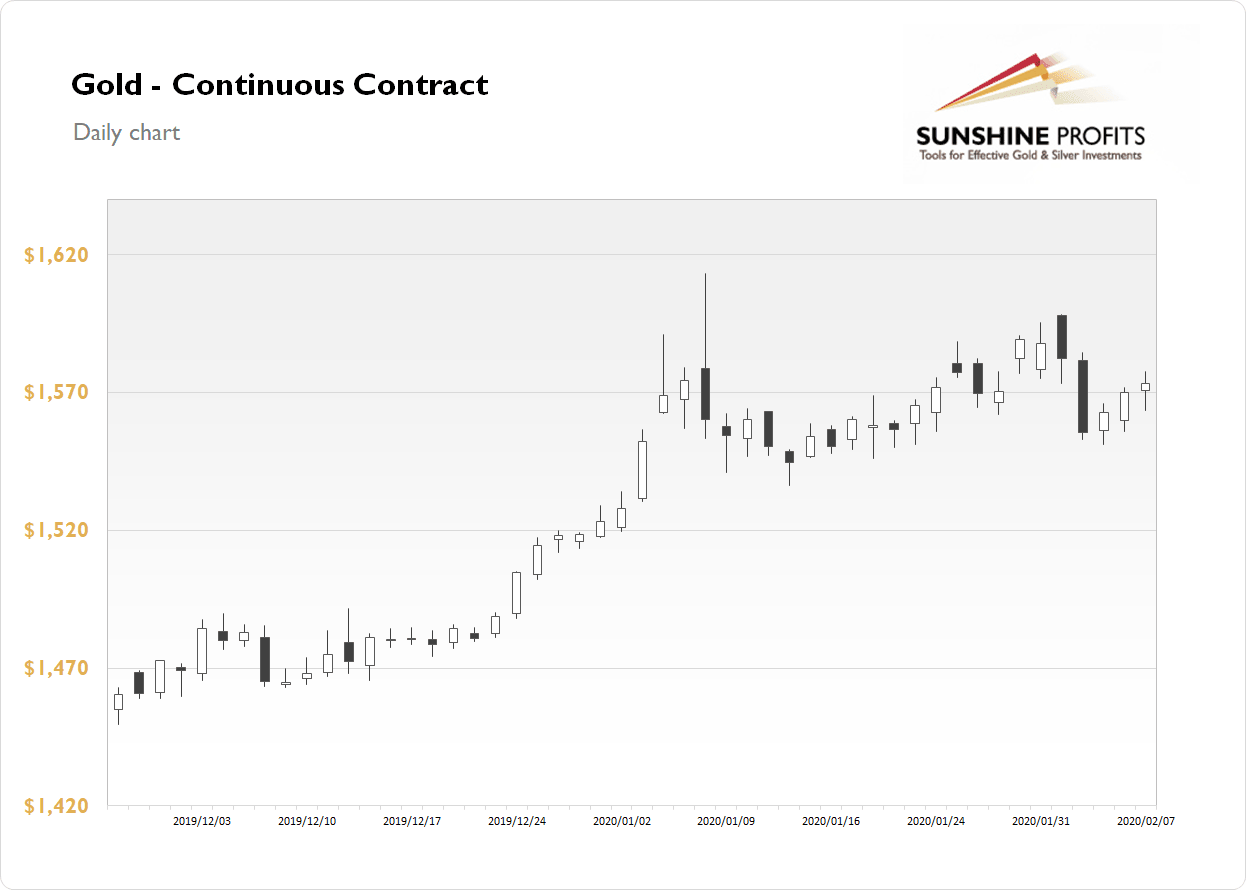

The gold futures contract gained 0.22% on Friday, as it slightly extended its short-term uptrend. The market has retraced some more of Tuesday’s decline following bouncing off $1,550 support level on Wednesday. Overall, gold continues to trade within a month-long consolidation following the early January rally over $1,600 mark.

This morning, gold is 0.1% higher, as it basically continues going sideways. What about the other precious metals? Silver lost0.71% on Friday, as it remained within a short-term consolidation after bouncing of $17.50 support level. It is currently 0.5% higher. Platinum gained 0.2% on Friday, and right now it is up 0.5%. Palladium lost 1.21% on Friday, as it extended its short-term sell-off after reaching close to the record high again. But it is 2.80% higher this morning.

The financial markets are still looking at China virus crisis developments. But the sentiment improved following last week’s record-breaking U.S. stock market’s rally. There will be no new important economic data releases today. However, the markets will await some FOMC Members' speeches.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Paul Rejczak

Sunshine Profits

Paul Rejczak is a stock market strategist who has been known for the quality of his technical and fundamental analysis since the late nineties.