Gold Price News and Forecast: XAU/USD bounces off lows, upside seems limited

Gold Price Forecast: XAU/USD: Downside appears more compelling below 200-DMA, US GDP eyed

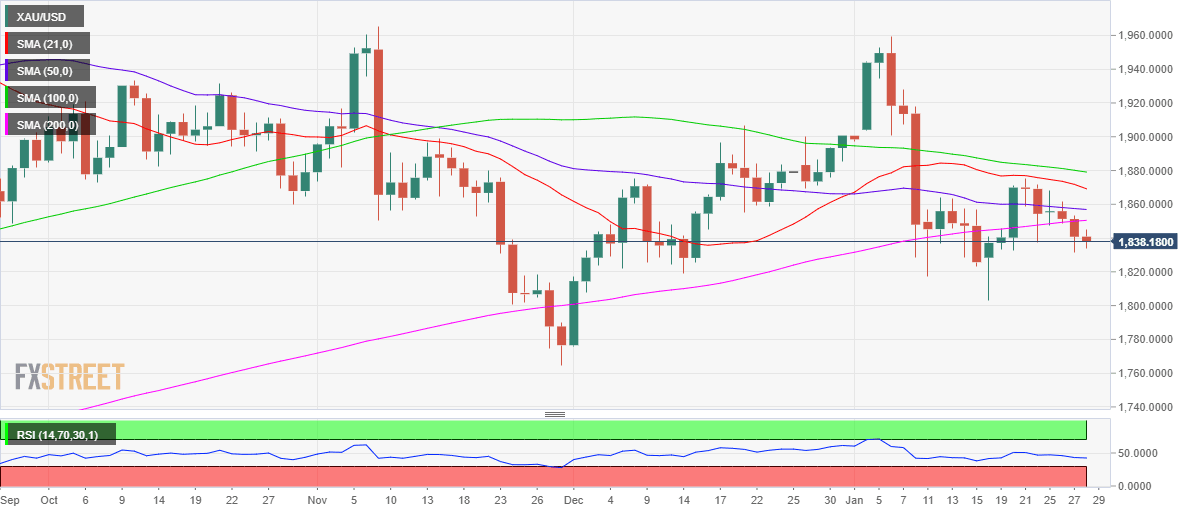

Gold (XAU/USD) fell as low as $1831 on Wednesday but recovered some ground, finishing the day down nearly $15. Gold traders were unimpressed by the Fed’s status-quo, as the central bank appeared less dovish than expected. Further, uncertainty over the US stimulus plan and the relentless covid surge added to the Fed-led pessimism and lifted the haven demand for the US dollar. Gold tumbled alongside Wall Street stocks amid broad US dollar strength.

Markets look forward to the US Q4 advance GDP and weekly jobless claims for a clear direction in the metal. Joseph Trevisani, FXStreet’s Senior, noted: “Annualized GDP in the fourth quarter expected to be 3.9% in the Reuters Survey. Dow Jones poll predicts 4.5%, Atlanta Fed GDPNow forecast at 7.5%.” Read more...

Gold Price Analysis: XAU/USD bounces off lows, upside seems limited

Gold recovered a major part of its intraday losses and has now moved to the top end of its daily trading range, around the $1843-44 region.

The prevalent risk-off mood extended some support to the safe-haven precious metal and helped limit the early slide. This, along with a modest US dollar pullback from highs, provided a modest lift to the dollar-denominated commodity. Read more...

Gold: Global demand hit 11-year low in 2020 amid covid crisis – WGC

Demand for gold globally slumped to an 11-year in 2020 as the coronavirus pandemic triggered a dip in jewelry sales and central banks buying, the World Gold Council (WGC) said in its latest quarterly report released Thursday.

Key takeaways: “Global demand for gold fell to 3,759.6 tonnes last year, down 14% from 2019 and the first year below 4,000 tonnes since 2009.” “The year ended on a weak note, with demand over October to December at 783.4 tonnes, down 28% year-on-year and the lowest of any quarter since 2008.” Read more...

Author

FXStreet Team

FXStreet