- The risk-off mood, a modest USD pullback assisted gold to recover its intraday losses.

- The near-term technical set-up still seems tilted firmly in favour of bearish traders.

- Any positive move might be seen as a selling opportunity near the $1855 region.

Gold recovered a major part of its intraday losses and has now moved to the top end of its daily trading range, around the $1843-44 region.

The prevalent risk-off mood extended some support to the safe-haven precious metal and helped limit the early slide. This, along with a modest US dollar pullback from highs, provided a modest lift to the dollar-denominated commodity.

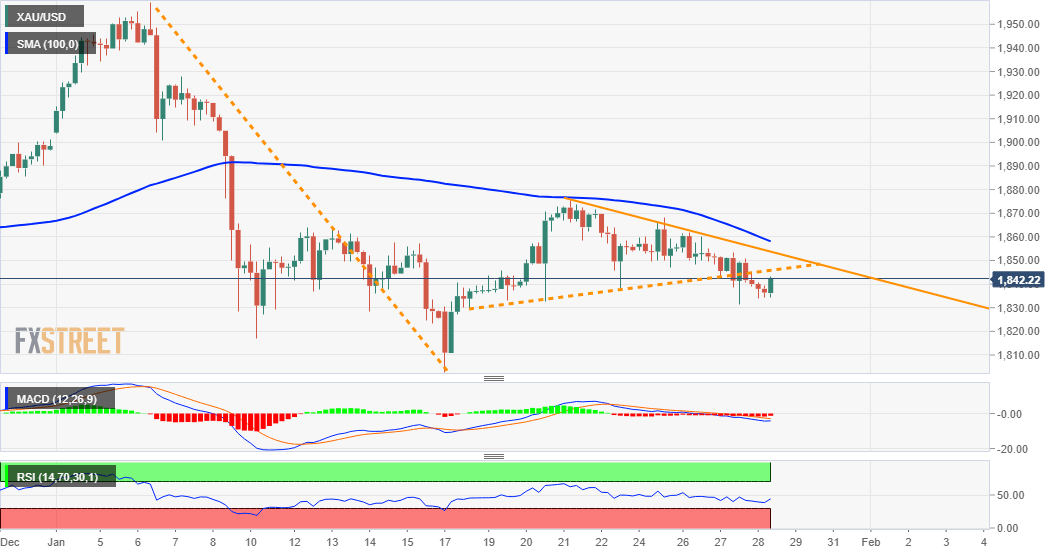

Looking at the technical picture, the commodity on Wednesday decisively breakthrough short-term symmetrical triangle support. Given the recent fall, the mentioned triangle constituted the formation of a bearish pennant chart pattern.

The bearish breakdown was further reinforced by the fact that technical indicators on the daily chart have just started drifting into the negative territory. Hence, any attempted recovery move might be seen as a selling opportunity.

The XAU/USD seems vulnerable to slide below the $1827-26 intermediate horizontal support and aim back to test monthly swing lows, around the $1800 mark. Some follow-through selling should pave the way for additional near-term weakness.

On the flip side, 50-day SMA, around the $1855 region, now seems to act as an immediate strong resistance. This coincides with the symmetrical triangle resistance, which if cleared will negate any near-term bearish bias.

XAU/USD 4-hourly chart

Technicallevels to watch

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.