Gold Price News and Forecast: XAU/USD bears to retain control below 21-DMA, focus on Biden’s speech

Gold Price Analysis: XAU/USD justifies Thursday’s doji below 21-DMA to drop towards $1,850

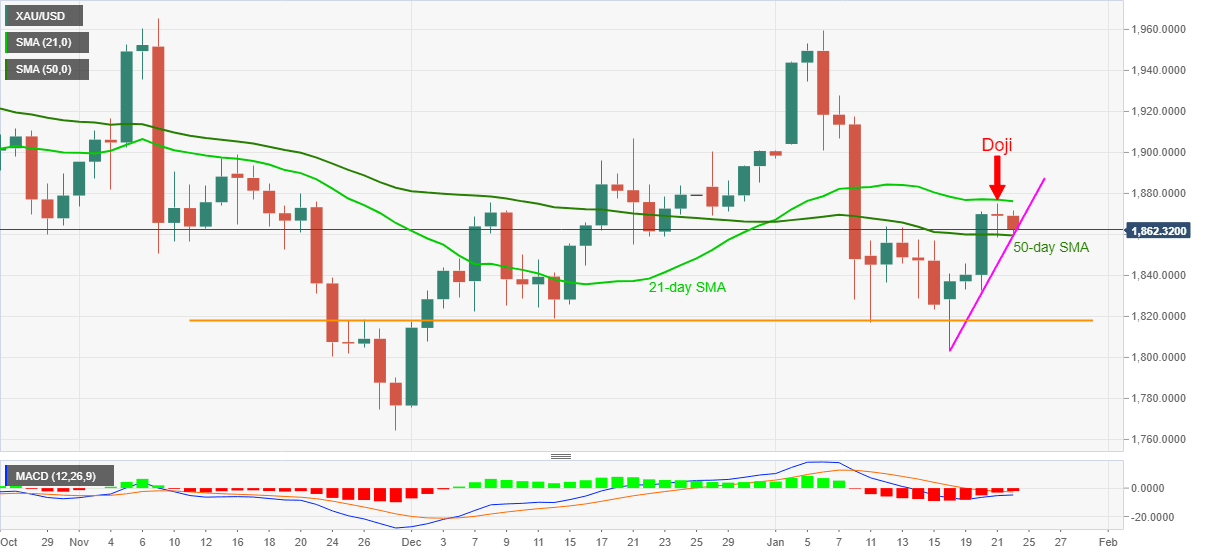

Gold bounces off intraday low of $1,859.00 to $1,862.10, down 0.37% on a day, during early Friday. The yellow metal refreshed two-week high the previous day but failed to cross a 21-day SMA. The resulted moves portrayed a Doji candlestick on the daily (D1) chart, which in turn gained support from the bearish MACD signals to portray today’s downtick.

However, gold sellers seem to struggle off-late as 50-day SMA and an upward sloping trend line from Monday limits immediate declines around $1,859.

Gold Price Forecast: XAU/USD bears to retain control below 21-DMA, focus on Biden’s speech

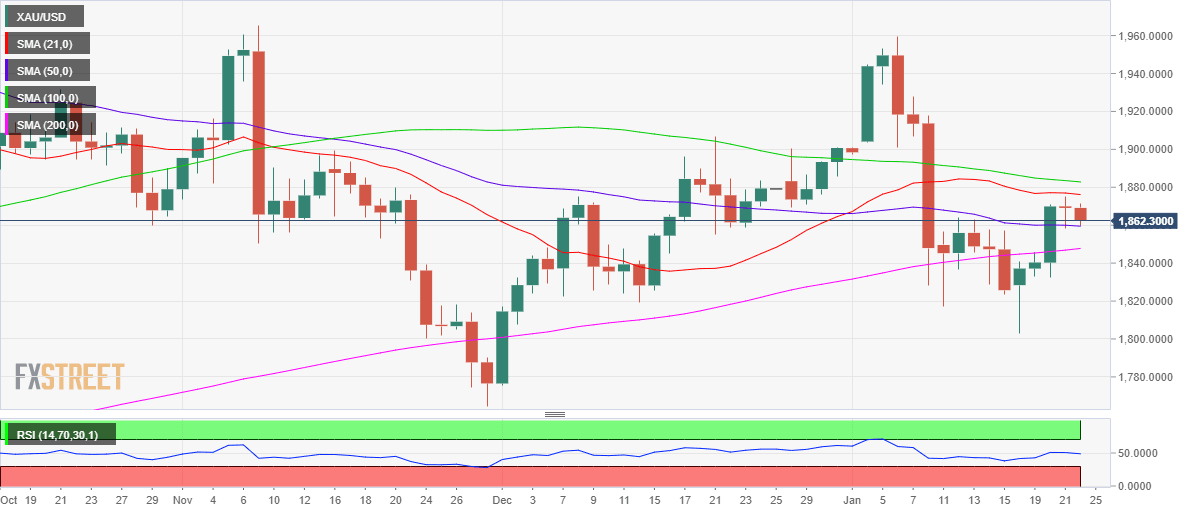

Gold (XAU/USD) witnessed good two-way price movements and settled almost changed at $1869 on Thursday. The yellow metal eased from two-week highs of $1875, as markets resorted to profit-taking after the three-day recovery rally fuelled by the prospects of further stimulus. The uptick in the US Treasury yields on rising inflation expectations and ECB’s inaction also collaborated with the retreat in gold prices. Rejection at the 21-day simple moving average (DMA) further added credence to the pullback in the prices.

Author

FXStreet Team

FXStreet