Gold price retreats further from two-week high; $3,300 mark holds the key for bulls

- Gold price pulls back after touching a two-week top earlier this Thursday, though the downside seems limited.

- US fiscal concerns and Fed rate cut bets continue to weigh on the USD, and should lend support to the XAU/USD pair.

- Renewed US-China trade tensions and geopolitical risks might also contribute to limiting any meaningful slide.

Gold price (XAU/USD) extends its steady intraday retracement slide from a nearly two-week high touched earlier this Thursday and slides to the lower end of its daily range during the first half of the European session. The pullback lacks any fundamental catalyst and is more likely to remain limited amid a combination of supporting factors. Investors now seem convinced that the Federal Reserve (Fed) will lower borrowing costs further in 2025, which might continue to act as a tailwind for the non-yielding yellow metal.

Apart from dovish Fed expectations, growing worries about rising US deficit amid US President Donald Trump's tax bill and a sluggish US economic growth outlook on the back of renewed US-China trade tensions weigh on the US Dollar (USD). This could further offer support to the Gold price and support prospects for an extension of the weekly uptrend. Hence, any subsequent fall might still be seen as a buying opportunity and is more likely to be limited as traders now look forward to the US macro data for a fresh impetus.

Daily Digest Market Movers: Gold price bulls have the upper hand amid a combination of supporting factors

- The Republican-controlled US House of Representatives Rules Committee voted to advance President Donald Trump’s sweeping tax-cut and spending bill, setting the stage for a vote on the House floor. The highly anticipated “One Big, Beautiful Bill” could add around $3 trillion to $5 trillion to the country’s already hefty debt pile.

- Furthermore, a crucial auction of 20-year Treasury bonds on Wednesday saw soft demand, pointing to growing worries that the tax and spending bill will worsen the US budget deficit at a faster pace than previously expected. This comes after Moody’s downgraded the US sovereign credit rating from the top "Aaa" last Friday.

- The US Dollar has been trending lower on the back of US fiscal concerns. Adding to this, bets that the Federal Reserve will lower interest rates further this year amid evidence of easing inflation and a dismal growth forecast might continue to push the USD lower, which should limit any corrective slide from a nearly two-week high.

- Meanwhile, China accused the US of abusing export control measures and violating Geneva trade agreements after the US issued guidance warning companies not to use Huawei's Ascend AI chips. China’s Commerce Ministry said on Wednesday that US measures on advanced chips are ‘typical of unilateral bullying and protectionism.’

- On the geopolitical front, Israel’s military continued to pound the Gaza Strip and block desperately needed food aid. Adding to this, Trump reportedly told European leaders that Russian President Vladimir Putin isn’t ready to end the war with Ukraine as he thinks he is winning, which lends additional support to the safe-haven commodity.

- Traders now look to the release of flash PMI prints for a fresh insight into the global economic health. The US economic docket also features the release of the usual Weekly Initial Jobless Claims and Existing Home Sales, which might influence the USD. This, along with the broader risk sentiment, could drive the precious metal.

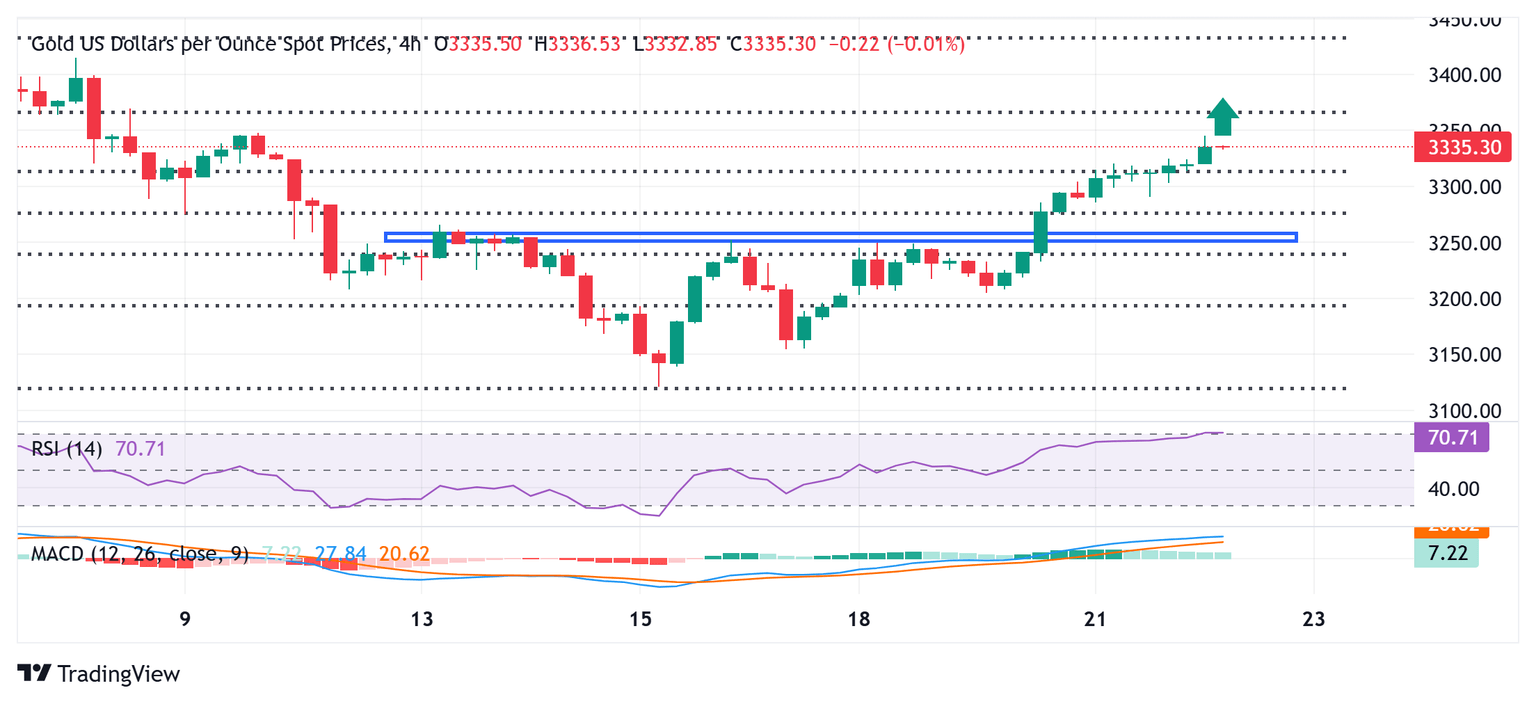

Gold price corrective pullback could be seen as a buying opportunity amid a constructive technical setup

From a technical perspective, the XAU/USD pair now seems to have found acceptance above the 61.8% Fibonacci retracement level of the recent downfall from the monthly peak. This comes on the back of this week's breakout through the $3,250-3,255 resistance zone and favors bullish traders. Moreover, oscillators on the daily chart have been gaining positive traction and suggest that the path of least resistance for the Gold price remains to the upside. Hence, a subsequent move towards the next relevant hurdle near the $3,363-3,365 region, en route to the $3,400 round figure, looks like a distinct possibility.

On the flip side, the $3,316-3,315 area, or the 61.8% Fibo. retracement level resistance breakpoint now seems to protect the immediate downside ahead of the $3,300 mark. Any further decline below the $3,285 area is more likely to attract fresh buyers and remain limited near the $3,255-3,250 hurdle-turned-support. A convincing break below the latter, however, might prompt some technical selling and drag the Gold price to the $3,200 mark.

Economic Indicator

S&P Global Composite PMI

The S&P Global Composite Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging US private-business activity in the manufacturing and services sector. The data is derived from surveys to senior executives. Each response is weighted according to the size of the company and its contribution to total manufacturing or services output accounted for by the sub-sector to which that company belongs. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. The index varies between 0 and 100, with levels of 50.0 signaling no change over the previous month. A reading above 50 indicates that the private economy is generally expanding, a bullish sign for the US Dollar (USD). Meanwhile, a reading below 50 signals that activity is generally declining, which is seen as bearish for USD.

Read more.Next release: Thu May 22, 2025 13:45 (Prel)

Frequency: Monthly

Consensus: -

Previous: 50.6

Source: S&P Global

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.