Gold Price Forecast: XAU/USD sees an establishment below $1,740 as DXY extends rally

- Gold price is likely to shift its business below $1,740.00 amid the risk-off market mood.

- The US Treasury yields have rebounded despite less-hawkish commentary from Fed’s Mester.

- Fed’s Mester has supported the view of a slowdown in the rate hike pace ahead.

Gold price (XAU/USD) is oscillating below the critical support of $1,740.00 in the early Asian session. The precious metal is declining gradually amid a global correction in risk-perceived assets. Weaker economic projections due to a significant fall in consumer spending have raised concerns. S&P500 dropped on Monday amid anxiety ahead of the release of the US Durable Goods orders data.

The US dollar index (DXY) has reached near the round-level resistance of 108.00 as investors turned risk-averse due to the absence of a key trigger for decisive action. Meanwhile, the 10-year US Treasury yields have rebounded to 3.83% despite a less-hawkish commentary from Cleveland Federal Reserve (Fed) Bank President Loretta Mester. Fed policymaker is of the view that it makes sense to slow down the pace of rate hikes a bit in an interview with CNBC.

He further added that “We have had some good news on the inflation front, but need more and sustained good news”. However, he doesn’t see any pause in the rate hike cycle yet.

Going forward, the show-stopper event this week will be the US Durable Goods Orders data. The economic catalyst is seen stable at 0.4%.

Gold technical analysis

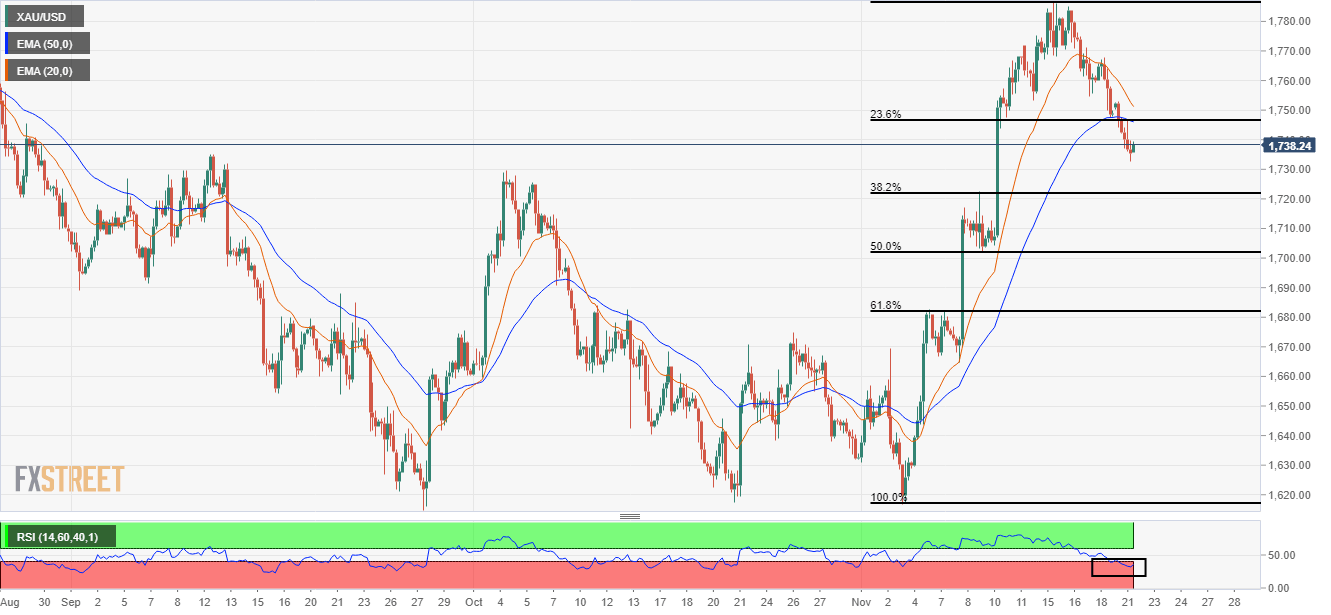

On a four-hour scale, the gold price has dropped below the 23.6% Fibonacci retracement (placed from November 3 low at $1,616.39 to November 15 high at $1,786.55) at $1,746.67. The asset has dropped below the 20-and 50-period Exponential Moving Averages (EMAs) at $1,751.40 and $1,746.67 respectively, which adds to the downside filters.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which indicates more weakness ahead.

Gold four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.