Gold Price Forecast: XAU/USD sustains above $1,980.00 as USD Index turns subdued despite hawkish Fed bets

- Gold price is keeping its auction steadily above $1,980.00 amid the subdued USD Index.

- S&P500 futures have generated losses as investors are anxious ahead of quarterly results from giant technology stocks.

- Gold price is expected to display sheer weakness after a breakdown of immediate support plotted from $1,969.26.

Gold price (XAU/USD) is holding its auction above the critical support of $1,980.00 in the Asian session. The precious metal is struggling around $1,985.00 as the US Dollar Index (DXY) is showing mixed signals around its crucial support of 101.63. After topsy-turvy moves in a wide range of 101.63-102.27 for the past four trading sessions, investors are anticipating a decisive move from the USD Index.

S&P500 futures are holding onto losses in the Asian session as investors are anxious ahead of quarterly results from giant technology stocks. Amazon, Facebook, and Google are expected to keep investors busy this week with their first-quarter CY2023 results. The yields offered on US government bonds have dropped marginally amid a subdued performance by the US Dollar Index. The 10-year US Treasury yields have dropped to near 3.56%.

This week, the USD Index will dance to the tunes of Durable Goods Orders (March) data. The economic data is seen expanding by 0.8% vs. a contraction of 1.0%. A recovery in demand for Durable Goods indicates that households’ demand is recovering, which could further lift core inflation expectations. An upbeat economic data would be supportive to more rate hikes from the Federal Reserve (Fed).

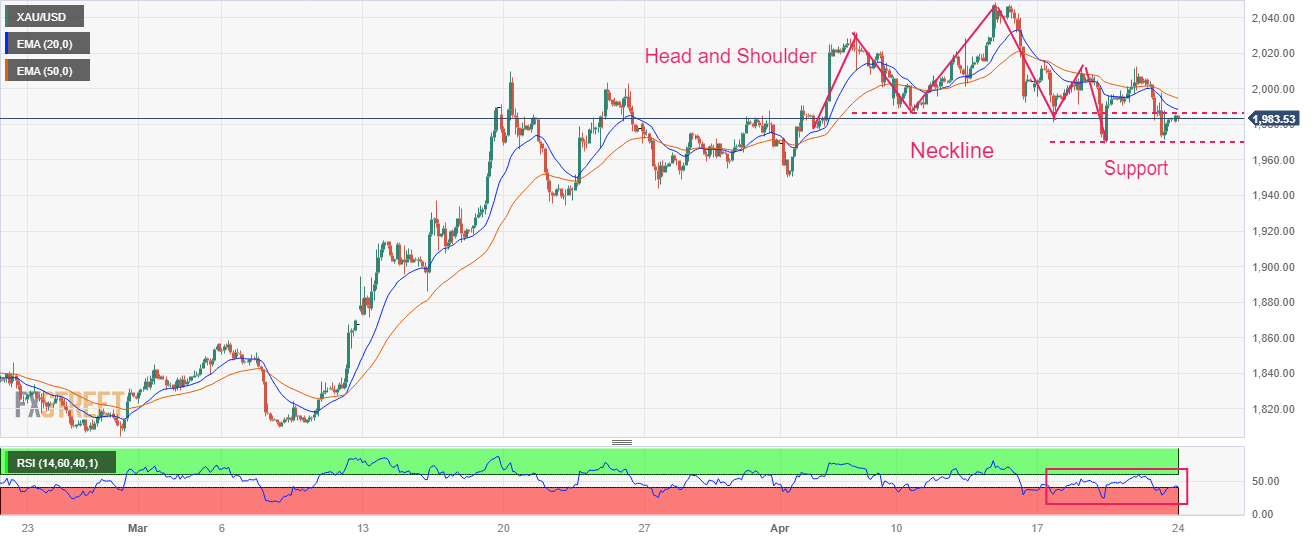

Gold technical analysis

Gold price has delivered a breakdown of the Head and Shoulder chart pattern formed on a two-hour scale. The precious metal might display more weakness after slipping below the immediate support plotted from April 19 low at $1,969.26.

Declining 20-and 50-period Exponential Moving Averages (EMAs) at $1,988.00 and $1,994.78 respectively, add to the downside filters.

The downside momentum will get triggered if the Relative Strength Index (RSI) (14) will drop into the bearish range of 20.00-40.00.

Gold two-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.