Gold Price Forecast: XAU/USD struggling to hold on to $1,915

- Gold buyers are struggling to hang on to $1,915.00 for Monday.

- A well-bid US Dollar is seeing the XAU/USD flounder into recent lows.

- Analysts see Gold reaching $2,200 by the end of the year, but policy risks remain.

The XAU/USD took a step lower on Monday, knocking into $1,915.00 and seeing little relief pressure as the US Dollar (USD) catches bids across the board.

Spot gold prices have steadily drifted lower in 2023, peaking just below $2,080.00 back in early May. The XAU/USD is down almost 8% from the year's high, but still remains well-supported looking long-term, with Gold up nearly 20% from last October's lows of $1,650.00

Gold's long-standing relationship with US Treasury yields has softened in recent months; while the yellow metal has a tendency to closely track with US yields, that relationship has broken down for most of 2023. US yields have appreciated considerably, but Gold remains unable to capitalize on bond momentum.

$2,000 by end-2023, $2,200 by end-2024?

Despite downward price pressure, analysts are forecasting lofty end-of-year Gold spot valuations.

Commodity analysts from Société Générale (SocGen) see Gold capped under $2,000 to end the trading year, but 2024 is expected to see Gold prices improve to $2,200 by the end of 2024, on the back of easing inflation expectations and a slipping US Dollar Index.

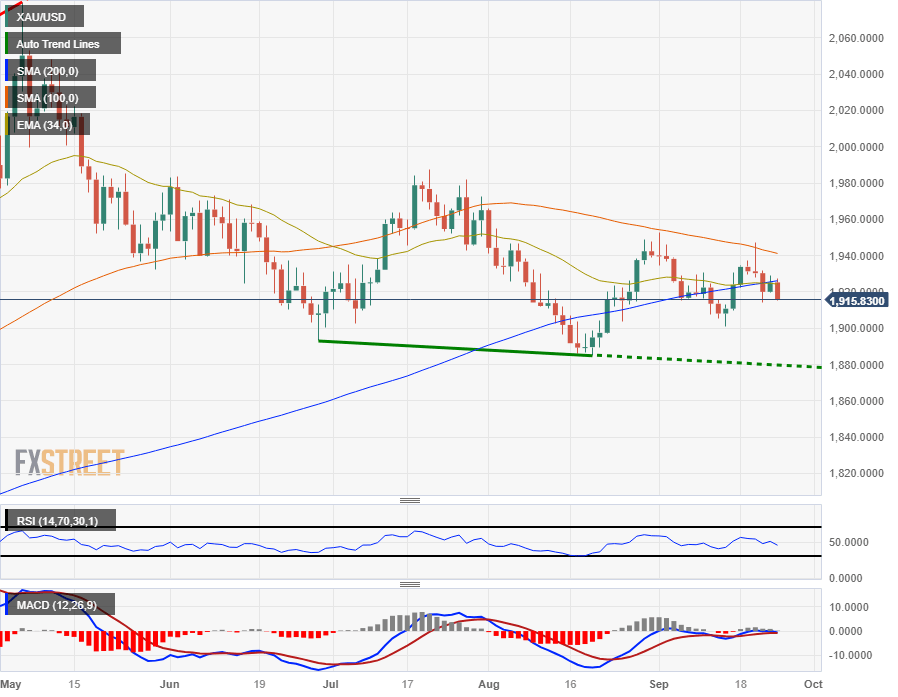

XAU/USD technical outlook

Hourly candles see Gold flubbing to last week's swing lows below $1,915.00, while the upside is set to be constrained by near-term resistance from the 100-hour Simple Moving Average (SMA) near $1,925.00.

On the daily candlesticks, the XAU/USD is seeing a notable lack of meaningful momentum, with Gold stuck near the 200-day SMA which is still moving bullish into $1,930.00.

Bidders will be looking to shove Gold back above $,1930.00 to continue a push higher, while sellers will be looking to take the XAU/USD down to August's lows below $1,890.00.

XAU/USD daily chart

XAU/USD technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.