Gold Price Forecast: XAU/USD shoots to near $1960 as higher US jobless claims eases labor market conditions

- Gold price has galloped to near $1,960.00 as US weekly jobless claims hit a 19-month high.

- The market mood could turn cheerful as higher jobless claims would trim hawkish Fed bets.

- Gold price has managed to defend a breakdown of the Ascending Triangle chart pattern.

Gold price (XAU/USD) has shown a sharp run after the release of higher-than-expected United States weekly jobless claims data. The precious metal has jumped to near $1,960.00 as the US Department of Labor reported a significant jump in the initial claims by 28K to 261K for the week ending June 02 while the street was anticipating a figure of 235K.

S&P500 futures are likely to open on a cautious note, however, the market mood could turn cheerful as higher jobless claims would trim hawkish Federal Reserve (Fed) bets. The US Dollar Index (DXY) has printed a fresh four-day low at 103.60 higher unemployment claims would ease out severe heat in the United States labor market.

19-month high US jobless claims are expected to fetch dovish commentaries from investment banking firms and Fed policymakers. Upbeat labor market conditions were the major catalyst, which was forcing Fed policymakers for supporting more interest rate hikes. The impact of higher jobless claims can also be seen in the US Treasury yields. The yields offered on 10-year US government bonds have sharply dropped below 3.78%.

In the longer-term, easing labor market conditions would also slim resilience in consumer spending and would further ease inflationary pressures.

Gold technical analysis

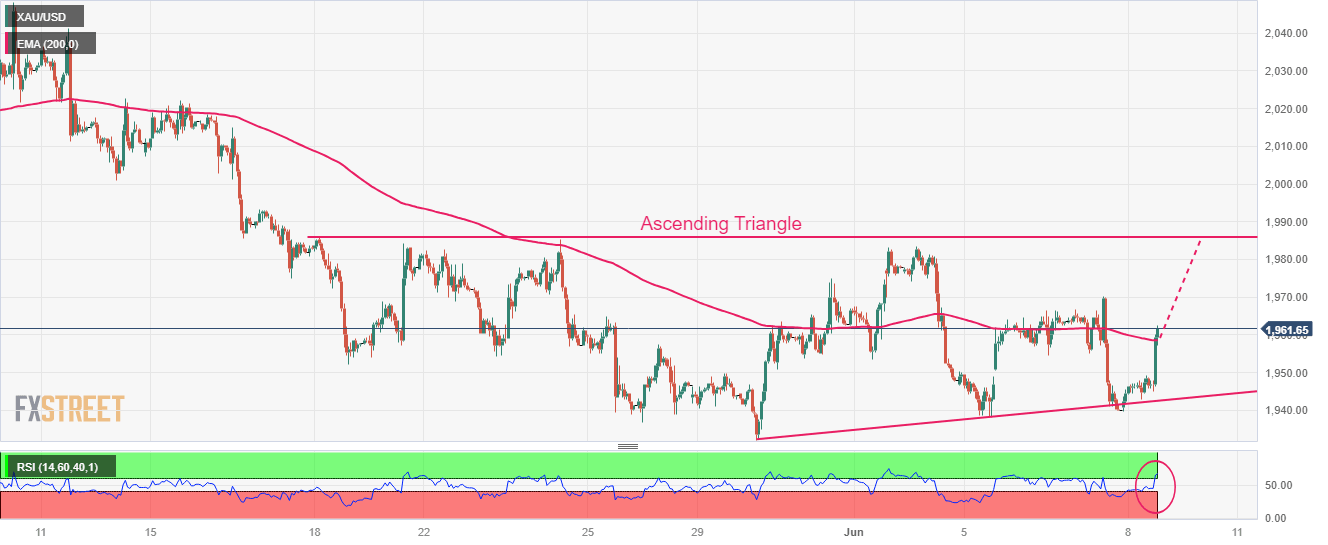

Gold price has managed to defend a breakdown of the Ascending Triangle chart pattern formed on an hourly scale. The precious metal has rebounded sharply and is approaching the horizontal resistance of the aforementioned pattern is placed from May 19 high at $1,983.29. While the upward-sloping trendline of the chart pattern is plotted from May 30 low at $1,932.12.

Gold price has climbed above the 200-period Exponential Moving Average (EMA) at $1,958.37, which indicates that the long-term trend has turned bullish.

Meanwhile, the Relative Strength Index (RSI) (14) has climbed above 60.00, which indicates that the upside momentum has been triggered.

Gold hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.