Gold Price Forecast: XAU/USD sets for action after sideways motion around $1,820 ahead of US PMI

- Gold price is oscillating in a narrow range below $1,820.00 as investors await US Manufacturing PMI.

- S&P500 futures have added more gains to Monday’s recovery, indicating an improvement in investors’ risk appetite.

- The resilience observed in US consumer spending has forced the street to ramp up its terminal rate projections.

Gold price (XAU/USD) is demonstrating a sideways auction below $1,820.00 in the Asian session. The precious metal is expected to come out of the woods as investors are shifting their focus towards the United States ISM Manufacturing PMI (Feb), which is scheduled for Wednesday.

Investors should note that US Manufacturing PMI is contracting consecutively for the past three months. As per the consensus, the economic data is expected to contract again, however, the scale of contraction will be lower. The US Manufacturing PMI is seen at 48.0, lower than the former release of 47.4.

S&P500 futures have added more gains to Monday’s recovery in the Asian session, portraying an improvement in the risk appetite of the market participants. The US Dollar Index (DXY) is expected to demonstrate a volatility contraction till the release of the US ISM Manufacturing PMI data. The 10-year US Treasury yields are juggling around 3.92%.

Meanwhile, resilience observed in consumer spending (Feb) in the United States has forced the street to ramp up their terminal rate projections. A note from Bank of America (BofA) suggests Fed chair Jerome Powell announcing three more rate hikes this year considering the resilience in the demand-driven inflation. The BofA sees the terminal rate above 6% and recession appears more likely than a soft landing.

Gold technical analysis

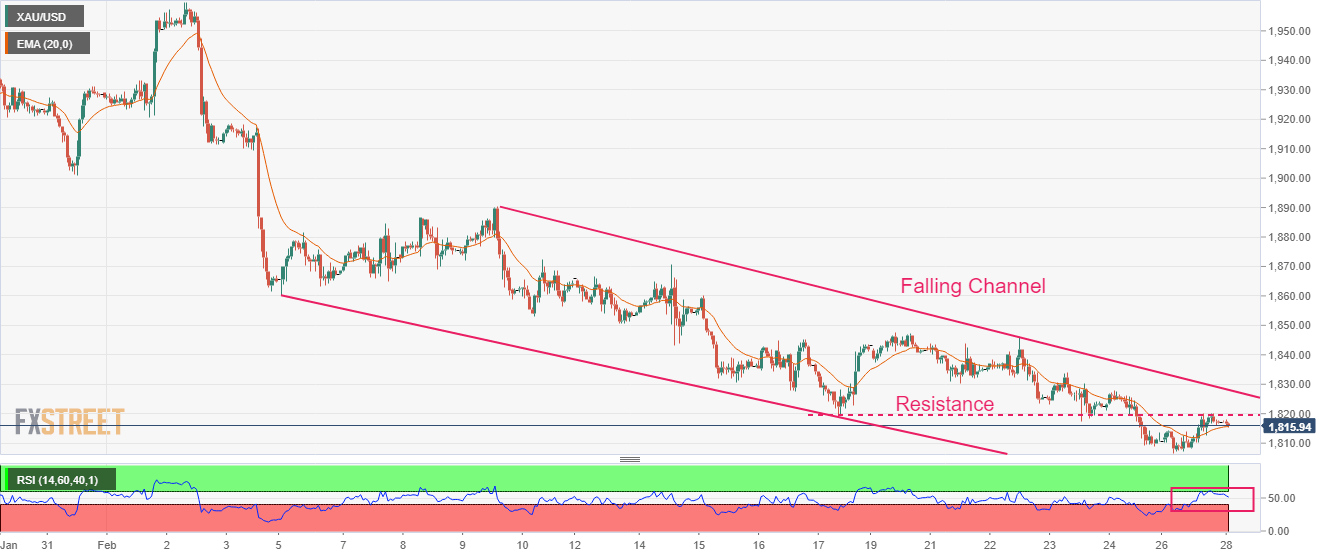

Gold price is auctioning in a Falling Channel chart pattern in which every pullback is considered as a selling opportunity before a reversal move. The precious metal has sensed resistance around $1,820.00 after a minor pullback move.

The 20-period Exponential Moving Average (EMA) at $1,815.83 is providing a cushion to the Gold bulls.

The Relative Strength Index (RSI) (14) is attempting to shift into the bullish range of 60.00-80.00.

Gold hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.