Gold Price Forecast: XAU/USD sees a downside to near $1,700, US Inflation hogs limelight

- Gold price is declining towards $1,700.00 as hawkish Fed Powell weakened gold bulls.

- The Fed is prepared to make growth sacrifices for bringing price stability.

- Falling gasoline prices may weigh pressure on headline US inflation data.

Gold price (XAU/USD) has displayed a less-confident pullback after a sheer downside move in the late New York session. The precious metal is expected to extend its weakness after dropping below the immediate support of $1,704.00. A downside break will drag the asset towards the psychological support of $1,700.00.

The gold prices witnessed a vertical drop after a hawkish speech from Federal Reserve (Fed) chair Jerome Powell. Fed Powell is ‘strongly committed to bringing price stability with odds of lower sacrifice in overall demand against prior instances of fighting inflation. Esteemed jobs demand sacrifices from growth prospects and the Fed is set to go all in to fix the inflation chaos.

Meanwhile, the US dollar index (DXY) has turned sideways as investors are shifting their focus toward the US Consumer Price Index (CPI) data, which will release on Tuesday. Well, the comments from US Treasury Secretary Janet Yellen on the inflation rate, citing that weaker gasoline prices may put further downward pressure on headline consumer price inflation for August, reported by Reuters, will trim the estimates for the headline inflation data.

Gold technical analysis

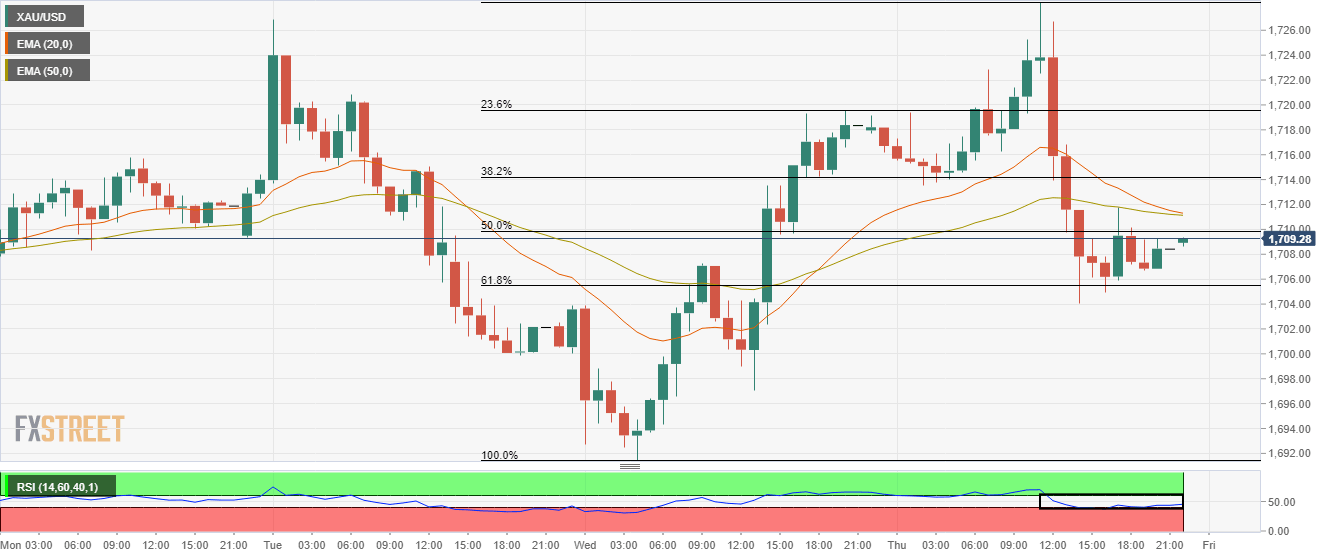

Gold prices are gyrating in 50% and 61.8% Fibonacci retracement placed at $1,709.87 and $1,705.53 respectively on the hourly scale. The touch points of the above-mentioned Fibo retracement are marked from Wednesday’s low at $1,691.47 to Thursday’s high at $1,728.27.

The 20-and 50-period Exponential Moving Averages (EMAs) are on the verge of displaying a bearish crossover at around $1,711.24.

Also, the Relative Strength Index (RSI) (14) has shifted into the 40.00-60.00 range and will trigger a downside momentum on sliding into the bearish range of 20.00-40.00.

Gold hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.