Gold Price Forecast: XAU/USD rises on speculation a Fed pivot lurks, US bond yields fall

- Gold price advances almost 1% as the market speculates on a Fed pivot, spurred by a WSJ article.

- US T-bond yields dropped, underpinning the gold price, which bounced off the month’s lows.

- Gold Price Forecast: The downtrend remains intact, though a break above $1650 would send gold to $1665.

Gold price rebounds from monthly lows around $1617, advancing steadily towards the $1640s region as US Treasury yields drop on an article published by the Wall Street Journal (WSJ), which mentioned that Fed officials are split about December’s rate hike, as November increase to the Fed funds rate (FFR) 75 bps, is utmost certain.

Gold advances as Fed officials debate December’s rate hike

Additionally, the WSJ article noted that policymakers are weighing whether to hike rates at a slower pace in December, namely 50 bps, though fears of being perceived as a “Fed pivot” could trigger a rally in equities, which according to the article, is not the case. Instead, Fed officials are adjusting the pace of rate increases as they try to cool down inflation. Once the article was published, US equities rallied, and US bond yields retraced, a tailwind for the gold price, as it printed a fresh monthly low early in the session.

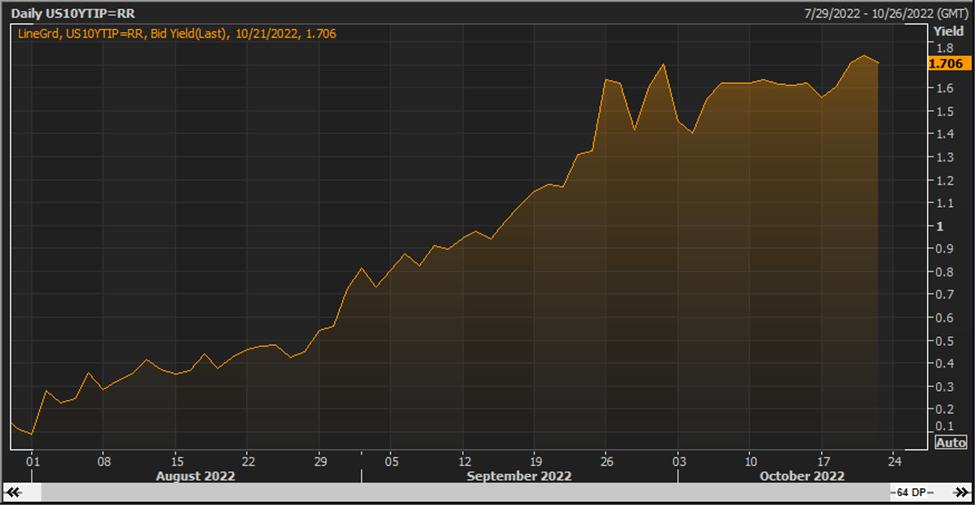

The US 10-year T-bond yield is gaining two bps, up at 4.250%, well below the YTD high of 4.338%, a level last seen before the global financial crisis in 2007. Also, US real yields retreated from 1.838% to 1.706% as measured by the US 10-year Treasury Inflation-Protected Securities (TIPS) bond yield, giving a respite to the yellow metal holders.

Fed officials reiterated the need to further action, as inflation remains high

Friday’s absence of US economic data to be reported left market participants leaning to further Fed commentary. On Thursday, a slew of Fed speakers, namely, the Philadelphia Fed President Patrick Harker and Fed board member Lisa Cook commented that the Fed would need to keep increasing rates. Harker commented that he is “disappointed of the lack of progress curtailing inflation,” while he added that he expects rates to be above 4% in 2023.

The US Dollar Index is dropping like a stone, from around 113.94 to 112.90, as speculations of an intervention in the USD/JPY increase, due to the broad trading range depicted by the hourly chart.

Gold Price Forecast

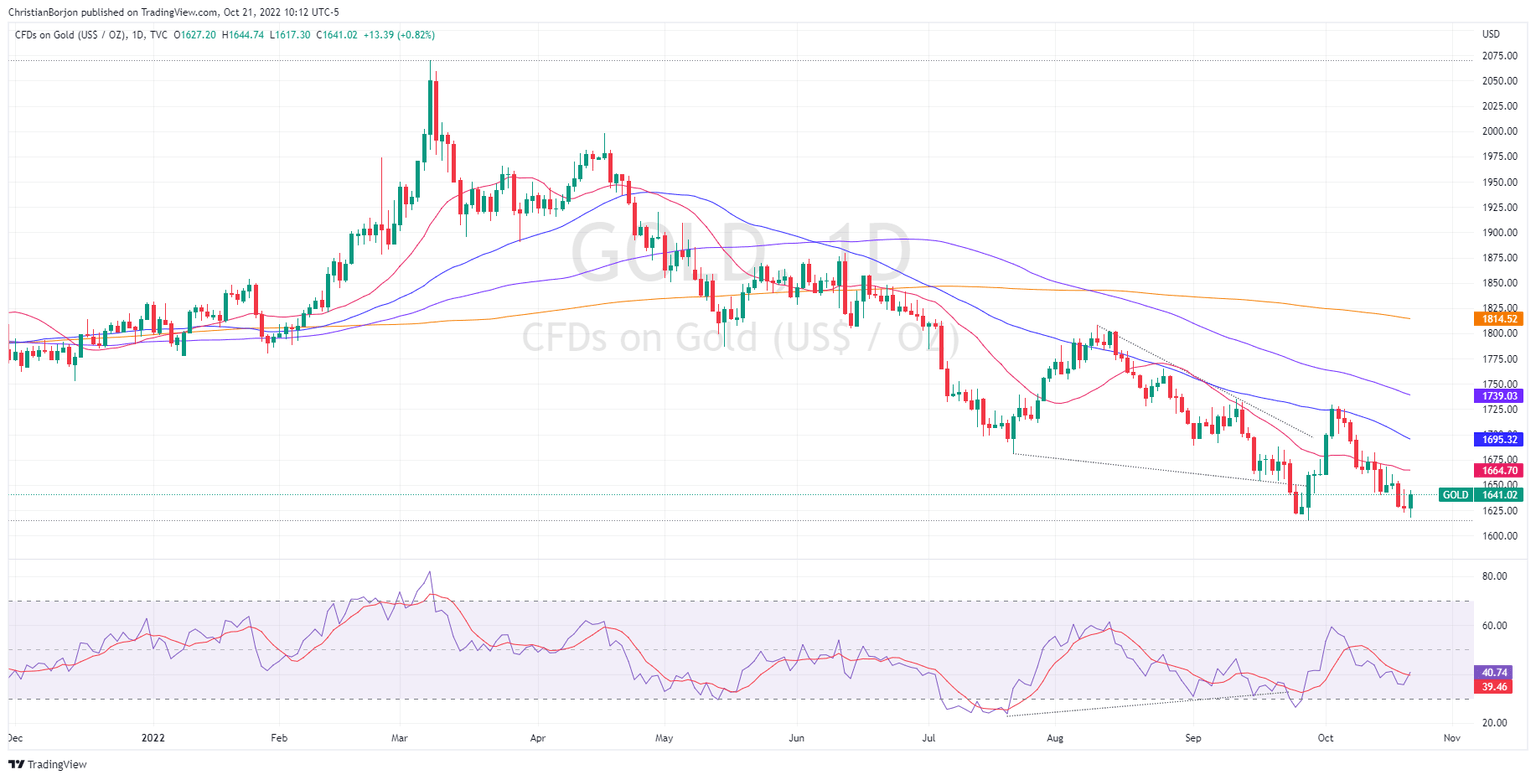

The daily chart shows that the XAU/USD is still downward biased, though it remains close to the YTD lows of $1614.92. The daily Exponential Moving Averages (EMAs) keep their bearish slope, trading well above the spot price, while the Relative Strength Index (RSI) at 39.86, although it’s aiming higher, remains in bearish territory. Hence, sellers remain in charge, though getting a respite, as the yellow metal prepares to prolong its losses for back-to-back weeks. If XAU/USD breaks $1650, a test of the 20-day EMA is on the cards; otherwise, it will remain exposed to re-test the YTD lows.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.