Gold Price Forecast: XAU/USD corrects lower to $3,325 with the bullish trend still intact

- Gold eases on risk appetite but maintains its broader upside trend intact.

- US Dollar's weakness is keeping Gold from falling further.

- XAU/USD: Below the $3,325 trendline support, bears will be targeting $3,285.

Gold (XAU/USD) is trading lower on Monday, weighed by softer demand for safe havens. Trump’s decision to back away from his plan to impose 50% tariffs on the EU has boosted risk appetite in an otherwise light trading day, and has trimmed some of the latest precious metals’ gains.

The US, however, remains on the defensive. The USD Index is struggling to take a significant distance from one-month lows, with investors wary about the US fiscal health and the impact of Trump’s sweeping bill on a ballooning debt. This is keeping Gold from retreating further.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.14% | -0.27% | 0.27% | -0.13% | -0.30% | -0.47% | 0.11% | |

| EUR | 0.14% | -0.12% | 0.47% | 0.01% | -0.16% | -0.33% | 0.26% | |

| GBP | 0.27% | 0.12% | 0.27% | 0.13% | -0.04% | -0.21% | 0.40% | |

| JPY | -0.27% | -0.47% | -0.27% | -0.40% | -0.59% | -0.81% | -0.18% | |

| CAD | 0.13% | -0.01% | -0.13% | 0.40% | -0.15% | -0.34% | 0.26% | |

| AUD | 0.30% | 0.16% | 0.04% | 0.59% | 0.15% | -0.21% | 0.43% | |

| NZD | 0.47% | 0.33% | 0.21% | 0.81% | 0.34% | 0.21% | 0.60% | |

| CHF | -0.11% | -0.26% | -0.40% | 0.18% | -0.26% | -0.43% | -0.60% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

XAU/USD Technical Analysis

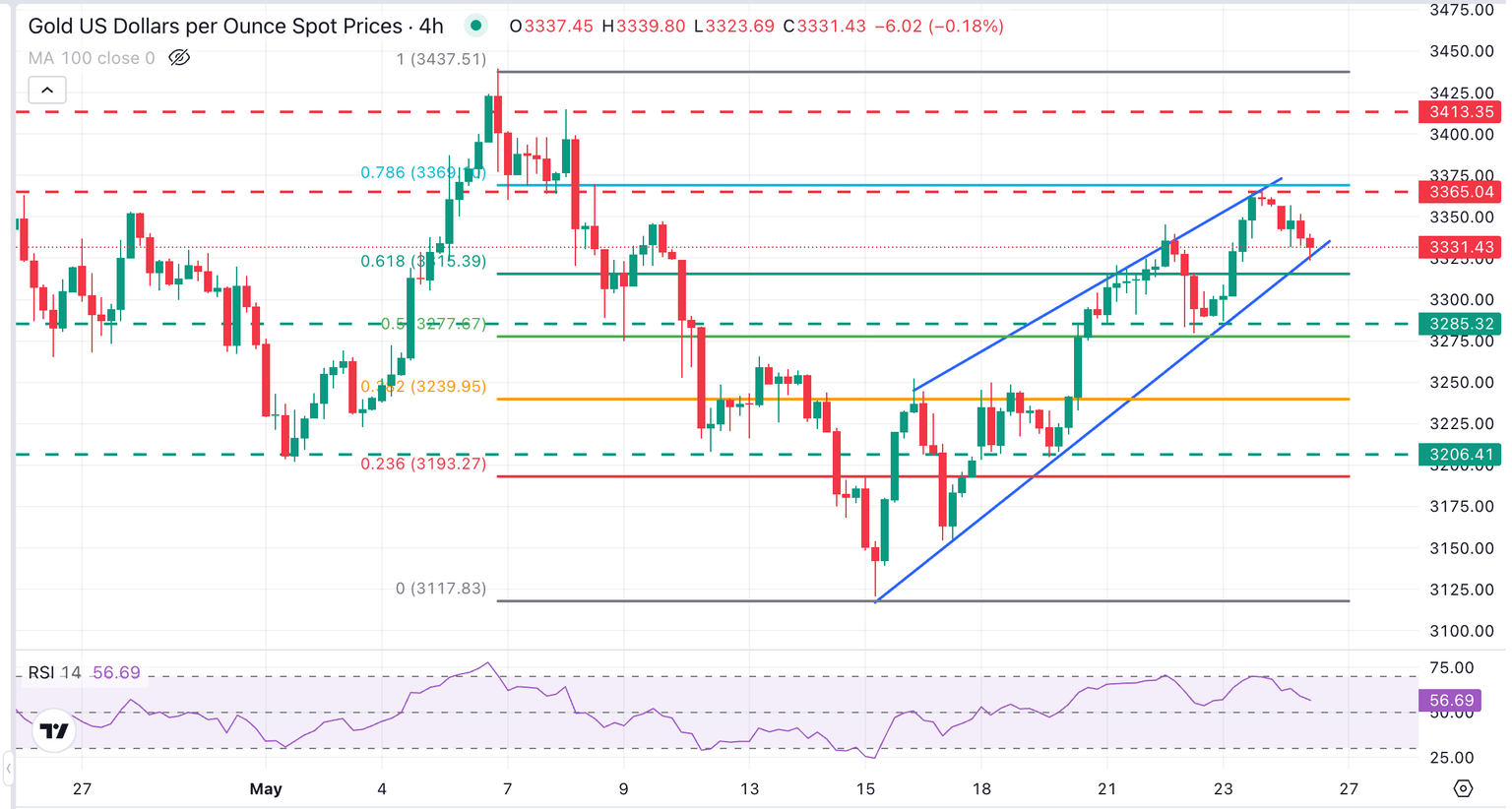

Gold prices are moving within an ascending wedge, with bears contained at the trendline resistance, the $3.325 area. A successful break of this level would bring the $3285 support into focus.

On the upside, immediate resistance is at Friday’s high, $3.365, which is also the 78.6% retracement of the early May sell-off. Above here, the next targets are the May 8 high, at $3,413, and the May 6 high, at the $3,440 area.

XAU/USD 4-Hour Chart

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.