Gold Price Forecast: XAU/USD pops and drops on Federal Reserve interest rate decision

- Gold price rallies to session highs on the Federal Reserve statement and interest rate decision.

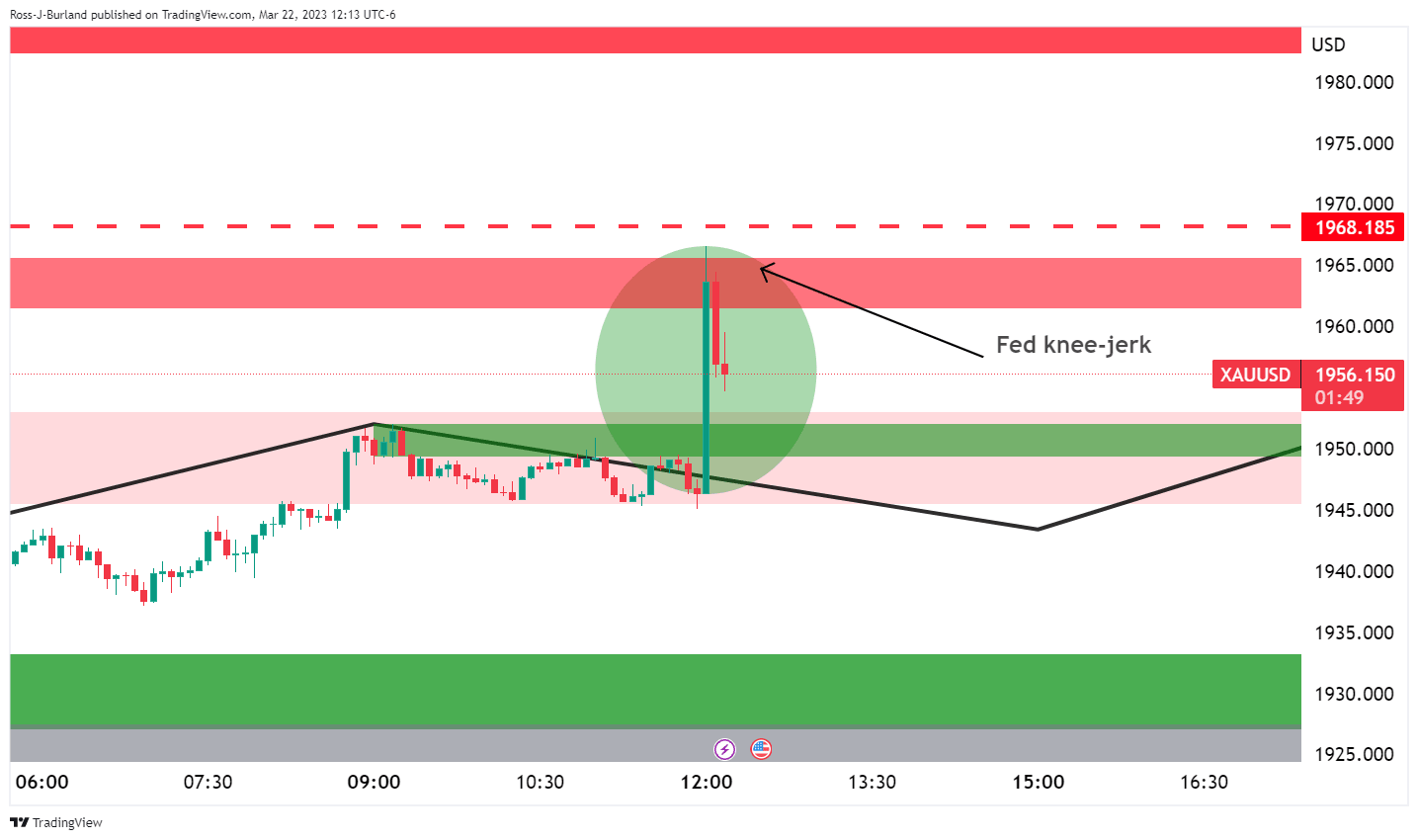

- Gold price prints a high of $1,966.55 and pulls back ahead of Federal Reserve chairman Jerome Powell´s presser.

Gold price rallies some $20.00 on the knee-jerk reaction to the Federal Reserve´s interest rate decision and statement. At the time of writing, Gold price is trading near $1,962 and up 1.14% on the day from a low of $1,934.

Federal Reserve hikes rates by 25 bps, as expected but the Fed statement deleted reference to 'ongoing increases' in rates. Ahead of the decision, the money markets were pricing in a year-end target rate of 4.36%. This has dropped in volatile reactions to the statement to 4.26%.

Key points so far

- The median forecast shows rates at 5.1% end-2023, 4.3% end-2024.

- 'Some additional policy firming may be appropriate.'

- FOMC deletes reference to ongoing increases.

- US banks are sound, resilient but events to weigh on growth.

- Likely to see tighter credit conditions that weigh on economic activity, hiring and inflation.

Next up will be the Federal Reserve´s chairman Jerome Powell whop will speak to the press.

Fed hikes policy rate by 25 bps as expected, focus shifts to Powell – LIVE

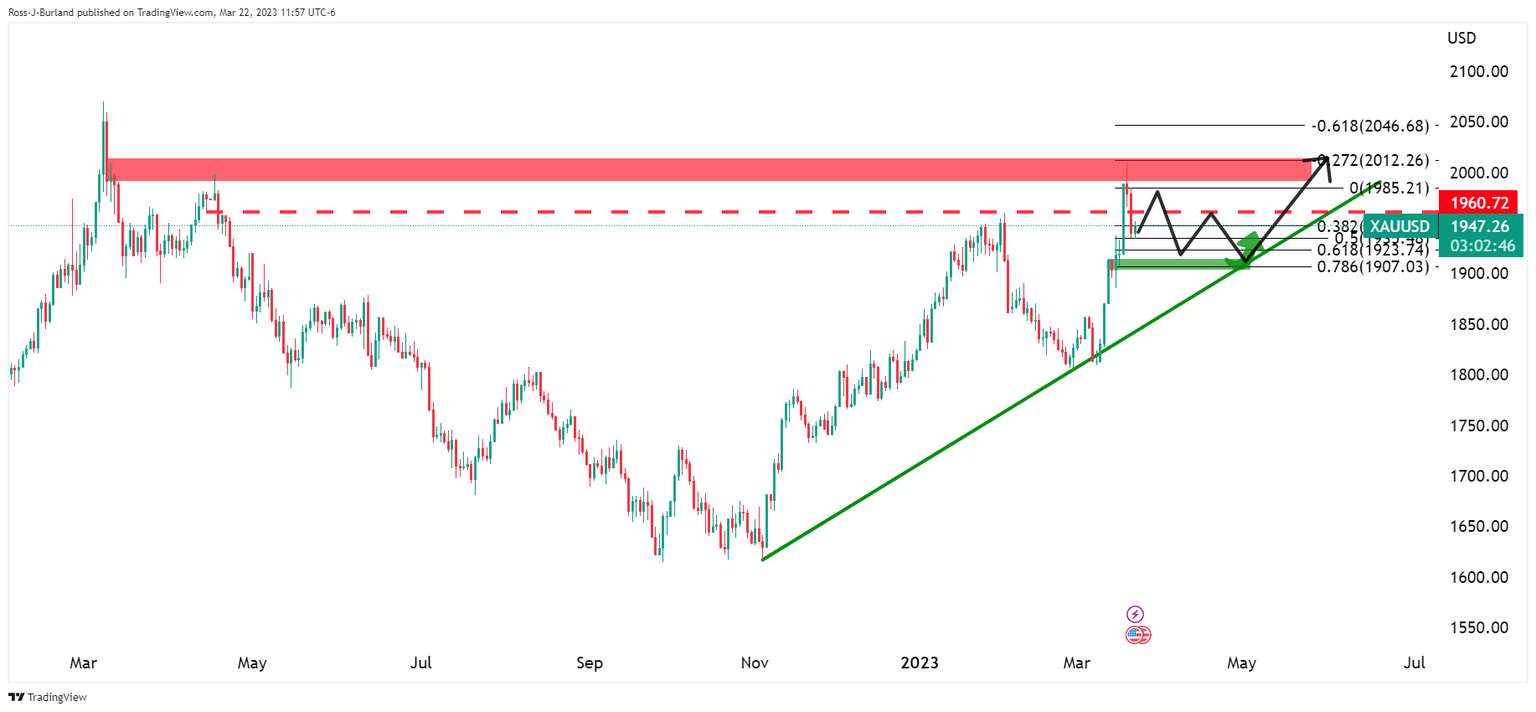

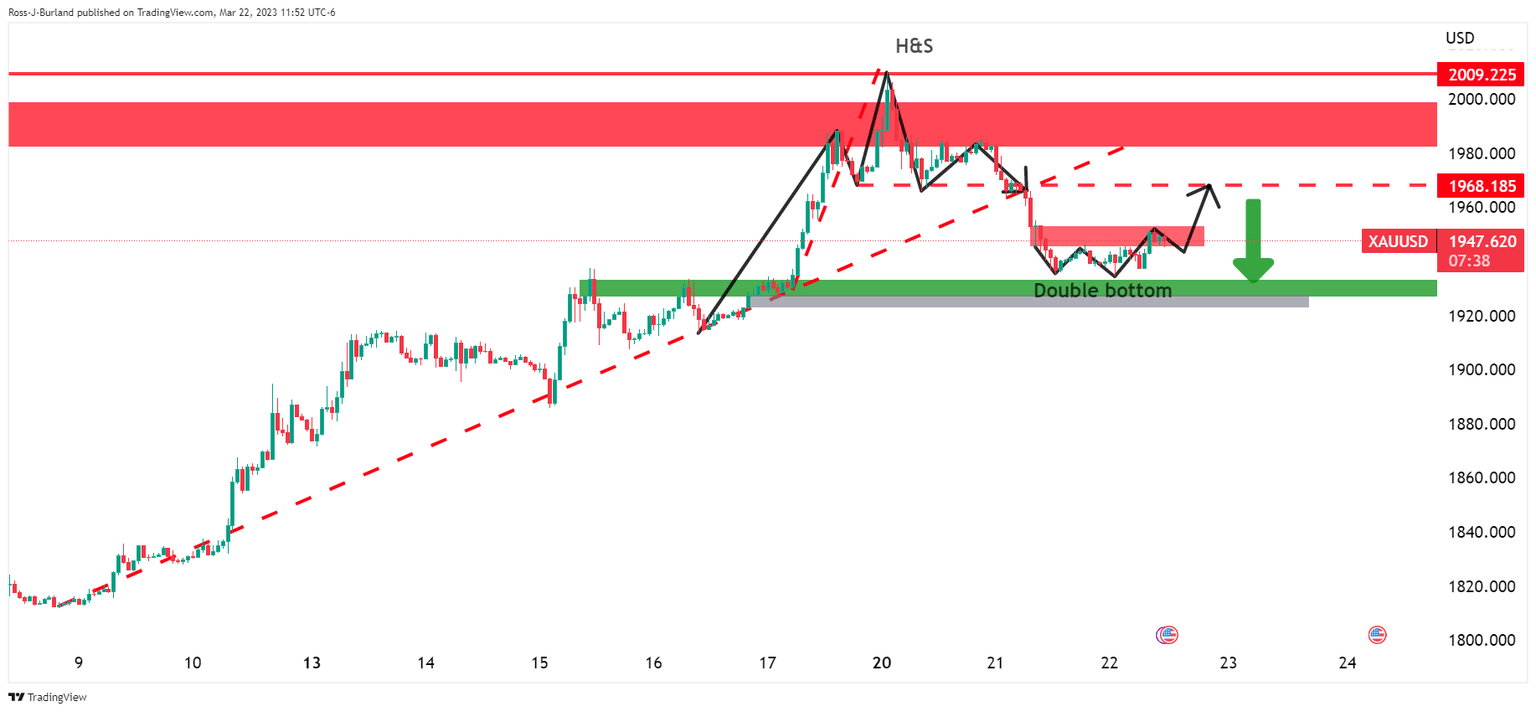

Gold price technical analysis

(Daily and H1 charts, ahead of the Fed, above and below respectively)

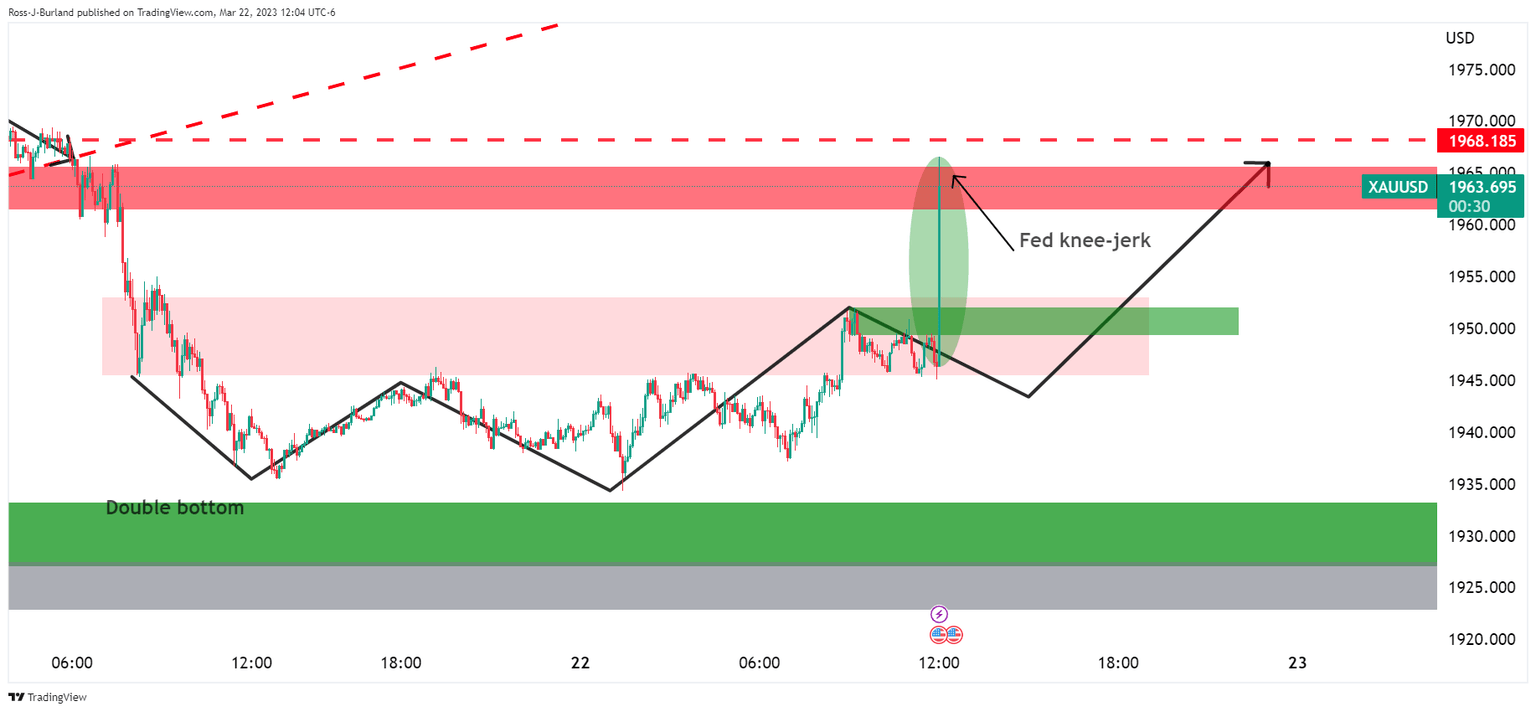

Gold price reaction to the Fed

On the knee-jerk to the decision, Gold price rallied as follows:

(5-min charts)

The price popped and dropped as markets await Fed´s Powell.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.