Gold Price Forecast: XAU/USD plunges to new two-year-lows below $1640

- Gold price tanked to new two-and-half years low at $1638.90.

- Global S&P PMIs revealed in the EU, UK, and the US sparked investors’ recession fears, increasing appetite for the safe-haven US dollar.

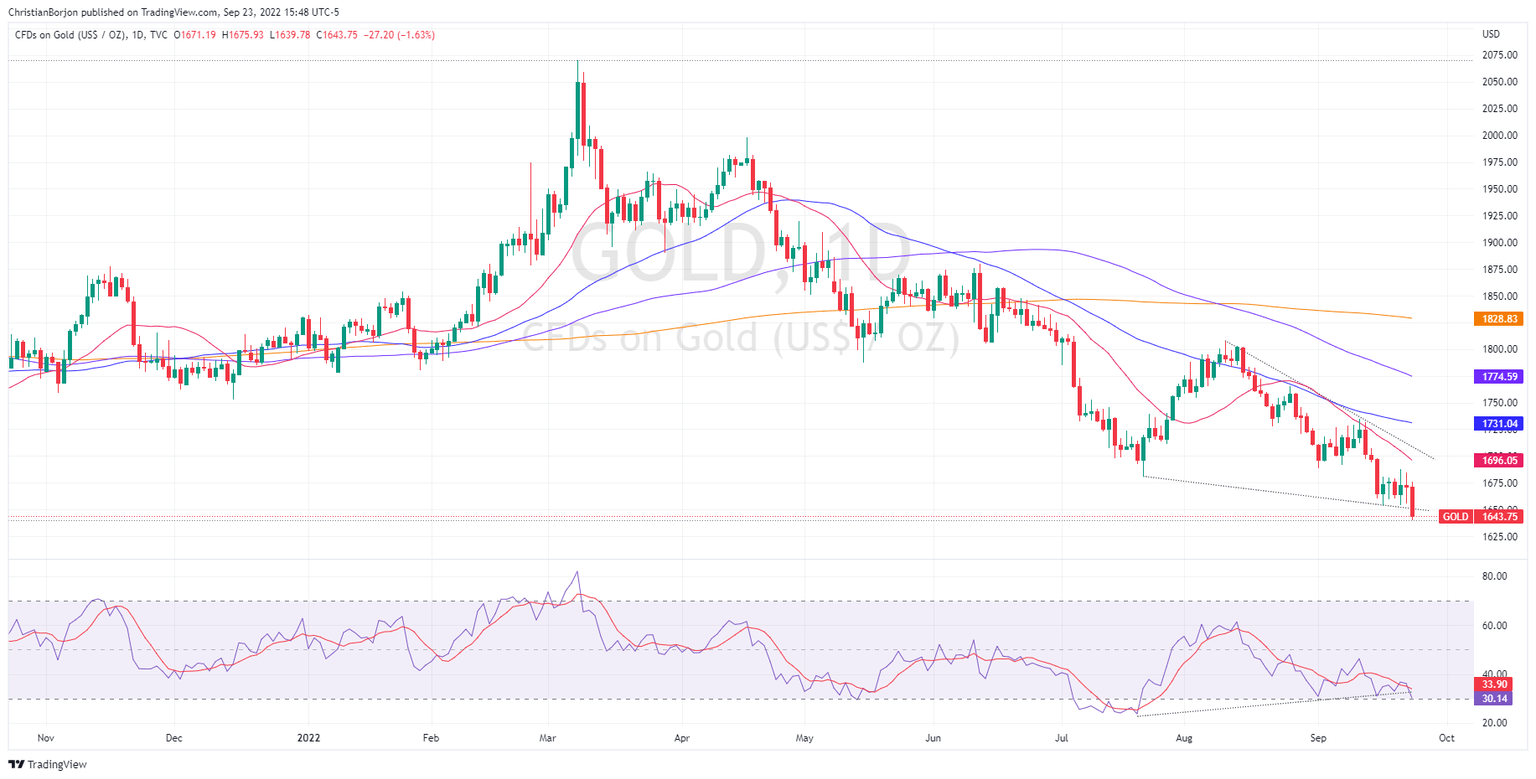

- Gold Price Analysis: A break below $1638 to send XAU/USD towards $1600.

Gold price slides to fresh two-and-half-year lows dampened by a risk-off mood and flows towards the US dollar, which rose to new two-decade highs. Overall, US dollar strength and higher US Treasury bond yields are two reasons for the fall in the precious metals complex, mainly the yellow metal. At the time of writing, XAU/USD is trading at $1643.50 a troy ounce.

US equities dropped as Wall Street closed with hefty losses between 1.62% and 1.80% on Friday. The US 10-year benchmark note rate retraced from yielding 3.829% and is set to end the week below the 3.70% threshold. On the same note, the US 10-year Treasury Inflation-Protected Securities (TIPS) bond yield weighed on the non-yielding metal, set to finish at 1.33%.

In the meantime, the greenback continues refreshing 20-year highs, with the US Dollar Index sitting at 112.990, up by 1.55%, after hitting the YTD high at 113.228.

Fed’s decision on Wednesday, lifting rates by 0.75%, and opening the door for another 120 bps increase, reignited US recession fears. A tranche of worldwide business activity measures revealed during the day foresees a recession in the Euro area and the UK. In the case of the US, S&P Global PMIs, improved, even though the Services and Composite readings remained in recessionary territory.

Sources cited by Reuters commented, “Gold and the other semi-investment metals like silver and platinum will likely continue to remain under pressure until the market reaches peak hawkishness.”

Aside from this, XAU/USD began trading at around the $1670 area and climbed to the daily high at $1675.93. Later, the yellow metal prices plummeted towards the fresh YTD low at $1638.90.

Gold Price Analysis (XAU/USD): Technical outlook

The falling wedge that emerged in the XAU/USD daily chart was invalidated once the spot price tumbled below the bottom trendline. Worth noting that even though the RSI is about to signal that gold is oversold, the yellow metal’s downtrend remains intact. Therefore, XAU/USD’s first support would be the YTYD low at $1638.90. Once cleared, the XAU/USD’s next support would be the $1600 psychological level, followed by March’s 2020 lows at $1451.41.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.