Gold Price Forecast: XAU/USD plummets to new cycle low, on elevated US yields, risk aversion

- Gold price plunges more than 1%, drafting a new cycle low below $1884.89.

- Elevated US bond yields and the looming threat of a US government shutdown added to the already deteriorated mood, driving Gold prices lower.

- Minnesota Fed President Neil Kashkari remains hawkish and opens the door for more than one hike.

Gold price plunged more than 1% in the mid-New York session, drafting a new cycle low below the August 21 swing low of $1884.89, as sellers set their eyes to March 2023 low levels at around $1800. At the time of writing, XAU/USD is trading at $1875 after hitting a daily high of $s1903.98.

XAU/USD under immense pressure as US Treasury bond yields soar

Risk aversion and elevated US bond yields keep XAU/USD under pressure. US Treasury bond yields continued to climb, with the 10-year benchmark note rates last seen at 4.63%, gaining 1.90%, while fears of the US Federal Government shutdown, which could furlough millions of federal employees next Saturday, added another reason to the already sour sentiment.

In the meantime, the Minnesota Fed President Neil Kashkari continued his parade on Wednesday, noting he’s unsure if the Federal Reserve is restrictive enough and suggested that another rate hike is needed. He added he’s expecting the US central bank to keep rates “steady” while keeping the door open for more than one hike, Kashkari said recently in an interview with Fox Business.

Earlier, the US economic docket revealed that US Durable Goods Orders for August increased more than expected, at 0.2% MoM, with estimates for a -0.2% drop; excluding Transports, the so-called core, came at 0.4% MoM, above estimates and the previous month 0.1% expansion.

XAU/USD traders would take additional cues from US economic releases. The calendar will feature the final revision of Q2’s Gross Domestic Product (GDP), Pending Home Sales, Initial Jobless Claims, and Fed speakers on Thursday. By Friday, the Fed’s preferred gauge for inflation, the Core PCE would be announced.

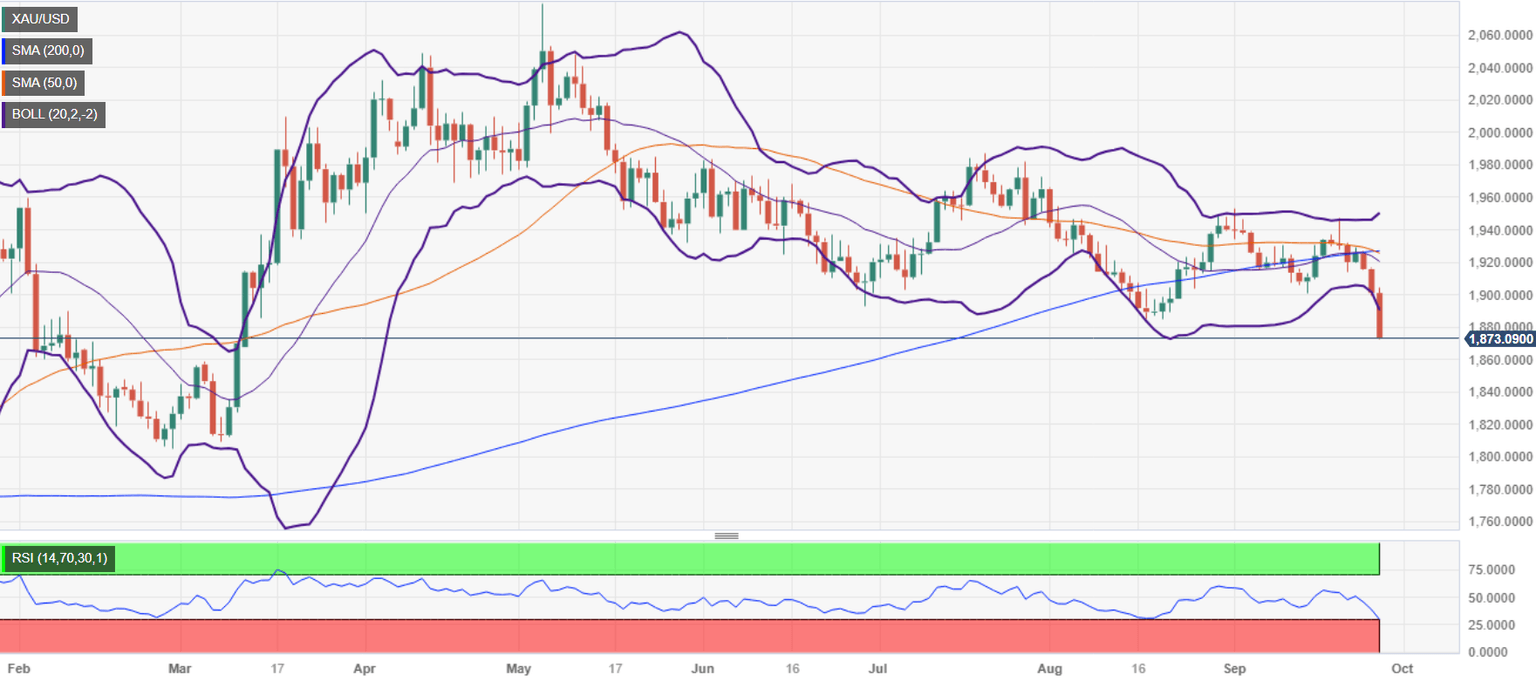

XAU/USD Price Analysis: Technical outlook

Gold’s daily chart portrays the non-yielding metal extending its losses toward the March 8 low of $1809.48. If that level is cleared, the yellow metal could test the year-to-date (YTD) lows at around $1804.78. Once that level is surpassed, XAU/USD’s next support would emerge at the November 15, 2022, daily high at $1786.53. Conversely, if XAU/USD reclaims $1884.89, the first resistance would be $1900.

XAU/USD Price Action – Daily chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.