Gold Price Forecast: XAU/USD plummets below $1890 after stunning US NFP report

- Gold plunges after a solid January US NFP report.

- The US economy added more than 500K jobs, and the unemployment rate fell to 3.4%.

- Gold Technical Analysis: To the upside eyeing $1890, and downwards $1850.

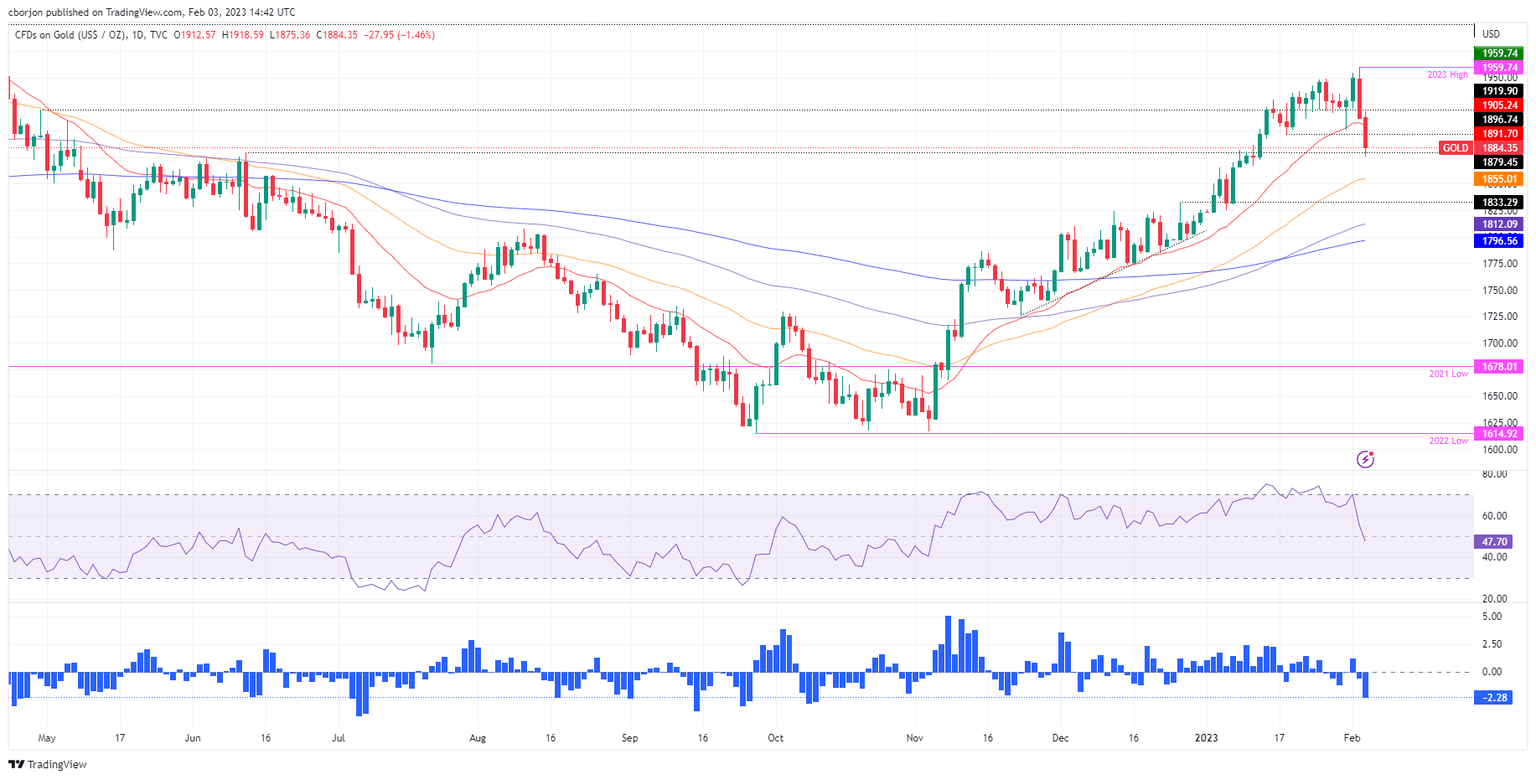

Gold price tumbles sharply after the US Department of Labor revealed a staggering Nonfarm Payrolls report that added more jobs to the economy than expected and saw the unemployment rate dip lower. Therefore, the XAU/USD is dropping from daily highs at $1918 and collapsing toward the $1880 area, breaking the 20-day EMA on the way down.

US jobs data crushed expectations; further Fed action warranted

US equity futures remain negative as Wall Street is set to open in the red. The greenback was lifted by a surprisingly upbeat US Nonfarm Payrolls report for January added 517 jobs in the last statement, raising the buck from its ashes, as the US Dollar Index advanced 0.58% and reached a new two-week high at 102.63. Consequently, the XAU/USD extended its losses below the January 18 daily low of $1896.74 and the 20-day Exponential Moving Average (EMA) at $1891.70.

Delving into the data, December’s report was upward revised from 223K to 260K people added to the workforce. Meanwhile, Average Hourly Earnings rose 0.3%in-line with estimates but below December’s 0.4%. The Unemployment Rate dropped from 3.5% in December to 3.4% and pressured the US Federal Reserve (Fed), as a tight labor market could cause another spike in inflation.

In the bond market, US Treasury bond yields, mainly the 10-year benchmark note rate, climbed 12.5 bps to 3.521% after falling towards a monthly low of 3.334% on Thursday.

Ahead into the calendar, the ISM Non-Manufacturing PMI is expected to improve, while the S&P Global Services and Composite PMIs are also headed toward a slight recovery.

Gold’s Technical Analysis

After the NFP report, the XAU/USD dropped from around daily highs and is trapped within the 20-day EMA and the 50-day EMA, each at $1891.70 and $1854.99. An extension below the 50-day EMA would put in play the December 27 daily high-turned-support at $1833.29 before Gold can challenge the 100-day EMA at $1812.11. On the bullish side, XAU/USD needs to reclaim January’s 18 swing low of 1896.74, so bulls can have a chance to test $1900.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.