Gold Price Forecast: XAU/USD faces selling pressure above $4,200 as US Dollar rebounds

- Gold price tumbles to near $4,180 as the US Dollar extends Monday’s recovery move.

- The US Dollar gains despite weak US ISM Manufacturing PMI data for November.

- Firm dovish Fed expectations keep the Gold price broadly on the front foot.

Gold price (XAU/USD) is down 1% to near $4,180.00 during the European trading session on Tuesday. The yellow metal slumps after failing to hold above $4,200 as the US Dollar (USD) bounces back despite weak United States (US) ISM manufacturing Purchasing Managers’ Index (PMI) data for November.

At the press time, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades 0.1% higher to near 99.55. The USD Index recovered on Monday after revisiting the monthly low around 99.00.

Technically, a higher US Dollar makes the Gold price an expensive bet for investors.

On Monday, the US ISM reported that the Manufacturing PMI came in lower at 48.2 from estimates of 48.6 and the prior release of 48.7, signaling contraction in the manufacturing sector activity at a faster pace. A figure below the 50.0 threshold is considered a contraction in the business activity. Also, sub-components of the Manufacturing PMI, such as Employment and New Orders Index, declined at a faster pace.

Broadly, the outlook of the Gold price remains firm as traders seem confident that the Federal Reserve (Fed) will cut interest rates in its monetary policy announcement next week.

According to the CME FedWatch tool, the probability of the Fed cutting interest rates by 25 basis points (bps) to 3.50%-3.75% in December is 86.5%.

This week, investors will pay close attention to the US ADP Employment Change for November and the Personal Consumption Expenditure Price Index (PCE) data for September on Wednesday and Friday, respectively.

Gold technical Analysis

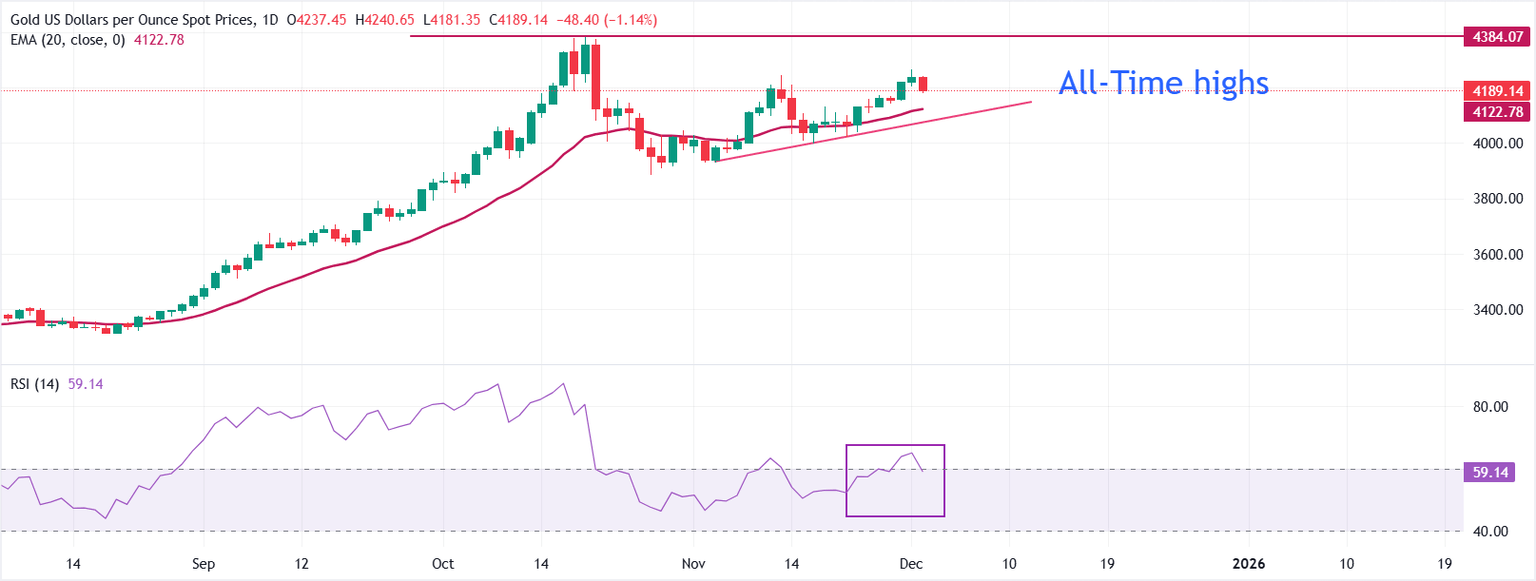

In the daily chart, XAU/USD trades around $4,190 during Tuesday’s European trading hours. The 20-day Exponential Moving Average (EMA) at $4,122.78 rises, with price holding above it to maintain a positive bias. Pullbacks toward the average would find support while its slope stays higher. RSI at 59, above 50, keeps bullish momentum intact despite easing from recent highs.

The 14-day Relative Strength Index (RSI) bends to near 60.00, while the momentum will remain in play until it holds that level.

The 20-day EMA remains positively aligned, keeping dip-buying interest in play. The rising trend line from $3,933.90 underpins the bias, offering support near $4,093.03. A daily close below that line would flag a deeper pullback, while holding above it would leave scope for an extension of the advance.

(The technical analysis of this story was written with the help of an AI tool)

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.