Gold Price Forecast: XAU/USD eyes triangle breakout, aims to revisit all-time highs around $3,500

- Gold price holds onto gains above $3,400 as US-EU trade tensions continue to persist.

- EU threatens proportionate countermeasures as Trump considers higher baseline tariff rate on imports from the shared continent.

- The US confirms a trade agreement with Japan ahead of August 1 tariff deadline.

Gold price (XAU/USD) trades firmly above $3,400 during the European trading session on Wednesday, the highest level seen in over five weeks. The precious metal strengthens as global trade tensions continue to persist even as the United States (US) has confirmed a trade agreement with Japan.

On Tuesday, US President Donald Trump announced through a post on Truth.Social that Washington has reached a deal with Tokyo in which the baseline tariff on imports from Japan will be 15%, lower than 25% imposed at the start of this month.

Escalating trade worries between the US and the European Union (EU) continue to keep the global trade outlook on a cliffhanger. Earlier this week, EU officials threatened to retaliate against US tariffs by proportionate countermeasures after a report from the Wall Street Journal (WSJ) stated that Trump is considering a higher baseline tariff rate in a range between %15% and 20% on imports from the trading bloc.

Theoretically, heightened global economic tensions bode well for safe-haven assets, such as the Gold price.

Meanwhile, the underperformance by the US Dollar has also strengthened the Gold price. Technically, lower US Dollar makes the Gold price an attractive bet for investors. The US Dollar trades lower even as the US-Japan trade deal has trimmed tariff uncertainty.

At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades weakly near the two-week low around 97.40 posted on Tuesday.

Gold technical analysis

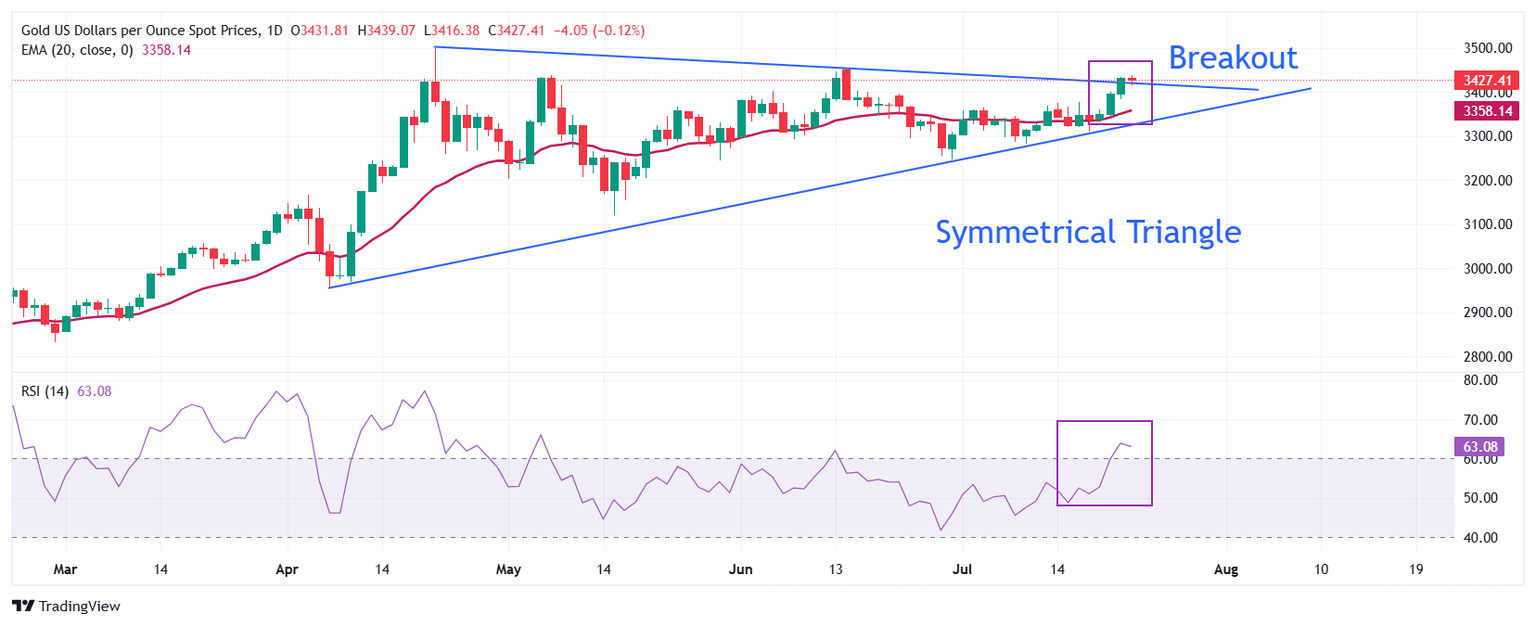

Gold price is close to breaking the Symmetrical Triangle formation on the upside – a move that often leads to volatility expansion. The upward-sloping trendline of the above-mentioned chart pattern is placed from the May 15 low of $3,120.83, while its downward-sloping border is plotted from the April 22 high around $3,500

The 20-day Exponential Moving Average (EMA) around $3,358 acts as a key support area for the Gold price.

The 14-day Relative Strength Index (RSI) rises above 60.00. A fresh bullish momentum would emerge if the RSI holds above that level.

Looking up, the Gold price will enter uncharted territory if it breaks above the psychological level of $3,500 decisively. Potential resistances would be $3,550 and $3,600.

Alternatively, the Gold price would fall towards the round-level support of $3,200 and the May 15 low at $3,121, if it breaks below the May 29 low of $3,245

Gold daily chart

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.