Gold Price Forecast: XAU/USD drops towards $1,793 support confluence as US Dollar follows firmer yields

- Gold price takes offers to renew intraday low, fades late Friday’s corrective bounce off two-month low.

- Lack of major data/events challenges market moves but hawkish central banks, recession woes keep XAU/USD bears hopeful.

- US Durable Goods Orders, ISM PMIs will be crucial for near-term directions.

Gold price (XAU/USD) takes offers to refresh a two-month low to around $1,808 during early Monday. In doing so, the bright metal justifies the latest pick-up in the US Dollar, after a week-start retreat, amid the hawkish concerns surrounding the US Federal Reserve (Fed) and geopolitical fears.

That said, the US Dollar Index (DXY) renewed its intraday high around 105.30, following the initial pullback from a seven-week high. In doing so, the greenback’s gauge versus the six major currencies remains firmer for the fifth consecutive day.

The DXY’s rebound from the intraday low could be traced to the firmer US Treasury bond yields as the US 10-year Treasury yields reverse the early-day losses of around 3.95%. Further, the two-year counterparts jump back towards the highest levels since November 2022, marked the previous day, as bond bears poke the 4.83% level by the press time.

Fears of the Aussie recession, slower consumption in New Zealand, and fears of a soft landing in the US have underpinned the XAU/USD’s recent weakness. Adding strength to the precious metal’s downturn could be the hawkish Fed concerns, especially after the last week’s strong inflation clues and upbeat comments from the policymakers. It should be noted that the latest chatters surrounding more Western sanctions on Russia and the Beijing-Moscow ties also favor the Gold bears.

It’s worth noting, however, that the S&P 500 Futures lick its wounds with mild gains after the Wall Street benchmark posted the biggest weekly slump of 2023.

The Gold price remains on the bear’s radar amid a firmer US dollar and geopolitical concerns. However, an absence of top-tier data might allow the XAU/USD to pare some losses. That said, the week’s US ISM Manufacturing PMI, Services PMI, Durable Goods Orders and China’s official PMIs will be crucial for the traders to watch for clear directions.

Gold price technical analysis

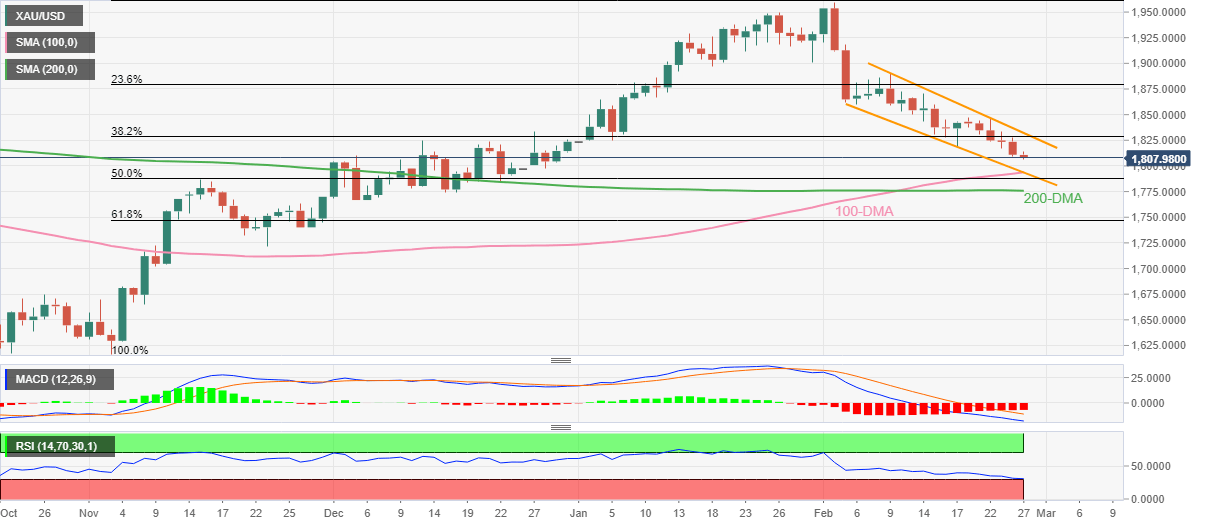

Although the oversold RSI (14) challenges Gold sellers around $1,810, the metal’s sustained trading within the three-week-old descending trend channel and bearish MACD signals keep the XAU/USD bears hopeful.

That said, a convergence of the 100-DMA and the stated channel’s lower line, close to $1,793, appears to be a short-term key support to watch for the Gold bears.

Following that, the 200-DMA level surrounding $1,775 could act as the last defense of the Gold buyers.

Alternatively, XAU/USD recovery remains elusive unless the bullion stays inside the aforementioned channel, currently between $1,793 and $1,832.

Even if the Gold price remains firmer past $1,832, the February 09 swing high of around $1,890 and the $1,900 threshold could challenge the buyer afterwards.

The Gold price remains on the bear’s radar, but the downside room appears limited.

Gold price: Daily chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.