Gold Price Forecast: XAU/USD flirts with daily lows, just above $1,820 level

- Gold stays firmer around monthly top, holds onto 200-DMA breakout.

- Bulls seem to benefit from doubts over Fed’s next moves even as Powell keeps rejecting need for policy adjustments.

- Fresh Sino–American tension, covid woes add to the market’s downbeat sentiment.

- US consumer-centric data awaited, qualitative catalysts are the key.

Update: Gold remained on the defensive through the first half of the European session and was last seen hovering near the lower end of its daily trading range, just above the $1,820 level. A strong rebound in the US Treasury bond yields turned out to be one of the key factors that prompted some profit-taking around the non-yielding yellow metal. Apart from this, a generally positive tone around the equity markets further acted as a headwind for traditional safe-haven assets, including gold.

That said, a subdued US dollar demand extended some support to the dollar-denominated commodity and helped limit the downside, at least for the time being. Market participants now look forward to the US economic docket, highlighting the release of monthly Retail Sales figures. The data might influence the USD price dynamics and provide some impetus to the XAU/USD. Apart from this, the US bond yields and the broader market risk sentiment could further produce some short-term opportunities around gold.

Previous update: Gold price is finding fresh bids near the 200-Daily Moving Average (DMA) at $1826, as it makes an attempt once again to retest monthly tops at $1834. A fresh leg lower in the US dollar across the board amid a recovery in the risk sentiment is boding well for gold optimists. The greenback reverses Fed Chair Jerome Powell-powered rally, as an improvement in the market mood weighs on its safe-haven appeal. At the time of writing, gold price is trading with small losses around $1827, gathering strength to regain the 100-DMA at $1838. Although, the further upside may remain elusive ahead of the critical US Retail Sales and Consumer Sentiment data.

Read: US Michigan Consumer Sentiment Index July Preview: Are inflation expectations changing?

Gold (XAU/USD) prices print a four-day winning streak to poke the monthly high with $1,830, up 0.05% intraday, amid Friday’s Asian session.

The yellow metal’s recent run-up likely takes clues from the risk-off mood and breached the key 200-DMA hurdle the previous day, opening the gate for the further upside to another important technical resistance. However, the US Dollar Index (DXY) remains firm and curbs the investment flows to gold due to the greenback’s safe-haven appeal.

That said, the DXY gained 0.21% on Thursday, after posting the heaviest losses in over a week the day before yesterday. The greenback gauge seems to struggle for a clear direction, while edging higher, amid indecision over the Federal Reserve’s next moves and mixed data.

US Fed Chair Jerome Powell reiterated less urgency for policy adjustments during the second round bi-annual testimony the previous day but St. Louis President James Bullard contrasted with the push for tapering. Also, mixed manufacturing figures from Philadelphia and New York, coupled with weaker-than-prior Jobless Claims, have an inflation component arguing the Fed policymakers’ rejection to act.

Also weighing on the sentiment could be the escalating coronavirus concerns in the West, as well as Asia–Pacific nations, which recently raised downside risk to the economic recovery from the pandemic. Furthermore, the fresh jitters between the US and China, due to the expected new sanction on Beijing and the dragon nation’s rejection of the Sino-American diplomat’s meeting, add to the market’s risk-off mood.

Amid these plays, S&P 500 Futures drop 0.23% whereas the US 10-year Treasury yields seesaw around 1.30% after two consecutive days of downside.

As the subdued markets keep challenging the gold buyers, US US Retail Sales and the preliminary readings of the Michigan Consumer Sentiment Index, expected 0.4% for June and 86.5 for July respectively, will be crucial to follow. Though, risk catalysts like the updates and US-China news, not to ignore the Fedspeak, will be on the top to track for fresh impulse.

Technical analysis

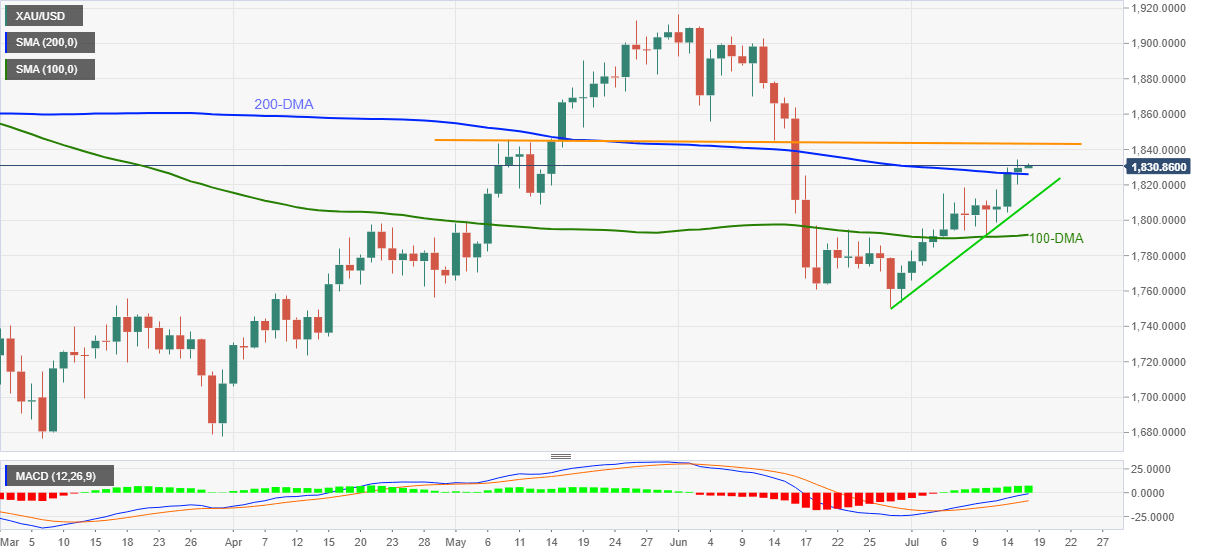

Gold’s sustained upside break of 200-DMA gains support from firmer MACD signals, not to forget successful trading beyond 100-DMA and 13-day-old support line, keeps buyers hopeful.

However, a horizontal area comprising early May’s top and mid-June lows surrounding $1,845 will test the metal’s further upside.

Also challenging the up-moves will be the June 02 lows near $1,855 and the $1,880 levels before highlighting the $1,900 hurdle that holds the key to June’s peak of $1,916.

Meanwhile, pullback moves need to close below the 200-DMA level of $1,826 to test the short-term rising trend line support of around $1,809. Though, bears are less likely to take the risk of entry until gold prices stay beyond the 100-DMA level of $1,791.

Gold: Daily Chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.