Gold Price Forecast: XAU/USD bulls eye key territories above ahead of NFP

- Gold price bulls are in the money but target higher still.

- All now depends on the NFP data on Friday.

Gold price was rising on Thursday and climbed from a low of $1,953.44 to score a high of $1,983.15 on the day. The US Dollar eased following passage of the US debt-ceiling agreement through the House on Wednesday.

US lawmakers appeared to avert a financial crisis with the news that US debt-ceiling agreement got through the House. The deal is to raise the debt ceiling for two years and this now moves onto the Senate, with passage expected well ahead of the June 5 deadline.

Due to a combination of factors, the US Dollar index fell to 103.52, the lowest for some time as fresh data and comments from some Fed officials raised bets the central bank will pause in June. Firstly, a slump in productivity was revised lower, while the ISM PMI showed the manufacturing sector contracted for a 7th month. Initial jobless claims and the ADP report beat forecasts but the data indicates a less tight labour market.

As for Federal Reserve speak, Fed´sGovernor Philip Jefferson and Philadelphia Fed President Patrick Harker suggested the central bank would skip a rate hike in the next meeting. This all comes ahead of the US Nonfarm Payrolls showdown on Friday. A strong outcome will likely reignite a US Dollar rally and weigh on the Gold price.

Overall, expectations are that the Federal Reserve might not hike interest rates when its policy committee meets later this month. The CME Fedwatch Tool showing a 75% probability the central bank will keep rates unchanged.

´´US payrolls likely slowed modestly in May, advancing at a still strong 200k+ pace for a second consecutive month. We also look for the Unemployment Rate to stay unchanged at a historical low of 3.4%, and for wage growth to print 0.3% MoM (4.4% YoY),´´ analysts at TD Securities said.

Gold technical analysis

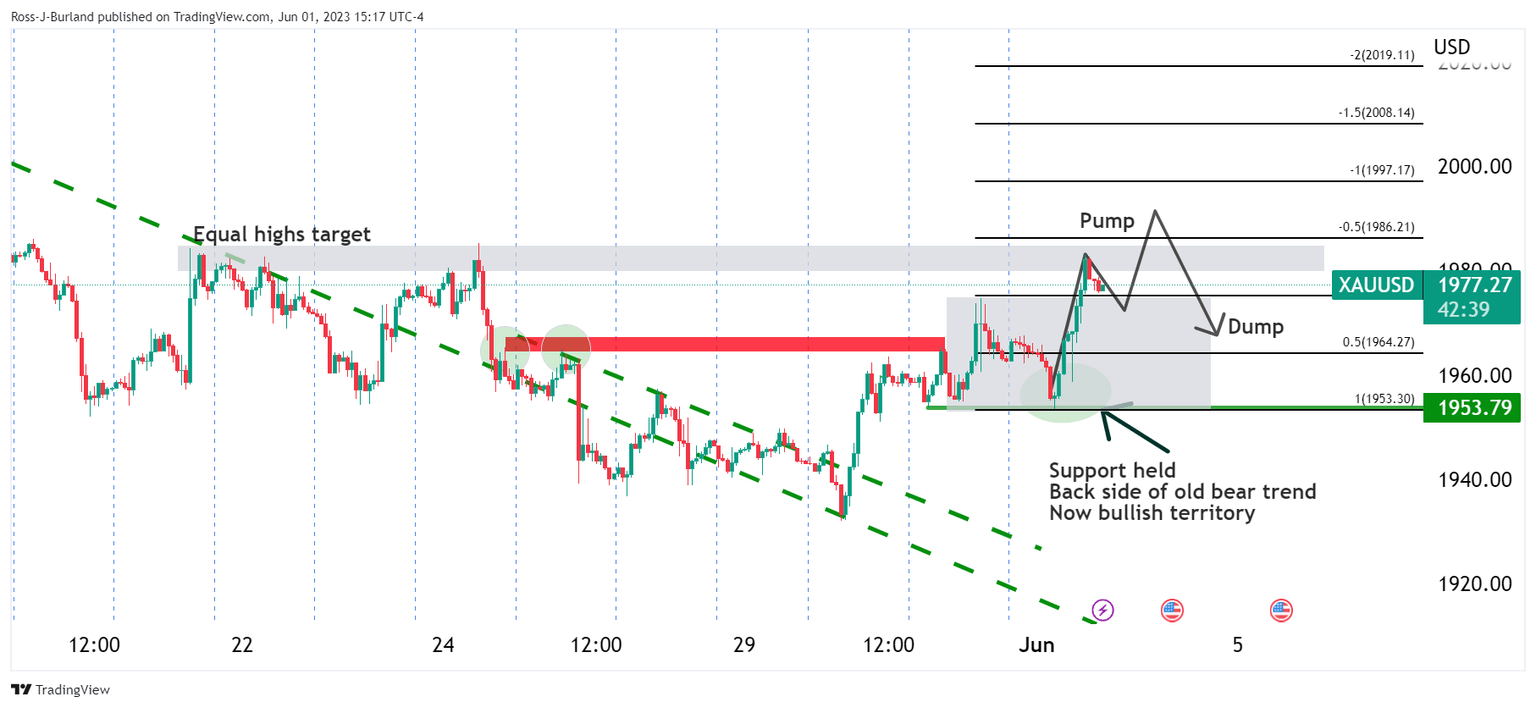

The above schematic is a hypothetical scenario for the Gold price as we head towards the Nonfarm Payrolls event on Friday. We are witnessing a pump towards equal highs in close to a 50% expansion of range between the prior swing highs and lows where support held on Thursday. The scenario illustrates a potential sell-off around the NFP data once the equal highs have been swept.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.